Cardano, Ripple Slide While Bitcoin entrepreneurs are waiting for ‘Fed’ Coin-flip ‘meeting

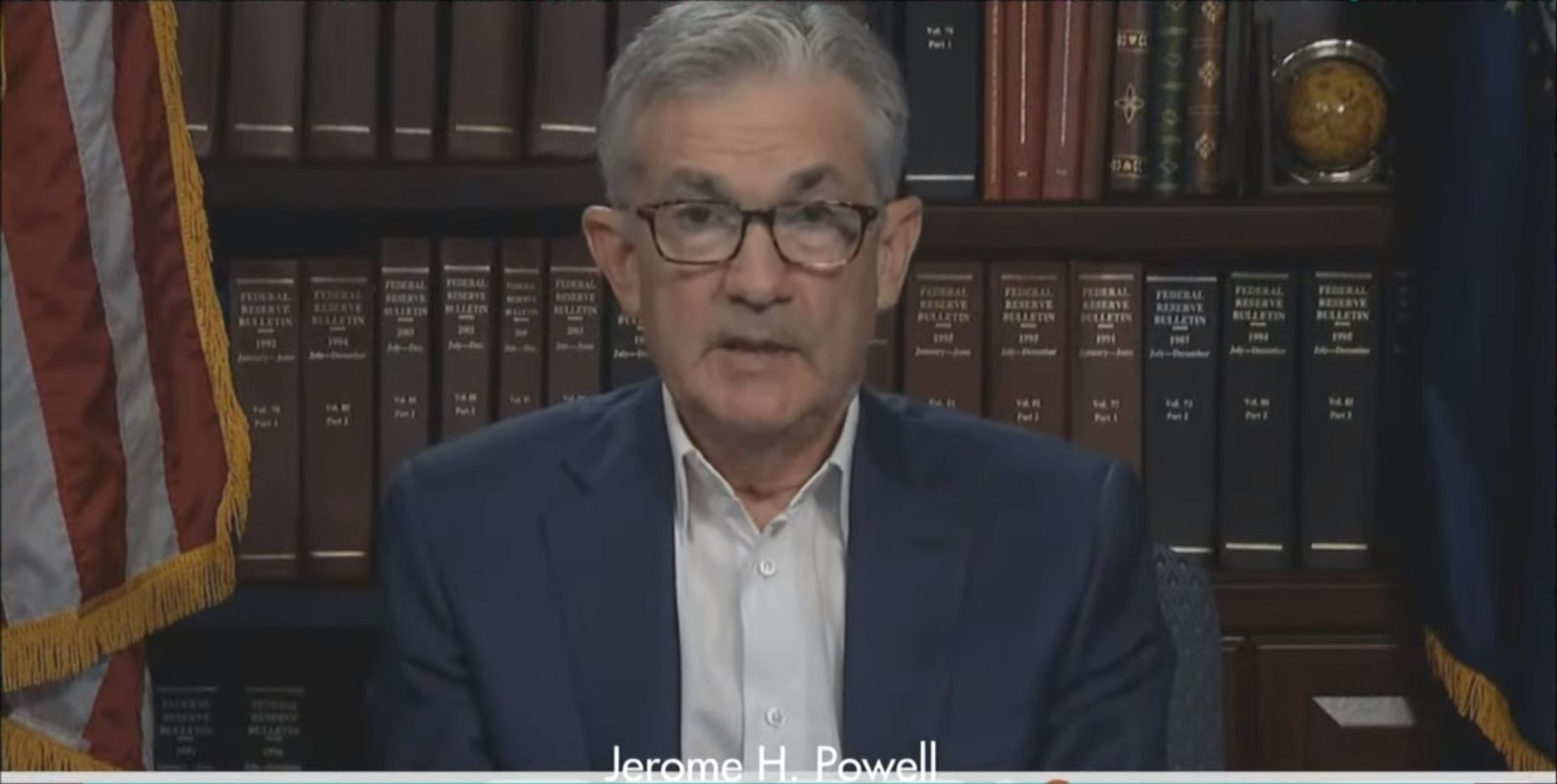

Cardano’s ADA and XRP led to losses to majors on Tuesday as entrepreneurs were waiting for the outcome of the upcoming Federal Reserve (FOMC) meeting, where rates were expected to remain unchanged but Fed Chair Jerome Powell’s comments could provide clues to further positioning on the market.

Bitcoin (BTC) prices held above $ 94,000 after a short sink below that level on Sunday, which continues the recent behavior bound to the range.

ADA price drops almost 4% while the XRP has slipped similarly. Ether (Ether) fell almost 1%, BNB Chain’s BNB rose 1.3% and Memecoin Dogecoin (Doge) dropped 2% in the past 24 hours.

CoinDesk 20 (CD20), a liquid index that monitors the largest tokens through market capitalization, drops a little to 1.8%.

Everywhere, some Defi tokens such as Aave, Curve’s CRV, and Hyperliquid’s Hype have seen a bump demanded last week in a sign of the entrepreneur’s interest towards projects with utility and harvest mechanisms, some say.

“As Memecoins fall, traders are returning to projects with a stronger foundation and token economy,” said Lu, CEO of Hashkey Eco Labs, CoinDesk said in a telegram message.

“Defi ecosystems benefit from this pivot, especially as Bitcoin shows that reduced volatility and the uncertainty of Macro.

Hype LEDs acquired the top 100 tokens with 72% progress over the past week, with AAVE and CRV up to 40%.

Powell’s comment is committed

Entrepreneurs in both crypto and traditional financial markets are looking at the FOMC rate of interest rate this week, with expectations of consensus pointing to a pause at rates.

However, uncertainty around inflation, tariffs, and greater US -China trade tensions leave many participants.

“We do not expect FOMC to spare a major move to markets,” said Augustine fan, head of views on Signalplus, in a telegram message. “This is a coin coin in the direction. Crypto is likely to take clues from greater income growth and how the economy digs the impact of recent trade policies.”

The recent strength of the stock market suggests that investors prote at a subtle risk of retreating, around 8%, according to historical drawdown models. That contrasts with more bearish signals from bond markets and macroeconomic forecasts, Fan added.

Last week, President Trump confirmed that there were no immediate plans for communication with China, Dampening hope for a success in US -China’s trade negotiations. However, the likelihood of separate trade agreements has helped maintain the fullness of emotion, as Reported Monday.