Bearish Bitcoin (BTC) sentiment continues despite Powell’s signal that QT may be about to finish

Federal Reserve Chairman Jerome Powell said Tuesday that the Central Bank could reach a point where its long -term program to reduce the balance sheet size needs to end. However, the BTC continues to trade in red with derivatives pointing to bearish’s ongoing feelings.

“Our long -standing plan is to stop the balance sheet runoff when the reserves are somewhat above the level we judge in accordance with many reserve conditions,” Powell said at the ready comments for his speech at the National Association for Business Economics Conference in Philadelphia.

“We can approach that point in the coming months, and we will closely monitor a wide range of indicators to inform this decision,” he added.

The so -called volume of strict restrictions (QT) began in 2022 to eliminate the extraordinary liquidity added by the Fed to the financial system by expanding the balance during the coronavirus crisis. Since then, the total size of the Fed balance sheet has refused $ 6.6 trillion from around $ 9 trillion.

Powell’s comments indicate that the Fed does not want to withdraw its balance so much that the bank reserves – the funds of banks held in the Federal Reserve – fall under a level that the Fed considers “enough. Staying above this threshold is important to prevent disruptions in short -term funding and financially secure.

According to the Chairman, that point may be closely as the Central Bank carefully examines market conditions, including recent increases in various overnight funding rates.

The comments came as markets expect two 25-base-point fed rates of cuts by the end of the year, following a similar reduction size in September and raised emotion on crypto social media.

BTC does not admire

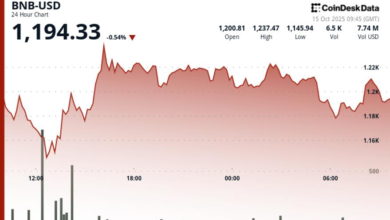

BTC, however, is not impressed, nor is the broad crypto market. As of writing, the leading cryptocurrency by market value exchanged near $ 112,600, mainly flat on a 24 -hour basis.

The options listed in the BTC-tied derival show a weekly put, offering downside protection, which continues to trade in a premium in bullish or bullish bets. Options until the expiry of March 2026 showed a similar bearish pricing.

Perhaps this is the way the market is reminding the crypto bulls that a potential end in tightening volume does not mean a rapid start to a new balance expansion program, such as during the covid that greased the Crypto Bull market.

In addition, the QT speed has slowed noticeable from mid-2024. Since April this year, the Central Bank has limited monthly redemption of wealth to $ 5 billion, while maintaining the cover for security supports of mortgage for $ 35 billion. Thus, the approaching end of QT does not have to signal a significant bullish or intricate surprise.

“The big takeaway from Powell’s talk today is that the QT program is likely to end soon. That is, the Fed is likely to stop its balanced balance in the coming months. The run rate on this balance sheet is very small, so it’s not a big change,” pseudonymous observer and Mayhem markets taught In X.