Bitcoin faces massive ‘supply gap’ between $ 70k and $ 80k

Bitcoin’s (BTC) continued pullback can be accelerated below $ 80k, as Glassnode’s on-chain review indicates that the $ 10K price range under this level was marked with vulnerable economic activity last year.

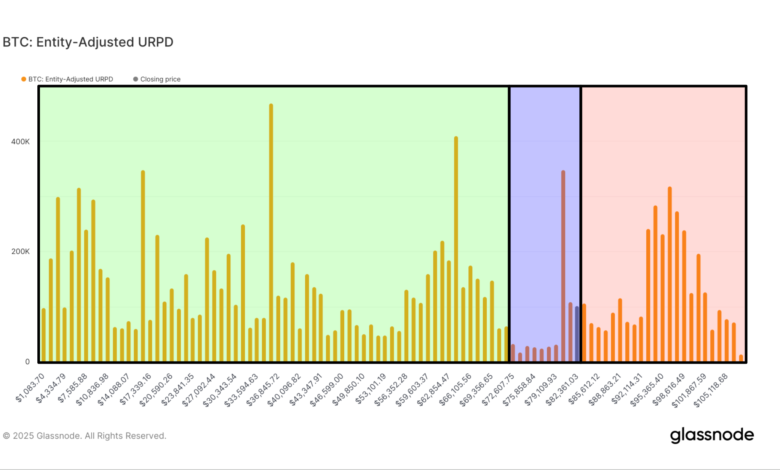

BTC prices rose quickly from $ 70k to above $ 80k in early November after pro crypto Donald Trump won the US president election. As a result, very little BTC changed hands between those levels, leaving a so-called “supply gap,” as bright from the UTXO chart of the glassnode realized (URPD).

This scale monitors price points at which existing bitcoin utxos were last moved. Each bar represents the volume of Bitcoin that last changed the hands within a certain price range. The data suits the entity, which means it assigns an average purchase price for each creature, categorizing its entire balance accordingly.

Bitcoin’s rapid flow from the mid $ 60k to more than $ 100k following US election victory left a small accumulation of $ 70k to $ 80K in range, as it only exchanged for a few days between these levels.

In other words, the total number of merchants with extraction prices between $ 70k and $ 80K is likely to be lower than other levels. So, a move below $ 80k is likely to see very little bargain hunting from those who are looking to buy more of their acquisition costs, thus ensuring a little support before $ 73K, all the time high set in March 2024.

Besides, since Bitcoin is currently combined -together above $ 80k, approximately 20% of the total supply is currently missing -meaning these handles are purchased above the current price of $ 83K. These wallets can add to the sale pressure below $ 80k, leading to a quick slide.

Glassnode data shows that approximately 100,000 BTC has been sold by Short -term Due to price correction. While supply and current Tepid Demand has contributed to the 30% pullback of Bitcoin from all times high $ 108K.