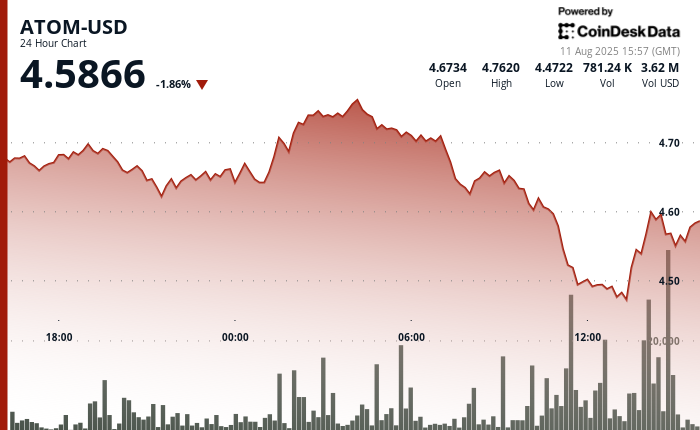

Atom experiences sharp decline after short rally

Atom experienced sharp volatility during the 23-hour trading period from August 10 to 15:00 to August 11 at 14:00, swinging 6.20% between $ 4.77 session high and $ 4.48 low. The token ranked early on August 11, up from $ 4.66 to $ 4.75 at 02:00 am in the middle of a trading volume of 1.465 million units, establishing support near $ 4.69. However, heavy sales pressure appeared at 07:00, driving atom up to $ 4.48 to 1.984 million units exchanged, with resistance that forms around $ 4.71 as the institutional sale intensified.

Despite the sharp decline, the atom showed stability at the last time of the session. From 13:07 to 14:06, the token gained 1.68%, moving from $ 4.49 to $ 4.56 while consumers won the resistance to $ 4.50 and $ 4.53. An explosion of trading activity, including a 60,000-unit spike between 13:46 and 13:47, helped adopt $ 4.54 as a new support level. This late-session rebound hints in updated institutional interests following the morning sale.

The market sentiment to the Cosmos Ecosystem received a help during the session after Coinbase announced support for DYDX (Cosmosdydx)A decentralized financial platform built into the Cosmos blockchain. The list emphasizes the growing integration of exchanges in cosmos -based projects, which boosts confidence in investors and potentially influences short -term price action for atom.

The volatile trading of the atom features pushing and pulling between institutional acquisition of income and opportunist purchases at technical support levels. As the initial sale reflects the broader uncertainty in the digital asset markets, rapid recovery suggests that some institution players are positioning for potential upside down as the cosmos network continues to expand the partnerships and traces of infrastructure.

Technical indicators feature basic levels

- Trade range of $ 0.29 represents 6% volatility between $ 4.77 maximum and $ 4.48 minimum level.

- The volume support established around $ 4.69 with 1.465 million units during the early session rally.

- The volume resistance created near $ 4.71 with 1.984 million units during the institution’s sale.

- The new support level established at $ 4.54 following the recovery of the momentum and consumer interest.

- Multiple resistance levels damaged at $ 4.50 and $ 4.53 at the time of purchase of institutional sessions.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.