Breakout eye entrepreneurs at $ 3.10. Here’s why

The XRP has sprung up to $ 3.05 in the double shift before fading the integration -together, with whales offloading more than $ 300m while institutional tables were recorded in advance of a pivotal fed decision.

The $ 2.99 floors held in the repeated defenses, leaving the price boxed between $ 2.99 and $ 3.05 while ETF deadlines and speculation rates.

News background

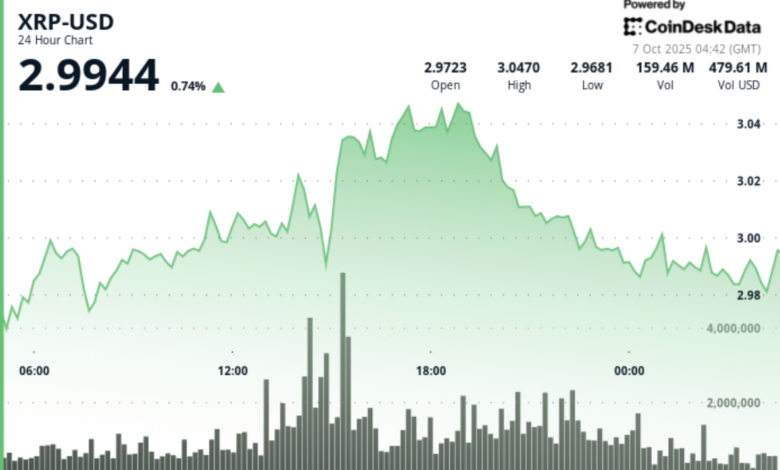

XRP gained 3% to 24 hours until October 7, the trading between $ 2.97 and $ 3.05 before closing near $ 2.99. The move is driven by a flow to institutional flows – more than 1.5B tokens transferred – and whale disposal exceeds $ 300m.

Macro catalysts are dominant emotions. Markets today are the price of a 96% chance of a fed rate cut on October 29, while 70+ ETF applications, including seven for XRP, have faced SEC deadlines since October 19.

Summary of price action

- The scope of the XRP session sailed $ 0.08 (3%), from $ 2.97 low to $ 3.05 high.

- The Japanese rally raised the price from a $ 3.00 to $ 3.04 in the 137M turnover, almost 2x the day -to -day average.

- Repeated -repeating denial of $ 3.04- $ 3.05 confirmed resistance.

- The price rolled around $ 2.99, where consumers stepped several times.

- A late flush at $ 2.981 is quickly absorbed, with a volume of 2.2M spikes creating a short -term floor.

Technical analysis

The resistance remains to be hidden at $ 3.04- $ 3.05, where heavy sales are on -govance. The support has been proven at $ 2.99, strengthened by many retests and absorption of flow of intraday flow. The price structure suggests accumulation at the $ 2.99 base, with a potential bullish continuity if the momentum can retrieve $ 3.03 and challenge $ 3.05. Breakout through this resistance can set up targets towards $ 3.10, even if macro catalysts remain dominant drivers.

What entrepreneurs are watching?

- If $ 2.99 holds as a support base firm under continuous whale distribution.

- If positioning at the institution maintains momentum on October 19 ETF deadlines.

- Market reaction to Fed policy signals – a cut can lift flows to risk assets.

- Confirmation of Breakout above $ 3.05 to unlock the next leg towards $ 3.10- $ 3.12.