Bitcoin account for one-third of crypto investor portfolios in 2025

Bitcoin exposure rises to cryptocurrency portfolios, driven by more US Crypto regulations and the growing institutional adoption that has been triggered by the introduction of funds exchanged by the Bitcoin (ETF) exchange, according to a new report from Bybit.

Bitcoin (Btc) Accounts for about one-third of investor portfolios, or 30.95% of total properties held by investors until May, from 25.4% in November 2024.

It makes Bitcoin the largest single owned by cryptocurrency investors, reports. Meanwhile, the Ether (Eth) in the ratio of Bitcoin’s handling ratio to fall to a 2025 less than 0.15 by the end of April, before recovering at the current 0.27.

This means that for every $ 1 amount of ether, investors are likely to hold an additional $ 4 worth of Bitcoin.

Related: The investor makes about $ 30m from Bitcoin purchased in 2013

Bitcoin has raised all the major Global owners after US president Inauguration by Donald Trumpincluding stock market, equities, treasury and precious metal, gaining meaningful interest as a Variety -Portfolio That could generate further returns, Cointelegraph reported in March 2025.

Bitcoin’s stable return has inspired a new wave of institutional adoption, seeing companies holding Bitcoin almost doubled since June 5. More than 244 companies are now holding Bitcoin in their balance sheet, From 124 companies only a few weeks past, past According to In Bitcointreasuries.Net.

A total of 3.45 million Bitcoin was held in wealth, with 834,000 or 3.97% of total supply to public wealth companies and over 1.39 million bitcoin or 6.6% by the Bitcoin ETF area.

Growing institution adoption can be put on track bitcoin $ 1.8 million by 2035As the first cryptocurrency in the world will begin to compete with the $ 22 trillion gold market, according to Joe Burnett, director of market research in unchained.

“When I think about where Bitcoin is in 10 years, there are two models I admire,” Burnett said during Cointelegraph’s Chainreaction Show. “One is the homogeneous model, which suggests that Bitcoin is about $ 1.8 million in 2035.

Related: Bitcoin Treasury Trend is new altseason for crypto speculators: Adam Back

Sol Holdings have dropped 35% since October 2024

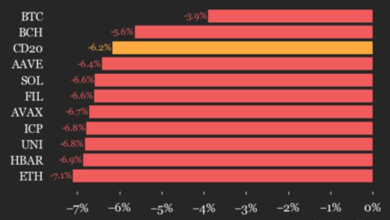

Despite the solid momentum, Bitcoin’s Bitcoin allocations fell 37% since November 2024, up to 11.6% – around half the percentage held by institutions.

Retail merchants are likely to “throw bitcoin handles to buy altcoins,” along with XRP (XRP) and stablecoins.

Meanwhile.

“The view of the crypto investment industry is that the approved Ripple Spot ETF is likely to be preceded by such approval for Solana spot ETF.”

“As such, we noticed the partial allocation of capital in the institutions from Sol to XRP,” the report reported.

Meanwhile, Solana’s portfolio handling fell from 2.72% in November to just 1.76% to May.

https://www.youtube.com/watch?v=GD81DFCMIH4

Magazine: History suggests Bitcoin taps of $ 330k, Crypto ETF odds hit 90%: Hodler’s Digest, June 15 – 21