Bitcoin’s short -term holders stopped, CME Open Interest Slid by record on Monday’s price falling

Short -term bitcoin (Btc) Market holders came out of the loss of Monday as the drops of prices also found derivative entrepreneurs thrown into the towel, leading to a significant denial of open futures of futures at the Chicago Mercantile Exchange.

Short-term holders, defined by Glassnode as addresses with a history of holding coins for less than 155 days, sent over 21,000 BTC ($ 2.2 billion) to exchanges at a loss as the largest cryptocurrency fell as much as 4.7%, the most in two Sunday, according to the pricing of coindesk indexes.

Moving to exchanges, often a primer in sales, is the second largest this month and may reflect that consumers purchased when the price is close to record highs around $ 108,000 towards the start of the years are five numbers.

These addresses, owned by active merchants, newly entered and weak hands, tend to be sensitive to price gyrations and often give up when prices slide. The BTC fell under $ 98,000 while the release of the weekend of China’s Beginning Deepseek challenged US leadership to AI and technology.

Other corners of the market are also apt in capitulation, which is often observed in local bottom prices. For example, the Perpetual funding rates For the BTC it has been negative, a sign of stronger demand for bearish bets. That is usually when Bitcoin reaches a low as on January 13, when Bitcoin sank below $ 90,000 and August 5, during the Yen to bring trade.

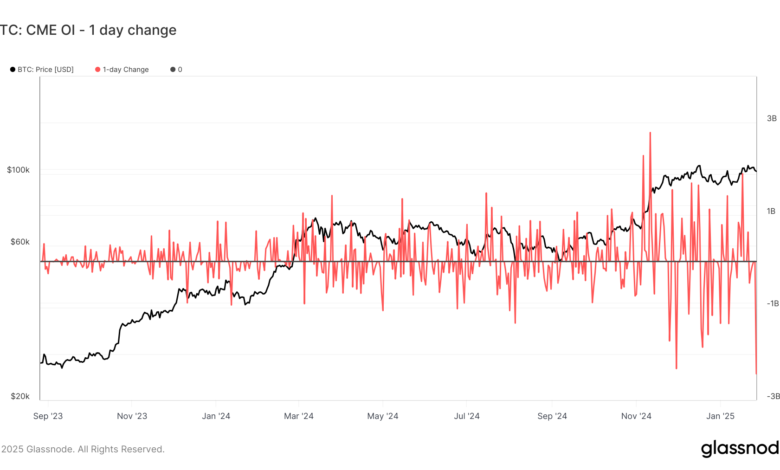

De-risk also occurred in the Chicago Mercantile Exchange, a proxy for institutional activity, which saw the largest notional drop in the open interest (OI) in conjunction with a double-digit slide in Chipmaker Nvidia (NVDA). The notional Bitcoin OI has fallen by a record of $ 2.4 billion (17,000 in BTC terms), which is lower basis, according to glassnode data.

The US listed the Bitcoin Exchange-Traded Funds (ETFS) a massive flow of $ 457.6 million. A similar flow took place on January 13, according to farside data.