BTC is facing heavy selling pressure despite seasonal bullish expectations

Bitcoin continues to trade sluggishly around the $110,000 level and remains under pressure compared to gold.

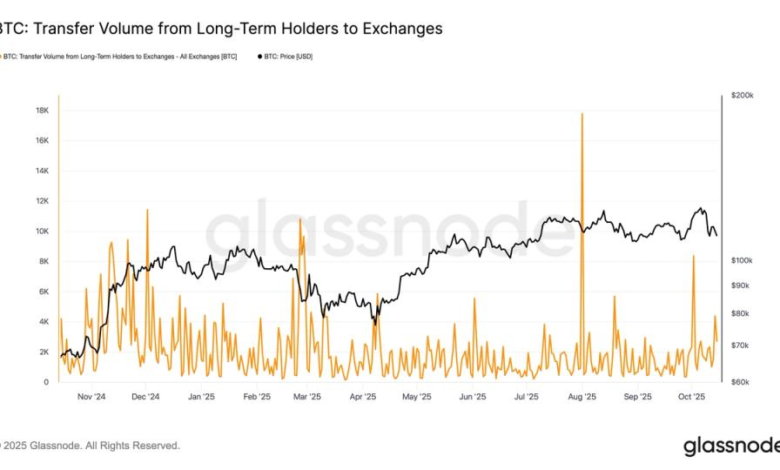

Onchain data from Glassnode shows that selling pressure from long term holder (Lths) intensified. Glassnode defines lths as investors who have held Bitcoin for 155 days or more.

Currently, LTHS collectively holds approximately 14.5 million BTC, but they continue to reduce their positions. In the past few days alone, this cohort has sold nearly 100,000 BTC. Since the peak of their holdings, they have offloaded more than 300,000 BTC since the end of June.

Given that almost all LTHs are currently profitable, the data suggests that significant profit-taking has been underway since the beginning of October.

There are many theories as to why this sale is taking place. Historically, Q4 has been a seasonal period for Bitcoin, and approximately 18 months after a splitting event is generally considered the most bullish phase of the cycle. However, with the current cycle not following this historical pattern, some investors may exit positions amid concerns that the four-year cycle theory played out in previous cycles may not hold this time.

Glassnode’s data also highlights that whales are the main distributors of Bitcoin currently. According to the accumulation trend score by cohort, entities holding more than 10,000 BTC are in heavy distribution. Cohorts holding between 1,000 and 10,000 BTC have a neutral stance with a score of 0.5, while all cohorts holding less than 1,000 BTC are net accumulators. Whales have been selling off the net since August.