BTC Miner Iren pours 25% after income

Iron (Iren) Reported fourth quarter results highlighted rapid development in both Bitcoin mining businesses and artificial intelligence businesses, according to a research report on Friday Broker Canaccord Genuity.

The broker repeated its purchase rating in stock and climbed a price target of 60% to $ 37 from $ 24, citing stronger visibility in both AI income streams.

In early trading, shares are 25% up to $ 28.75.

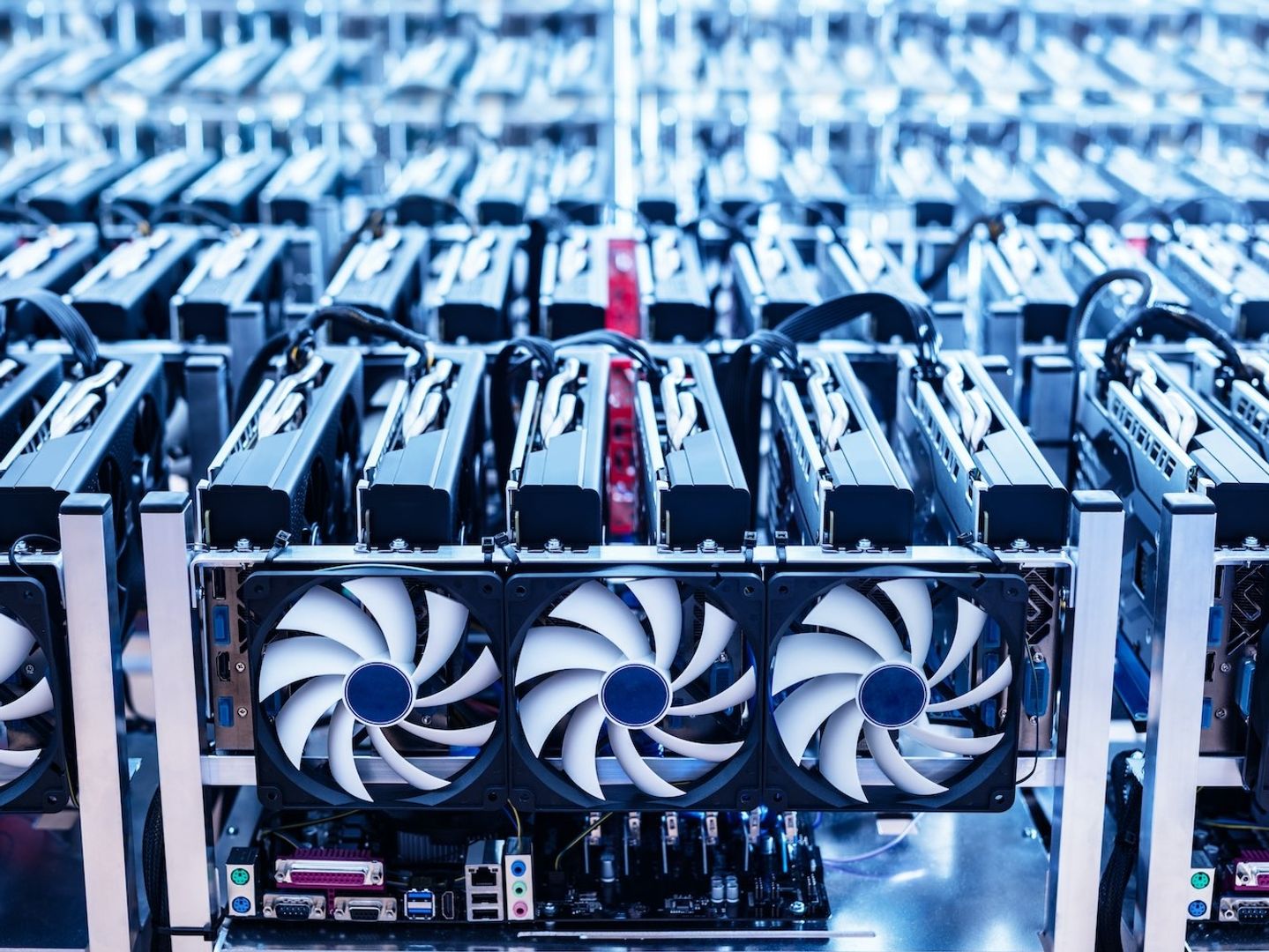

Company mining unit reaches an annual income run rate above $ 1 billion, reinforced by 50 exahash per second (Eh/s) of the capacity and one of the most efficient fleets of the industry at 15 J/th, which operates at 3.5 cents/kWh power, the analysts led by Joseph Vafi wrote. That translates to a $ 36,000 cost to the mine of a bitcoin, which is less than market levels.

Bitcoin’s mining revenue came at $ 187.3 million for the quarter, up to 33% in succession, as EBITDA was adjusted to jump 46% to $ 121.9 million.

On the AI side, Iren speeds up the expansion, the report mentioned. The Bitcoin Miner has quadruped its hashrate and added another megawatt of power capacity, which now covers 3 MW, with further growth expected in fiscal 2025.

The hashrate refers to the total computational power combined computation used in mine and process transactions in a Proof-of-work Blockchain, and a proxy for industry and mining poverty competition.

Canaccord also mentioned Iren’s recent designation as a Nvidia (NVDA) Preferred partner, which almost arrives at the same time announcing the purchase of an additional 2,400 GPU.

With 2,910 MWs of safe power capacity and some of the lowest all-in cash costs in the industry, Canaccord focuses on Iren is positioned to be one of the largest and most efficiently listed in public miners, with significant optionality in high-performance computing.

Read more: Iren posted a first-year-old revenue on AI cloud growth, expanding mining; Climbing of Shares