Coinbase (coin) cut to sell by compass point as crypto momentum stalls and stretching appreciation

Coinbase (Coins) has been downgraded to a sale mark via compass point, which also cut off the end of the year’s end price from $ 330 to $ 248, citing the weaker than expected income and fading interest in crypto equality as major risks.

The coin trades moderately above Monday at $ 316 following revenue -related revenues last week.

“While we remain in the current crypto cycle, we look forward to a choppy 3Q in conjunction with the weak August/September that is time -to -date and devastating the interests of the crypto treasury stocks,” wrote analysts. “We also look forward to increasing Stablecoin competition to weigh both coin and CRCl values in 2H25.”

Coinbase has not gained expectations for second-quarter results, and early third-quarter trends are not looking better. Subscription and service revenue, an investor a scale seen as a reliable income stream, arrives at 8% below Wall Street estimates in Q2. The company’s mid -forecast of the company’s Q3 is also 5% below the consensus.

“‘Other S&S Revenue’ is a major contributing to the 2Q/3Q Miss,” written by Compass Point, who teaches a sharp quarter-over-quarter refusal to Coinbase Isa and other fees related to the tech-mga segments that many investors expect to drive long-term growth.

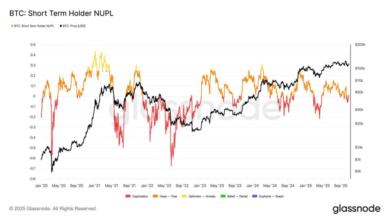

The compass point collapse came as the crypto market lost momentum despite the wider stock markets recovered after last week’s sinking. Bitcoin

And Ethereum struggles to get land, and retail investors appear pulling from “Treasuryco” stocks – companies holding a large amount of BTC or other cryptos on their balance sheets. This includes coinbase and approach (Mstr).

Analysts have realized that elevated action in crypto markets pose an additional risk. The July rally was fueled by aggressive trading, but with the open interest rebound after a brief sinking into the fluids, a deeper sale-off could trigger another cycle of forced sale.

Appreciation is also a concern. Despite the weak Q2 results, coin sharing rallies at 56% from May to July. The compass point warns that “the coin is still trading in the 44x annual 3Q25E Street Ebitda Forecast,” believing that headwinds are very high in retail trade, competition from ETFs and Defi, and limited term regulations are limited.

The Compass Point also doubts The Clarity Act – a bill that is seen as the key to regulation reform – will be passed this year. “We are more skeptical towards a market structure bill that passes this year,” said the company, the movement of the project in early 2026.

Coinbase floats the idea of offering stock trading to users, but analysts do not believe that it will be a significant stream of income, especially to competitors like Robinhood earlier.

“Under a backdrop of the weak crypto performance, we see the premium that appreciates the coin back to its previous scope,” concluded the report.