Bitcoin Long-Term Holders Have Sold 1M BTC Since September: Van Straten

Bitcoin (BTC) is currently trading 13% below its record high of around $108,000, the most since President-elect Donald Trump won the US election in early November.

Since then, the largest cryptocurrency has spent several periods at 10% below the record, a level that some investors correction term.

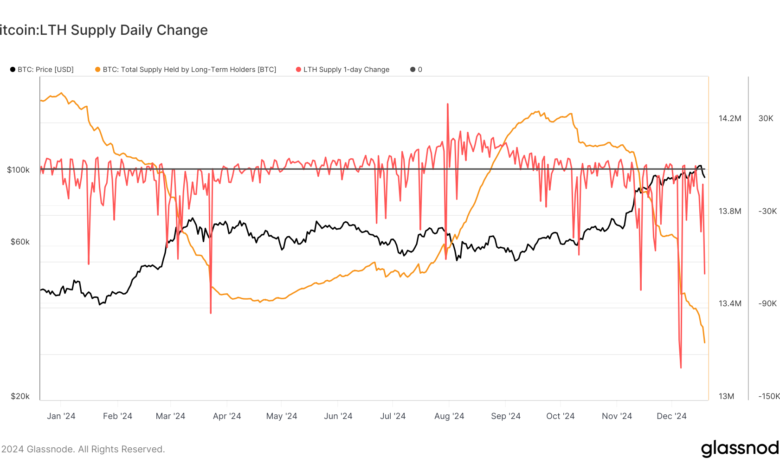

The selling pressure is coming from long-term holders (LTH), which Glassnode defines as investors who have held bitcoin for at least 155 days. They tend to sell on price strength after accumulating bitcoin when prices are depressed.

LTHs have been distributing a large amount of BTC about a week ago, previous research on CoinDesk showed up Since then, they have picked up the pace and reduced their total holdings to around 13.2 million BTC from around 14.2 million in mid-September.

On Thursday, they sold nearly 70,000 BTC, the fourth largest single-day sale this year, according to Glassnode data.

On the other hand, for every seller, there must be a buyer. In this case, it was the short-term holders (STH) who accumulated around 1.3 million BTC in the same time period. The number indicates that they have picked up coins from LTHs and more.

Over the past few days the narrative has changed and LTHs are looking to sell more than short-term traders are looking to buy. That imbalance contributed to a price drop of about $94,500.

There are 19.8 million tokens in circulating supply and another 2.8 million sitting on exchanges, though the balance continues to decline: about 200,000 bitcoins have left exchanges over the past few months.

These cohorts are key to tracking bitcoin price activity in the coming days.