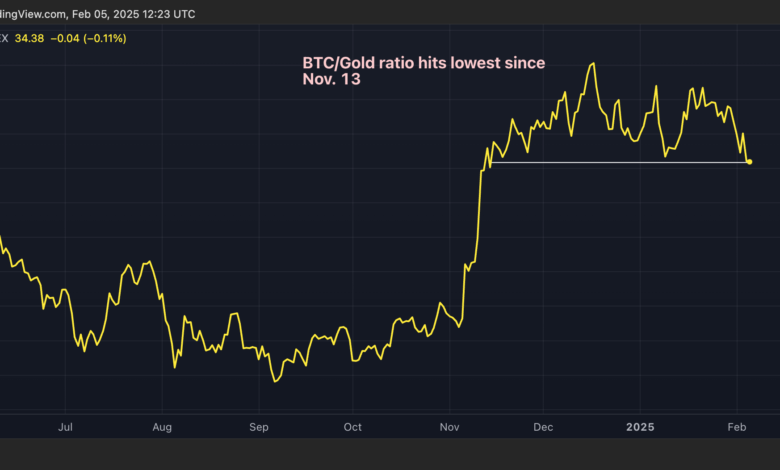

Bitcoin-Gold ratio to 12-week low as US Xau delivers Soar

Gold (Xau) re-proves its status as a safe possession of the shelter amid the ongoing fear of a US trade war led by the US, while Bitcoin (BTC) is struggling to gather reversed traction. The dynamic is driving the Bitcoin-Ginto ratio less.

The ratio between USD prices of Bitcoin and Gold’s Per ounce dollar prices has dropped to 34, the lowest since November 14, nearly testing the past peak hit in March 2024, data from the charting platform tradingview show. It dropped by 15.4% from hitting a climax above 40 in mid -December.

The year-to-date climbing gold of almost 10% of a per-record record price of $ 2,877 was driven safely in the middle of the US-China trade war, according to Reuters.

The threat of tariffs has focused on metal products futures prices of trade prices above the area price in recent months. That has traders loading planes bound in the US with yellow metal. Giant banking banking JPMorgan plans to deliver a $ 4 billion gold bullion in New York this month, according to The Guardian. Plus, Chinese demand for gold is Surged because of the Spring Festival Holiday.

Meanwhile, the flow to the US listed areas Bitcoin (BTC) ETFs is primarily from entrepreneurs engaged in non-direct arbitrage bets at BTC, according to 10X Research.

“The purchase of ETF can be offset by simultaneous place or sale of futures (not to avoid long positions), dampening any significant price impact,” said Markus Thielen, founder of 10x Research, in a note to clients Monday, cited $ 4 billion in the US listed the US listed on ETFs from the release of Inflation data Three weeks ago.