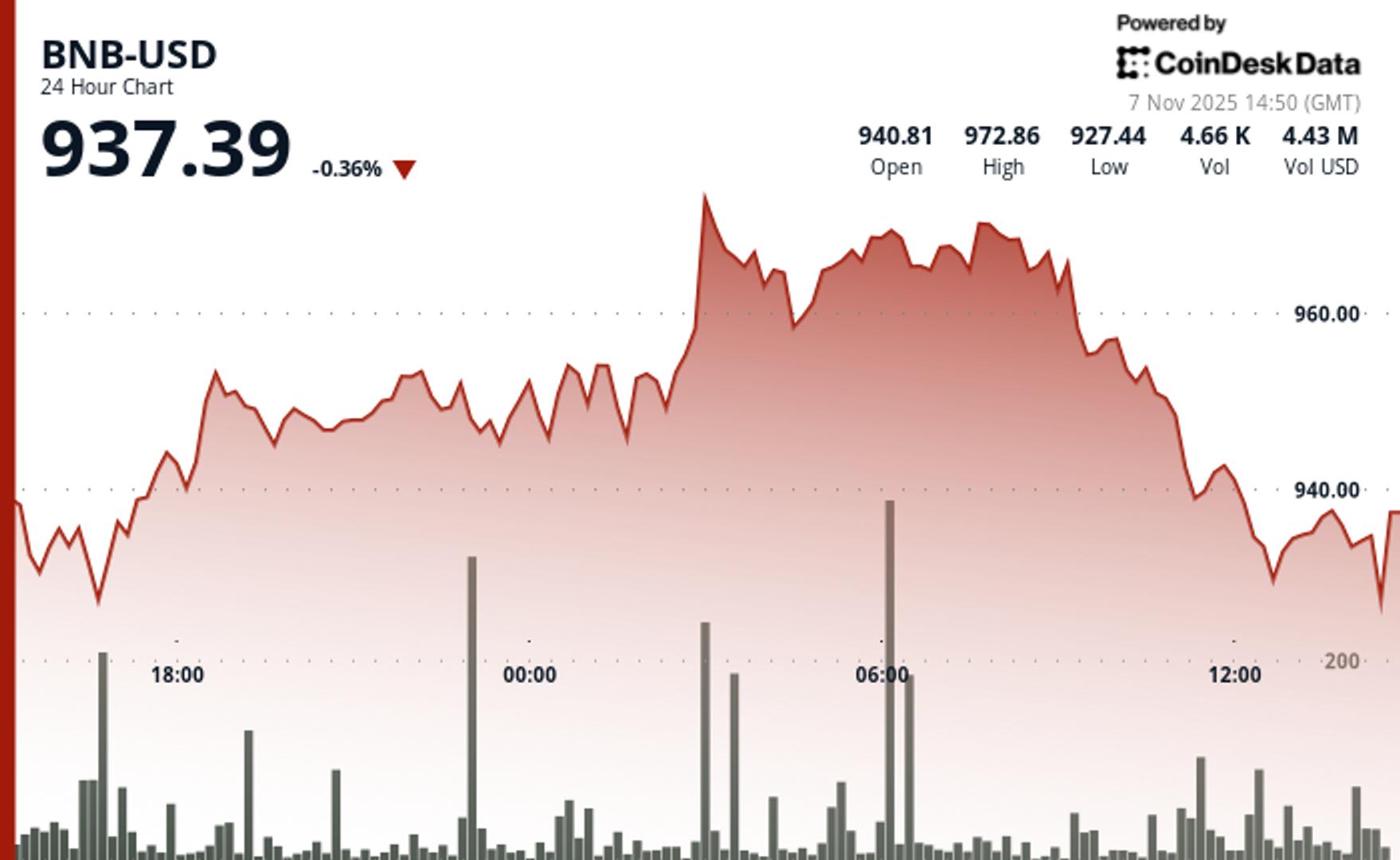

BNB drops to key support level above $930 as markets react to liquidity pressures

The BNB chain’s native token, BNB, slipped slightly in the last 24-hour period, moving to $933 after a brief dip at $974, as the broader crypto market showed signs of stress tied to tight financial conditions.

The token’s price action played out in a narrow $46 range. Volume rose sharply in the morning move higher, 71% above the 24-hour average, but cooled nearby according to Coindesk technical research’s technical analysis model.

The decline near $975 marked a technical ceiling, while BNB found support again near $930.

“BNB’s ability to hold support mirrors the broader strength we see in the chain,” Johnny B., the founder of BNBPAD.AI, told Coindesk in an emailed statement. “Despite market headwinds, the BNB chain saw 82 million active addresses in October, a new all-time high, while Dex volume is close to $120 billion based on Defillama.”

BNB’s muted performance comes alongside a broader market drawdown. The broader market, as measured by Coindesk 20 (CD20) index, is down 0.9% in the last 24 hours as Bitcoin struggles to stay above $100,000.

A US Treasury Cash Rebuild and Falling Bank Reserves, estimated at $500 billion since July, have drained capital from markets and made assets less attractive, according to a recent report from Citi.

That also saw stocks fall as well, with the tech-heavy Nasdaq 100 seeing a 4.7% decline this week, and the S&P 500 dropping 2.7%.

In this environment, BNB’s ability to stay above the key $930 support level may reflect confidence in network adoption and the performance of newer decentralized applications like Asper, even if the broader outlook is dim.

A break above $975 could reopen the path to recent highs, but further declines in major assets could test buyers’ resolve. BNB remains tied to technical setups for now, but broader market forces are starting to call the shots.

Disclaimer: Parts of this article were generated with help from AI tools and reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see Coindesk’s full AI policy.