BNB has slipped below $ 860 while resistance holds and traders of US jobs

BNB prices have seen sharp intraday swings in the past 24 hours period as it continues to decrease from a full time high of $ 900 seen last month.

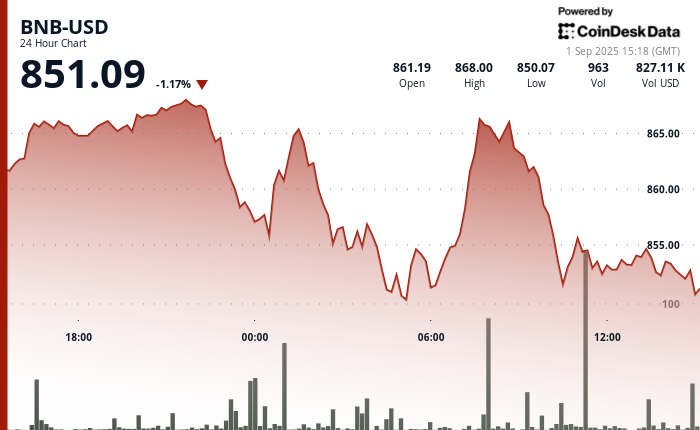

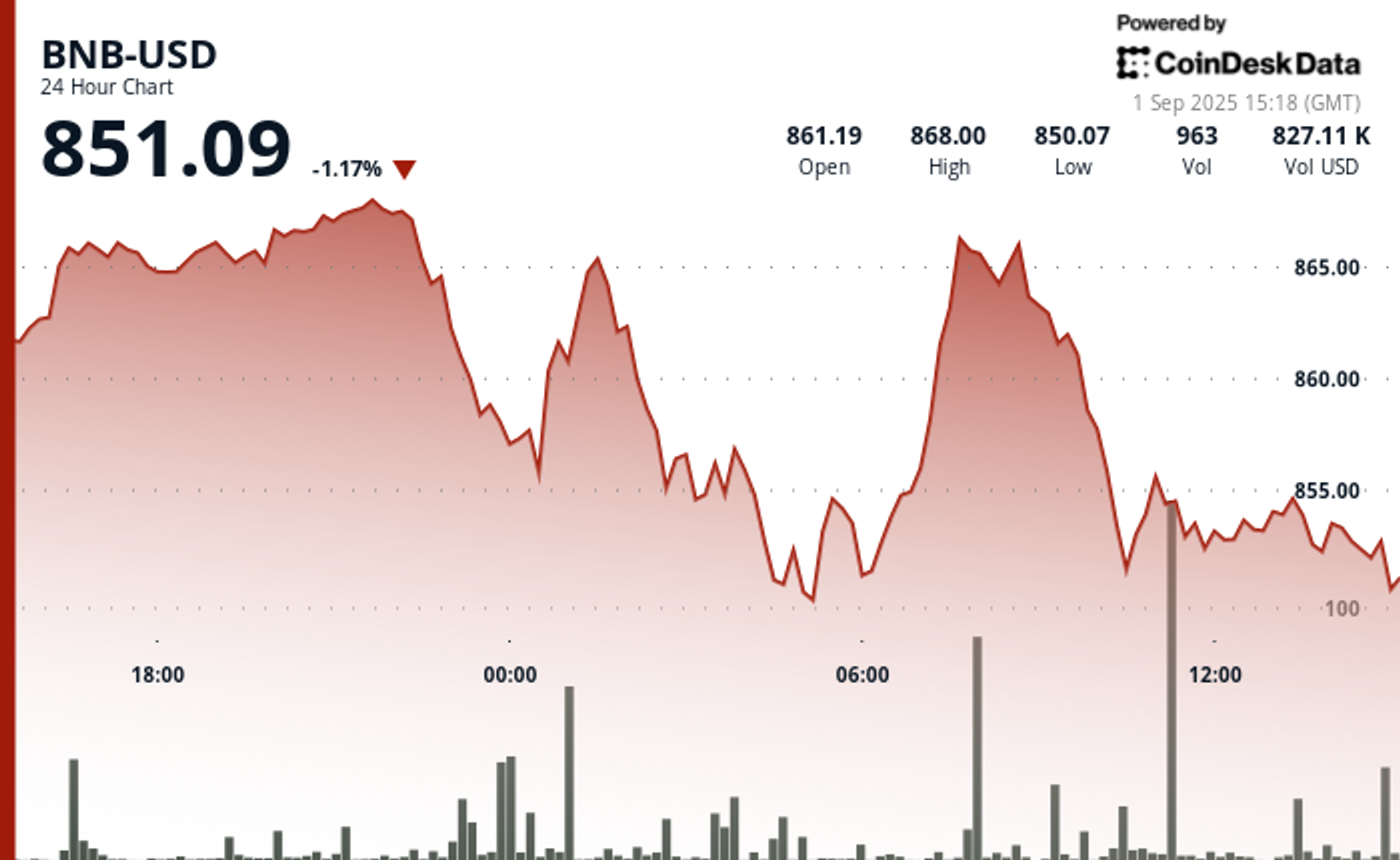

Within a 24-hour window, the property was exchanged between $ 849.88 and $ 868.76, a 2% move that started with the bullish momentum but ended with signs of fatigue near the resistance.

The volatility follows filings Along with the US Securities and Exchange Commission of Rex’s sharing last month, along with the rise of Treasury -focused Treasury companies. The latest, B approach, aims to handle $ 1 billion BNB worth Backing from the investment firm led by Binance co-founders Changpeng Zhao and Yi He.

While the BNB failed to handle its gains from earlier, the underlying network activity moved forward. Early -Active Active Wallet Address to BNB Chain Over Double, Climbing near 2.5 million according to Delete Data.

However, transaction volumes have continued to decline since late June, data from the same resource shows. BNB price decline is also preceded by the basic economic data from the US this week, including manufacturing and services surveys and payroll numbers of August.

Job data can influence the odds of the interest rates of federal cutting this month. Like standing, the CME’s Fedwatch The tool weighs close to 90% chance of a 25 bps cut, while Polymarket Entrepreneurs put odds in 82%.

Overall -analysis of technical analysis

BNB entered the session with a flow from $ 860.30 to $ 868.08, but the rally quickly lost the steam. Heavy sales pressure appeared around the $ 867- $ 868 level, a zone that now established itself as a major ceiling resistance, according to the technical review model of Coindesk Research.

Many have grown in this attempt, the release of 72,000 tokens, which is more than a average of 54,000, indicating a high level of participation during the failed breakout.

After the refusal, the BNB retreated to the $ 850- $ 855 range, where the purchase interest emerged. This is most visible as the token sank to $ 851.40, which triggered a spike of volume. This response is directed at solid demand at lower levels.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.