Close to protocol surges 10% before the rally rally rally

AI focused near the token to stop at 10% rally this Thursday while entrepreneurs began to retrieve income from a rally spurred by Bitwise’s announcement that it was launching a closely exchanged product (ETP) in Germany.

“The close staking ETP in Xetra opens a new bridge near institutions by providing a regulated, exchange that has been exchanged by a way to earn rewards,” Illia Polosukin told CoinDesk. “Investors get the following access to the close ecosystem and user-owned without having to handle private keys or node operations, and with full price transparency.”

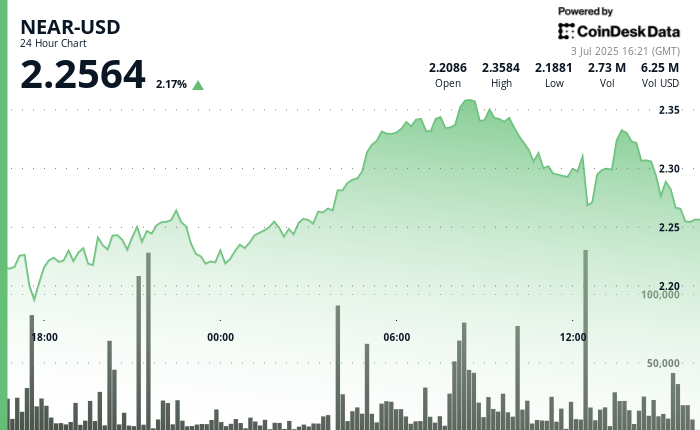

The token now has established a major support level at $ 2.26 as it seems to be joining before proceeding upside down.

Technical analysis

- Near the established strong support to $ 2.26 with more than average volume over the 24 -hour period from 2 July 16:00 to 3 July 15:00.

- The price ruined the resistance level of $ 2.30 in the early hours of July 3, reaching a new high at $ 2.36 during the period of 08pm with a huge confirmation of volume.

- The 23.6% level of Fibonacci’s retracement provided support at the income removal stage, suggesting the underlying ulend remains intact.

- Within the 60-minute period from 3 July 14:50 to 15:49, near the experienced of a steep seller-off at 15: 04-15: 07, where the volume reached more than 310,000 units.

- A new zone support has been established between $ 2.26- $ 2.27, with a price closure of $ 2.26 suggesting ongoing bearish pressure in the short term.

CoinDesk 20 Index jumped 2% before the late sale session

In the last 24 hours from 3 July 15:00 to 2 July 16:00, the CD20 showed significant volatility with a general range of $ 37.27 (2.11%).

The asset showed amazing strength at the mid-session rally, gaining more than $ 21 (1.18%) From the overnight low $ 1,778.85, with a particularly aggressive purchase of momentum observed during the period of 09pm and 13:00 hours suggesting institutional accumulation despite the late session taking.