BNB SLIPS below support as broader crypto market reacts to Fed Uncertainty

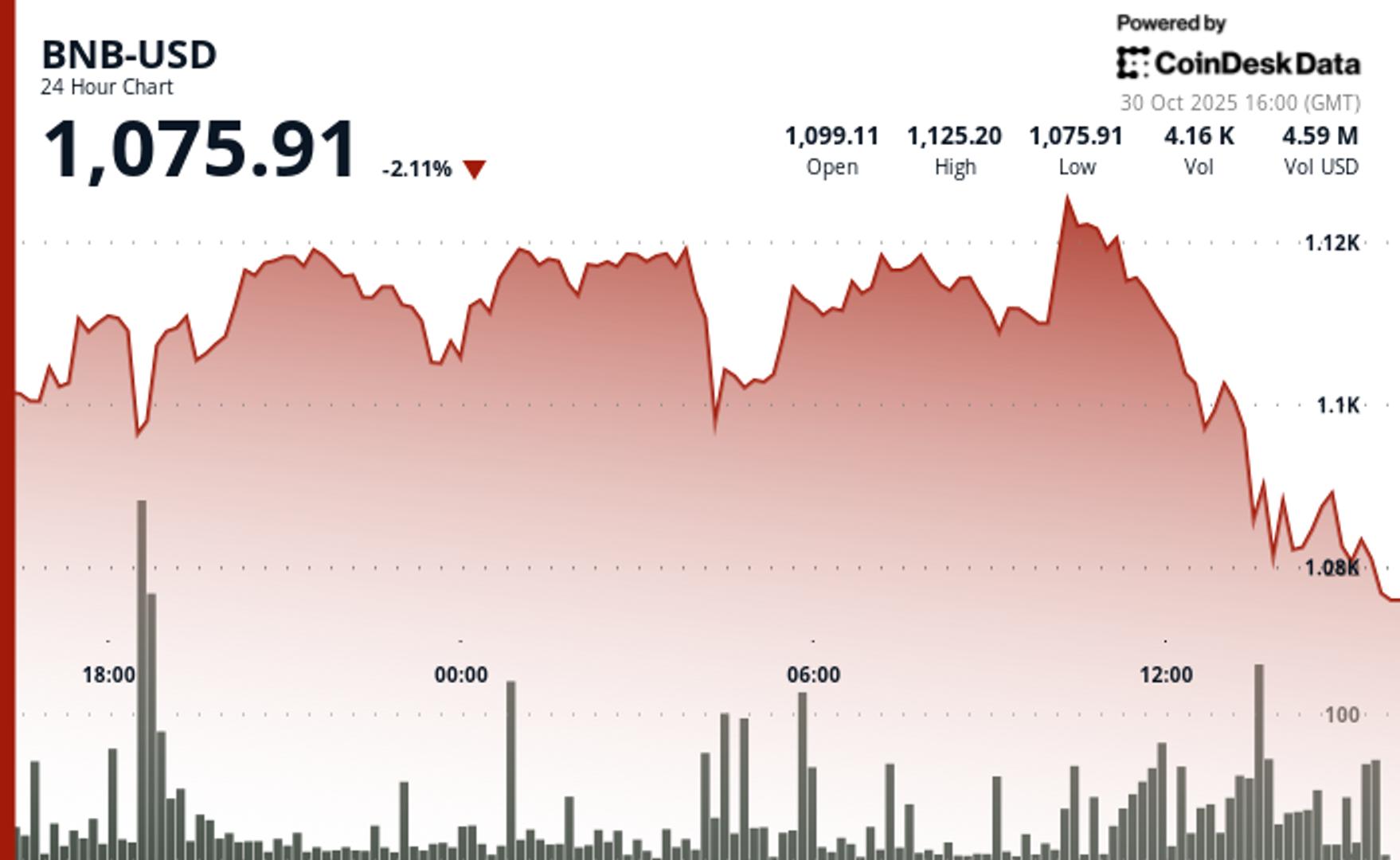

BNB is down more than 2% in the past 24 hours, falling to $1,073 after failing to hold key technical support around $1,095 according to Coindesk Research’s technical analysis data model.

The fall comes as the broader crypto market reels from a wave of selling tied to Shifting signals from the US Federal Reservewith the broader market slipping 4.7% based on Coindesk 20 (CD20) index.

The Fed Cut interest rates by 25 basis points, as widely expected. But Chair Jerome Powell’s remarks that further cuts in December do not warrant shaking off risk assets, including crypto.

As a result, the 24-hour liquidation flew to more than $ 1.1 billion according to Coinglass data, including most long positions.

For BNB, selling accelerated after repeated failures to break the resistance near $1,115. After prices fell below $1,095, selling pressure intensified with the token falling to an intraday low near $1,081 before settling around $1,073. The price action showed a series of lower highs, a signal of fading momentum.

The fall appears to be driven more by market structure than any token-specific news. BNB’s technical patterns mirror those of other major tokens as the Digest Central Bank traders and position for Friday’s $13 billion option.

BNB now faces short-term resistance around $1,087. A recovery above $1,095 could help neutralize the downtrend, but if sellers remain active, a retest of the $1,081 level is in play.

Disclaimer: Parts of this article were generated with help from AI tools and reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see Coindesk’s full AI policy.