Blockchain Group to raise $ 340m for Bitcoin Treasury

The Paris-based cryptocurrency firm plans the blockchain group’s plan to raise more than $ 340 million worth of capital for its bitcoin treasury, the sign of the ongoing institutional adoption of crypto in Europe.

The blockchain groupwhich is said to be Europe’s first bitcoin (Btc) Treasury Company, plan to raise 300 million euros, or around $ 342 million, to fund more BTC purchases, According to on a release of June 9.

The structure of $ 340 million rotation is inspired by the US skill of “market” (ATM) offerings. Under this structure, shares are sold in market conditions initiated by the company counterpart, subject to a pre-agreed volume.

The increase will be carried out on the branches, with pricing based on “higher in the price of the previous day closing or the average weight price price,” which is trapped by 21% of the trading volume that day, the announcement added.

Related: Stablecoin law to drive a bitcoin market cycle in 2025: financially re -defined

Announcement will come one week after the European cryptocurrency firm Got $ 68 million The value of Bitcoin, which drives its total handling at 1,471 Bitcoin, or over $ 154 million, Cointelegraph reported on June 3.

Other Bitcoin institutional holders are also launching fundraising efforts to capture more BTC.

On June 6, Michael Saylor’s approach announced its plans to raise nearly $ 1 billion through a stock offer to fund the future purchase of Bitcoin, which quadrupling previously announced the firm $ 250 million increases.

The approach is the largest corporate holder with Bitcoin holder, with more than $ 61 billion worth of bitcoin in its books, representing 2.76% of the entire BTC supply, Bitbo Data displays.

Related: Swedish MP recommends the Bitcoin Reserve to the Minister of Finance

Bitcoin’s momentum driven by “Strategic Treasury” moves

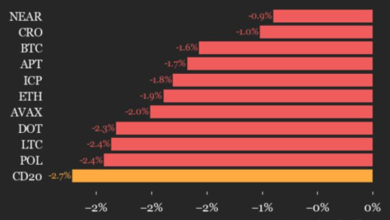

Bitcoin enters a period of integration — with the price of the price after breaking the $ 112,000 all time on May 22th.

Despite the short-term disadvantage, the adoption of the institutional and strategic moves in the box continues to “anchor the long-term narrative,” Nexo dispatch editor Stella Zlatareva told Cointelegraph, added:

“Strategic buys, treasury allocations and infrastructure investment paint a picture of long-term confidence-whatever the action of short-term prices.”

Bitcoin’s strong rebound from $ 103,000 support signals is elastic, with “no signs of mass deleveraging or forced sale,” Zlatareva added.

Despite the positive sentiment around the Treasury-based accumulation, the funds listed in the US listed in the US have struggled to maintain the flows.

ETFS saw more than $ 47 million worth of flow on June 6, a second consecutive sale day after $ 278 million worth of net outflows on June 5, According to to investors in farside.

https://www.youtube.com/watch?v=gnunx0QWH3Q

Magazine: Bitcoiner sex trap extortion? BLTS Firm’s Blockchain Disaster: Asia Express