Bitcoin (BTC) can threaten the state of the dollar, Larry Fink from Blackrock

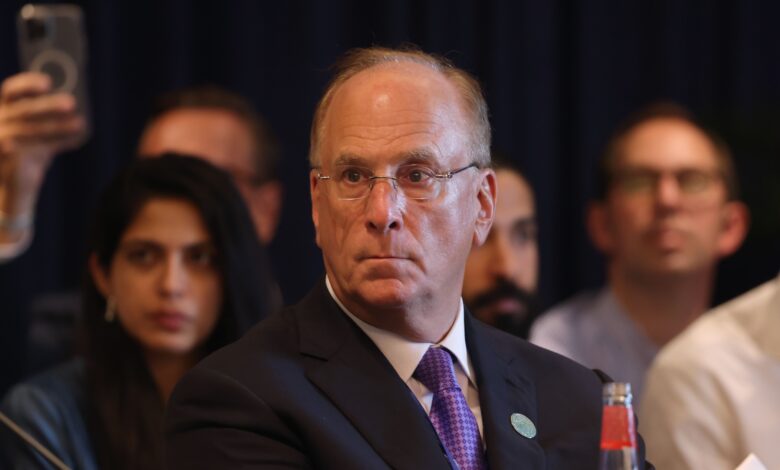

However, Larry Fink, CEO of Blackrock, said that he is not blind to the potential risks of the United States from Bitcoin (BTC) to the lead.

“The United States has benefited from the dollar, which works as a backup currency in the world for decades,” said Fink Ining. His annual message For shareholders. But this is not guaranteed to continue forever … If the United States does not bear its debts under control, if the deficit continues to swell, then America risks the loss of this position in front of digital assets such as Bitcoin. “

“Obviously, I am not an anti -point asset, FINK. But two things can be true at the same time: decentralized financing is an unusual innovation. It makes the markets faster, cheaper and more transparent. However, this innovation can undermine America’s economic advantage if investors start seeing Bitcoin more securely betting than the dollar.”

The Findi’s speech comes at a time of uncertainty and anxiety in the high market between investors about the country’s economic situation, amid changes in the policy that US President Donald Trump has developed. Fink said that to achieve a balance between the national deficit, investors must diversify their governor to add private market assets in addition to stocks and bonds.

Fink said that he doubles his commitment and belief in digital assets, that he believes that the distinctive money will be known among investors such as the money traded on the stock exchange (ETFS), provided that the industry can create a better infrastructure for digital identities, which Fink believes is an obstacle to obtaining investors from the fully dyed appetite.

“Every arrow, every bond, every box – every one of the assets – can be symbolic. If that, a revolution will happen in the investment.” “If we are serious about building an effective and accessible financial system, the defense of the distinctive symbol will not be sufficient. We must also solve digital verification.”

Blackrock, in January 2024, became one of the exporters who launched the health of Bitcoin ETF. Their product has become, Ishares Bitcoin Trust (Ibit), The most successful ETF in the history of the assets category. As of today, the fund deals with approximately $ 50 billion of assets, with half of the retail investors. The director of assets also released the Ramzi Money Fund, Buidl, which is On the right track to cross $ 2 billion of assets by AprilThis makes it the largest symbolic box in the market.

publish_date