Bybit Revamp Security After $ 1.4 Billion Hack

Bybit, the second largest cryptocurrency exchange by trading volume, revealed a comprehensive security overhaul following its $ 1.4 billion hack in February.

In Feb. 21, Bybit is that -hack of more than $ 1.4 billion to the liquid-staked ether (Steth), Mantle staked Eth (Meth) and other ERC-20 tokens, making it one of the largest security violations in crypto history.

To strengthen the defenses, Bybit implemented a three-pronged security upgrade, targeting security audits, purse forts and improving information security, according to a June 4 announcement shared with the cointelegraph.

Within a month of breach, the exchange completed nine security audits, conducted by both home specialists and independent external experts, resulting in the implementation of 50 new security measures, the announcement said.

Related: How Bybit Hack happened: a $ 1.4 billion crypto breach explained

Cold wallet protection and certification

In front of the hardware, Bybit said it was tightly tight with the cold purse protocols, introducing an updated safety procedure that regulates the full supervision of security experts throughout the purse process and adopted multiparty calculation to further enhance purse protection.

In addition, hardware security modules are combined to provide higher levels of hardware security.

Bybit now holds ISO/IEC 27001 certification for the management of security information. It said it also contained all internal and customer internal and communications and data storage.

Related: Bybit Exchange has been hacked, more than $ 1.4 billion in ETH-related tokens drained

Healing of Liquidity and Lazarus Bounty Program

Despite the attack, Bybit almost returned to pre-hack liquidity levels, and the LazarusBounty initiative continued to monitor stolen funds. So far, more than $ 2.3 million in Bounty rewards have been distributed through the program.

Kaiko’s Report Bybit’s liquidity revealed that bitcoin (Btc) Depth of the market, within 1% of the price, rebounds at a sun -average of $ 13 million only 30 days after the hack.

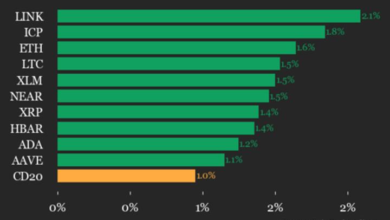

Altcoin’s liquidity also reverses, even at slower pace than Bitcoin. The depth of the market for the top 30 altcoins by market capitalization has once again gained more than 80% of its pre-hack levels.

The Swift Recovery is partially credited to Bybit’s (RPI) Price Price orb) orders, a feature designed to attract institutional liquidity. These specialized orders have helped stabilize market conditions when liquidity is most insistent.

As for the temporary non-RPI liquidity after the hack, RPI orders play an important role in stabilizing trading conditions and improving pricing efficiency.

While the hardening of the infrastructure is a focus, the Bybit warns that hackers are increasingly exploiting human mistakes rather than protocol weaknesses.

There is an increase in “more sophisticated attacks,” along with hackers indicating large brands and protocols, a Bybit spokesman Cointelegraph said, added:

“While interference at the level of the system remains a concern, the attacks are increasingly targeting the human element as the weakest link to the security chain.”

The Transfer of attack vectors The signal that blockchain’s wise contracts and infrastructure are no longer the weak link, while attacks are increasingly exploiting the “human behavior rather than code,” Ronghui Gu, Certik’s co-founder, said Cointelegraph.

Magazine: Dangers to us are ‘front run’ in Bitcoin Reserve by other countries: Samson Mow