BNB Token News: Cuts to be cut off

Validators in the BNB chain have suggested Lowering the minimum gas price from 0.1 GWEI to 0.05 GWEI while reducing block intervals from 750 milliseconds to 450 milliseconds.

The goal is to drive average transaction costs up to about $ 0.005, making the network competitive with low chains such as Solana and Base.

The proposal complies with a decision in April 2024 to cut gas from 3 GWEI to 1 GWEI, and again in May it is cut to 0.1 GWEI, with fees dropping 75% as a result.

“As long as the staking apy remains more than 0.5%, the BNB chain should strive to have the lowest gas fee,” the record notes, which frame ultra-low-lowering as a basic network growth principle.

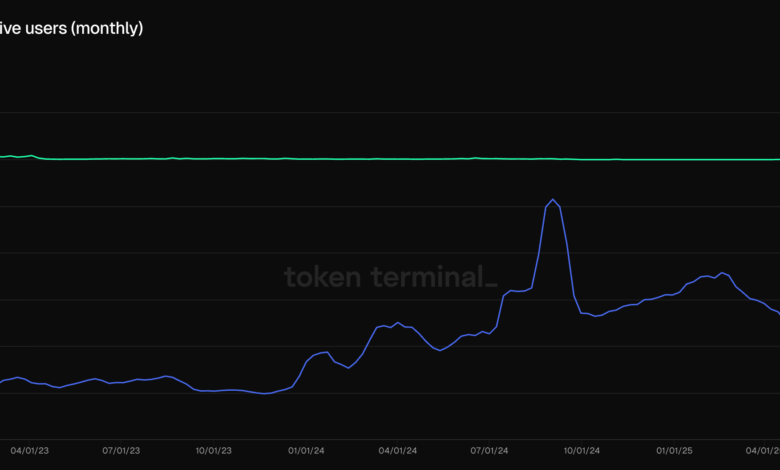

The timing of the proposal is key; On-chain trading activity is emerging with a decentralized exchanging aster emerging as a breakout trading area.

According to CoinMarketCapThe exchange processes $ 29.37 billion in continuous quantity of futures over the past 24 hours. Data from Delete The aster shows that make up $ 7.2 million in sunny income, more than double $ 2.79 million of hyperliquid.

That strength is a mirror in their tokens. AST has advanced 37% in the past 24 hours, raising market capitalization from $ 931 million a week ago to $ 3.74 billion. By contrast, the hype poured billions -billion worth, falling from $ 14.88 billion to $ 11.73 billion.

Trade -related transactions dominate the BNB chain activity, rising from 20% by the start of 2025 to 67% in June. The proposal records that a lower cost environment can drive further growth.

Meanwhile, the BNB token, has dropped 1% in the past 24 hours but still remains above a major psychological level of $ 1,000 with a sun -sun volume of topping $ 3.8 billion.