Retail investors dominate the crypto markets

While investors are recovering their area in the crypto market, the memecoins and real-world asset tokenization democratize access and challenging institutional dominance.

Opinion

The table turns out, mainly with increasing real-world asset (RWA) tokenization and a decisive decline of capital-supported tokens. Crypto is no longer a class of niche assets for institutional investors – retail users are actively shaping the future of finance.

Crypto has a division of retail

As governments think of the development of strategic Bitcoin reservesThey risk being locked in Central Bank Cold Wallets. For optimal use, it is important to keep Bitcoin accessible to retail investors Open reserves.

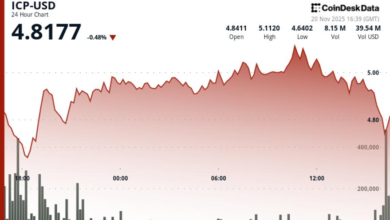

Retail investors reclaim crypto

This article is for general information purposes and is not intended to be and should not be done as legal or investment advice. The views, attitudes, and opinions expressed here are unique and do not necessarily reflect or represent the views and opinions of the cointelegraph.