The results of Bitcoin (BTC) Miner first-quarter may fail as the hashprice fell, hit the tariffs: Coinhares

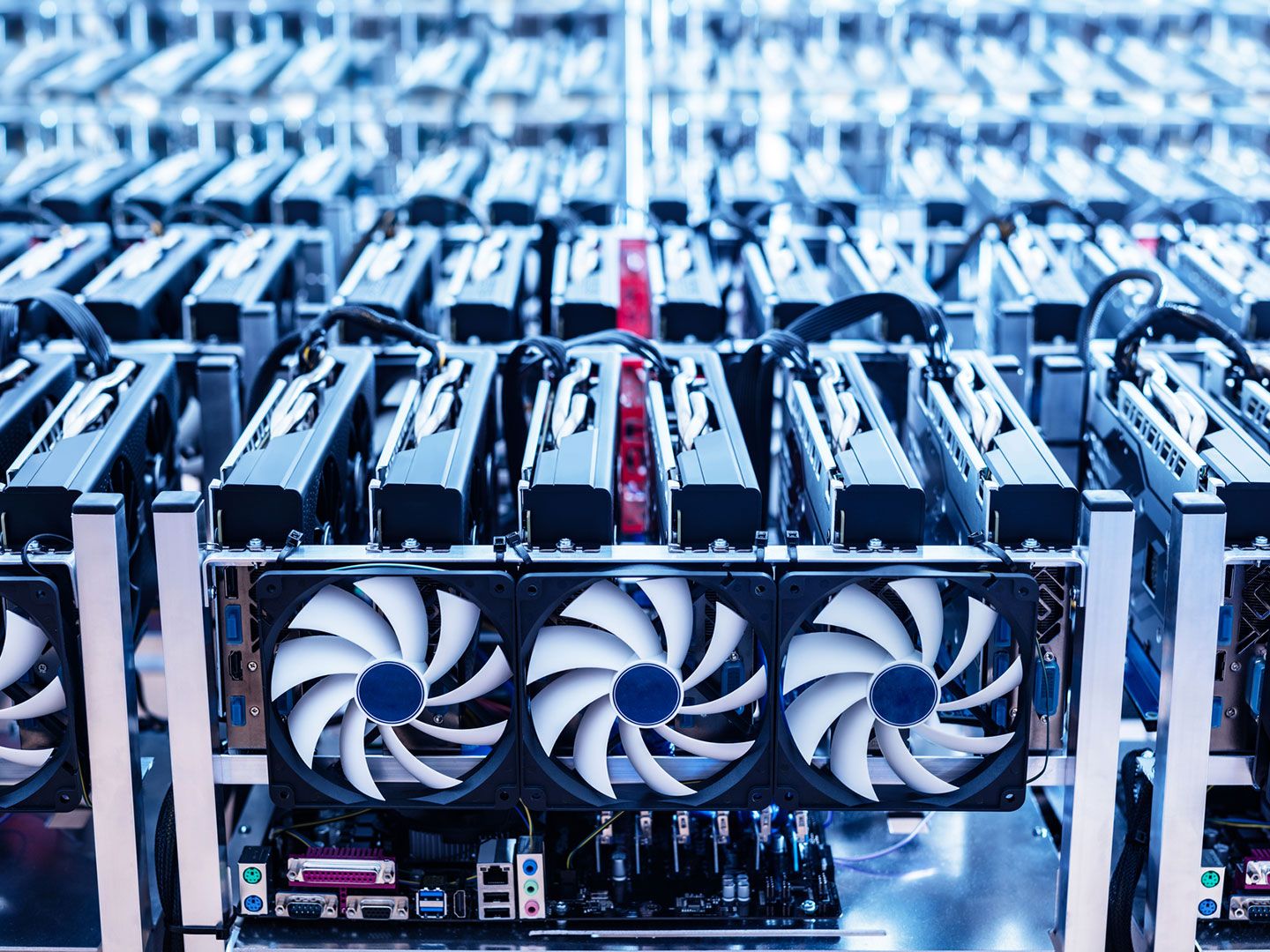

Bitcoin (Btc) The results of the first-quarter of miners may fail because the hashprice, a measure of daily mining profitability, has fallen and trading tariffs weigh in the market, asset manager CoinShares (CS) said in a Blog post on Friday.

“Q2 results may show destruction, as tariffs on that imported mining rigs range from 24% (Malaysia) to 54% (China),” written by analysts led by James Butterfill.

Bitcoin miners depending on older or less efficient rigs face increased exposure to these tariffs, the report said.

The Core Scientific (Corz) is “better insulated, as it moves to the HPC,” those with -set writes, adding that the bitdeer (BTDR), which makes their own rigs, can see the pressure of margin in sales outside the US

The asset manager foretold that the bitcoin network hashrate can reach 1 zettahash per second (zh/s) by July and 2 ZH/s in early 2027.

Hashprice’s view is not positive.

The asset manager model indicates “a gradual structural decline, with prices likely to remain ranges between $ 35 and $ 50 per pH/day until the 2028 halving cycle.”

Tariffs and trading tensions can be positive for the adoption of Bitcoin in the medium term, asset manager Grayscale said In a research report earlier this month.

Read more: Bitcoin miners with exposure to HPC do not change in the first two weeks of April: JPMorgan