Bitcoin needs to fill in $ 110,000 CME gap, dispute review

Basic Points:

-

Bitcoin returned on a trip to $ 114,000 at Wall Street Open.

-

Entrepreneurs remains to be careful with a secret, especially thanks to a new CME gap opening over the weekend at $ 110,000.

-

The Macro review finds the beautiful odds of another “uptober” for crypto.

Bitcoin (Btc) resumed its sudden rebound on Monday of Wall Street Open as entrepreneurs remained careful.

CME gap cools the excitement in bitcoin rebound

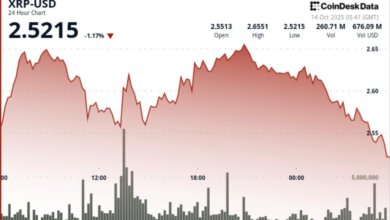

Data from Cointelegraph Markets Pro and Tradingview showed that the BTC/USD hit $ 114,000 because the sun -earned gains exceeded 1.5%.

An unlikely weekly near the top of $ 112,000 set a pair for a strong first Asian session, which also saw gold making new hours high.

As the BTC’s short -term price action appeared, merchants were nothing but relaxing. A new “gap” in the Bitcoin futures market of the CME group has formed a major reason to expect lower levels.

“$ BTC now has a CME space around $ 110,000 levels,” crypto investor and businessman Ted Pillows summary in a Post on x.

“Bitcoin has filled every CME gap in the last 4 months, so it is likely to be filled. Look at it.”

Number Cointelegraph reportedCME gaps tend to act as “magnets,” which attract the market to fill them for weeks, days or even hours.

“Bind that we will come back and close it if we want a clean move higher this week,” Nic Puckrin, CEO and Crypto Adoption Platform Coin Bureau, CEO and Cofounder, Argued.

To fill in the gap, the BTC/USD needs to sliced through a new mass of liquidity bid centered at $ 111,000, according to data from coinglass.

The momentum of the order-book continues to drive, with 24-hour crypto liquids passing $ 400 million at the time of writing.

On Saturday, Keith Alan, co-founder of the material resource material indicators, called liquidity above the price “Paper thin” below $ 115,000.

“I expect especially spicy things around the weekly close to the week and continue monthly near Tuesday,” he predicted At the time.

“UPTOBER” ODDS FLIP with BTC price

As gold combined after its earlier high $ 3,831 per ounce, Bitcoin followed a bullish start on Sunday for US stock markets.

Related: BTC Price Due to $ 108k Ping Pong: 5 Things to Know Bitcoin this Sunday

The S&P 500 and Nasdaq Composite Index are up to 0.5% and 1%, respectively, at the time of writing.

Commenting, the QCP Capital Trading Company suggested that the view for a classic crypto “uptober” was good.

“Vols are less trending, with expectations that they are still drift as the premises combined US payrolls that are non-farm,” it wrote in the latest edition of “its”Color Asia“Analysis series before opening Wall Street.

“While there are questions around if the NFP can be delayed if the US government has collapsed, the markets appear to be a bit of a non -guilty, which has been the Wall Street’s acquisitions.”

The QCP argues that $ 115,000 must be re -observed to “confirm a modified submission.”

This article does not contain investment advice or recommendations. Every transfer of investment and trading involves risk, and readers should conduct their own research when deciding.