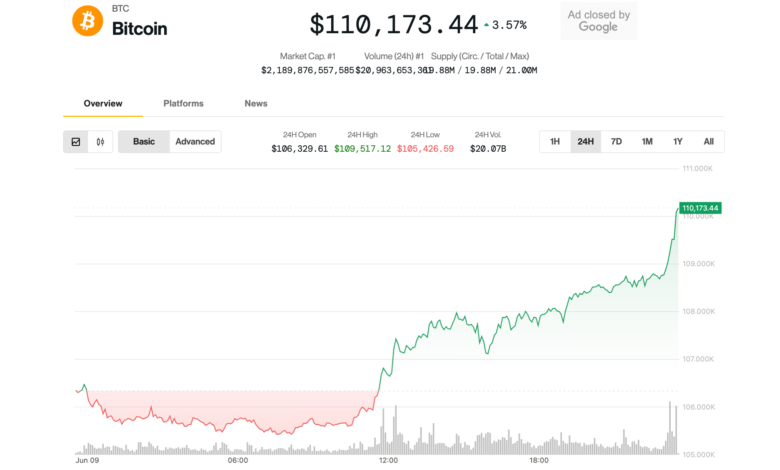

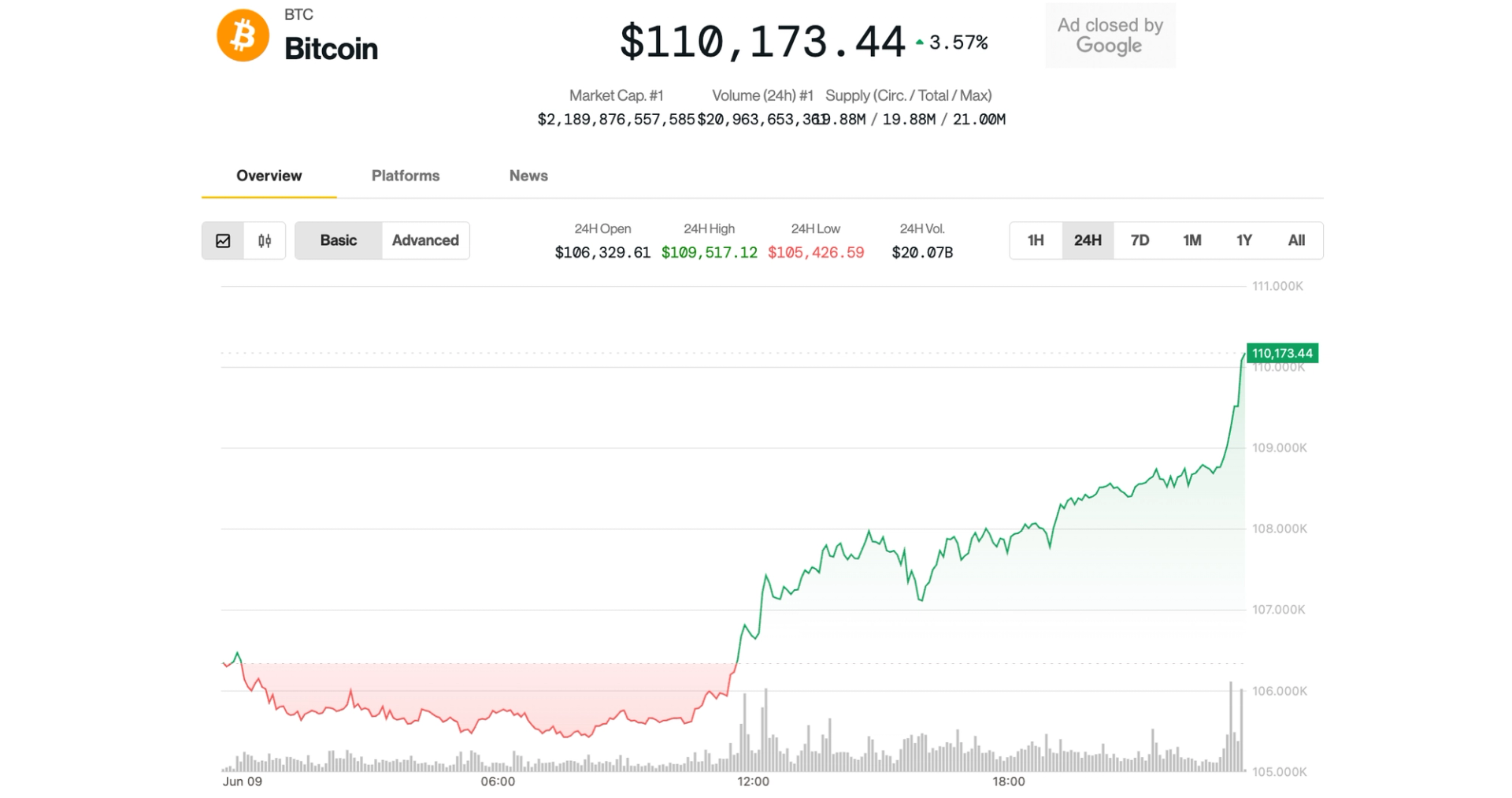

Bitcoins climbed above $ 110k near records highs

Bitcoin’s

The quiet climb on Monday accelerated at its strongest price in June, which rebuke from the fall of the past week to close to all hours of high levels.

The largest crypto advanced 3.7% in the last 24 hours, leading $ 110,000, and it only changes hands by just 2% from record prices observed in May. Ethereum’s ether

Continued speed of a 3.8% gain at the same time, which bounces above $ 2,620. Native token of hyperliquid And the SUI raised most large cryptocurrencies, rising by 7% and 4.5%, respectively.

Moving bitcoin higher caught uplifting traders, which liquidated more than $ 110 million worth of short positions within an hour, coinglass Data Shut up. Throughout all crypto possessions, about $ 330 million shorts were liquid in the sun, most a month. Shorts seek to earn from declining the prices.

The transition occurred as traditional markets showed mute action, along with S&P 500 and Nasdaq’s indexes flat during the day. Crypto-related stocks bounce in the session to meet BTC recovery over the weekend.

“A ‘peaceful rally’ is a perfect way to describe this price action,” said well -followed analyst Caleb Franzen, founder of Cubic Analytics. “Only a very similar development of higher and higher lows. Any signs of weakness? Consumers come in and defend the trend.”

The crypto market is now on steadier footing for a potential next leg higher after 10% Bitcoin’s decline in close to $ 100,000 and has more than $ 1.9 billion in liquids throughout the crypto derivatives over last week, which has filed excessive action, the Bitfinex analysts mentioned in a report of Munays.

However, on-chain data suggests an increase in sales pressure from long-term holders that can fill the demand, analysts added.

“Bitcoin is in a branch -a balance between structural support and bullish momentum prevention, waiting for the next macro cue,” the Bitfinex Note added.

Macro catalysts may come later this week, Jake O, OTC Trader in the Crypto trading firm Wintermute.

“US and Chinese trade representatives are set to meet today, with markets that are likely to be sensitive to any headlines following the positive momentum of last week, and the data calendar remains light until Wednesday, when the CPI will offer a fresh perspective on US inflation,” he said.

Update (June 9, 21:51 UTC): Adds short destruction data from coinglass.