BTC stalls as whales lead to sales wave

remains stagnant to $ 110,000 to $ 120,000 range, while gold And the US priests close to all times high.

According to The mark of the accumulation of glassnode Through Cohort, the sale of pressure is apparent in all purses. This measure measured the relative -child of accumulation based on the size of the creatures and the volume of coins obtained over the last 15 days. A value closer to 1 signal accumulation, while a value closer to 0 signal distribution. Replaces and miners are not included in this calculation.

Currently, each cohort, from wallets holding less than 1 BTC to whales holding more than 10,000 BTC, is in distribution. The largest whales, with holds of over 10,000 BTCs, show some of the most aggressive levels of sale last year.

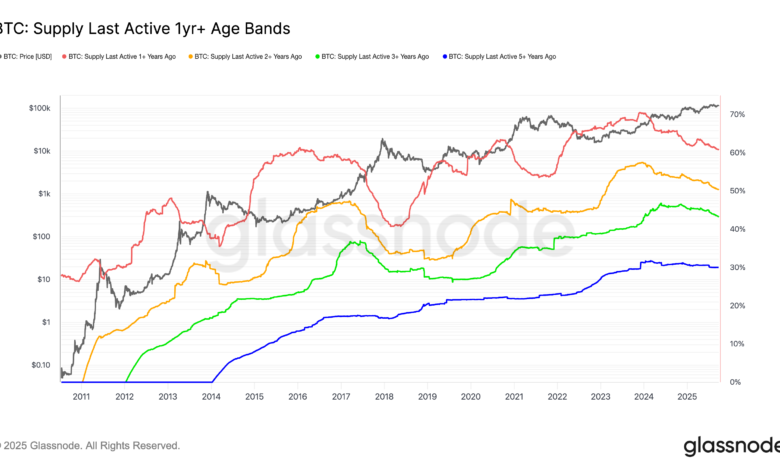

Looking at the long-term supply of the holder, the percentage of the circulating supply that is not moving at least 1 year has dropped sharply from 70% to 60%. The peak was in November 2023, when Bitcoin traded near $ 40,000. At the same time, the 2+ people who were starting to sell, with their shares from 57% to 52%.

The three years with the Cohort now sat above 43% and continued to fall since November 2024. These purses largely represent consumers from the previous top top in November 2021 around $ 69,000, many of them gathered more than 2022 bear market when prices hit $ 15,500. In the recovery of Bitcoin, these investors realized the acquisitions.

On the contrary, the five years with the holders remain stable, reflecting that the longest investors do not participate in the seller.

This trend shows that investors sitting on the unlucky income from this cycle continue to realize the income, increasing the ongoing pressure on sale.

Read more: Blackrock’s Bitcoin ETF: Bearish sentiment to ibit stays strong within two straight months