Why the BNB now? The $ 1B token burn and corporate treasury is planning fuel demand

BNB edit closer to $ 700 mark while entrepreneurs respond to a fresh $ 1 billion tokens burn and the growing interest in using the owner as a corporate treasury reserve.

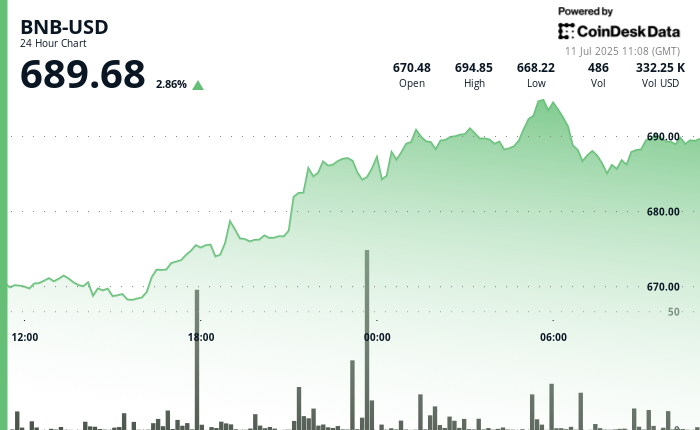

In the last 24 hours period, BNB increased about 2.8%, from $ 670.40 to $ 688.7. Trade grew louder as the price moved, amid a broader cryptocurrency market rally to see Bitcoin hit the New all-time high to $ 118,000.

The price briefly hits a peak of intraday near $ 695 before fixing a tight range of around $ 689.

Wally is not just -fueled by rising crypto tides. Binance’s 32nd quarterly burn is permanently removed about 1.59 million BNB from circulation, carrying a total amount of burnt in 265,605 BNB according to a Website tracking.

Burns are part of a deflection approach aimed at cutting the total supply to 100 million tokens.

On top of this, Over 30 The teams have been reported working on ways to structure public-competitive reserves in BNB, with a 10x capital firm that supports a plan for a $ 500 million listed US Treasury company.

Active addresses in the BNB chain doubled since March, walking around 2.5 million days -day, according to Nansen Data. Similarly, the average day -to -day volume of transaction is three times.

Investors are watching to see if BNB can crack the psychological barrier to $ 700 in the next few days.

General -Definition of Technical Analysis:

- BNB gained 2.77% over the 24-hour period, signing a solid upward momentum, according to the technical review model of CoinDesk Research.

- Price reached $ 27.51 (4.11%) between a low $ 667.61 and a high $ 695.12.

- The trading volume sprouted to 155,426 tokens at the end of the trading yesterday, more than double the 24 -hour average of 64,169.

- The resistance can be seen near $ 695.12, as the support appeared around $ 667.61.

- After the initial rally, prices were combined within a narrow $ 1.51 band from $ 688.81 to $ 690.73.

- The strong support was fixed near the $ 688.80- $ 689.00 zone.

- The market briefly tested the resistance to $ 690.73 before being brought back to a controlled pullback.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.