Bonk led Memecoin in the middle of the crypto rally as the 1M token approaches holding a milestone

As Bitcoin

Hovers near a fresh all-time high, Solana based in Memecoin, Bonk, leads the main rally of Altcoin.

The Surge coincides with the modified optimization of risk assets following the Bitcoin recovery above $ 110,000, which has been able to overcome widespread gains throughout the established cryptocurrencies.

Bonk’s momentum appears to be sustainable as many crypto analysts expressing emotion, citing significant reversal potential left.

Adding to Bonk’s Bullish Case, the token launchpad of Bonk Foundation, Letsbonk.Fun, recently Nailed Competitor pump.fun in sunny volume with an increase of 126%. This development benefits Bonk holders as 50% of the platform revenue is allocated to the purchase and burning of Bonk tokens, creating additional positive price pressure in a market that expects the upcoming 1 trillion token burned when the project reaches 1 million holders.

Meanwhile, Tuttle Capital Management confirmed July 16 as the earliest possible launch date for the suite of leveraged Crypto ETFs, including a 2 × bonk ETF, fuel of bullish.

Technical assessments

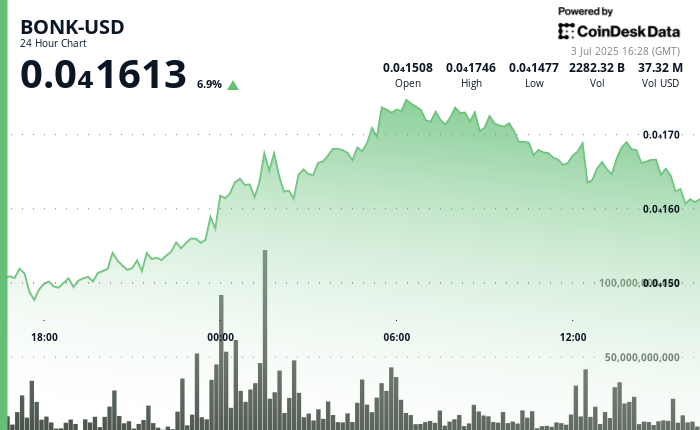

- The Bonk-USD pair has experienced increasing purchase pressure in the last 24 hours, from July 2, 16:00 UTC, until July 3, 15:00 UTC. It advanced from $ 0.0000147 to a peak of $ 0.0000175, which represents a range of 10.4%, according to the CoinDesk Research’s technical review model.

- A significant spike volume at 2.9 trillion at midnight on July 3 established strong support at $ 0.0000157 level, while buying high volume at the level of $ 0.0000168 during the UTC’s 05:00 hours that pushed prices higher despite the late session-taking, the model showed.

- However, in the last 60 minutes from July 3 to 14:50 to 15:49 UTC, Bonk-USD experienced significant volatility, dropping from $ 0.00001666 to the low $ 0.00001619 before recovering to $ 0.00001624.

- A well -known spike volume of 86.9 trillion at 15:35 at the same time lowering the price to $ 0.00001619, which established a major support level. The subsequent recovery was formed by an ascending trend with an increase in volume, especially at 15:49, of which 22.5 trillion in volume pushed prices 2.7% from the low session, according to the model.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.