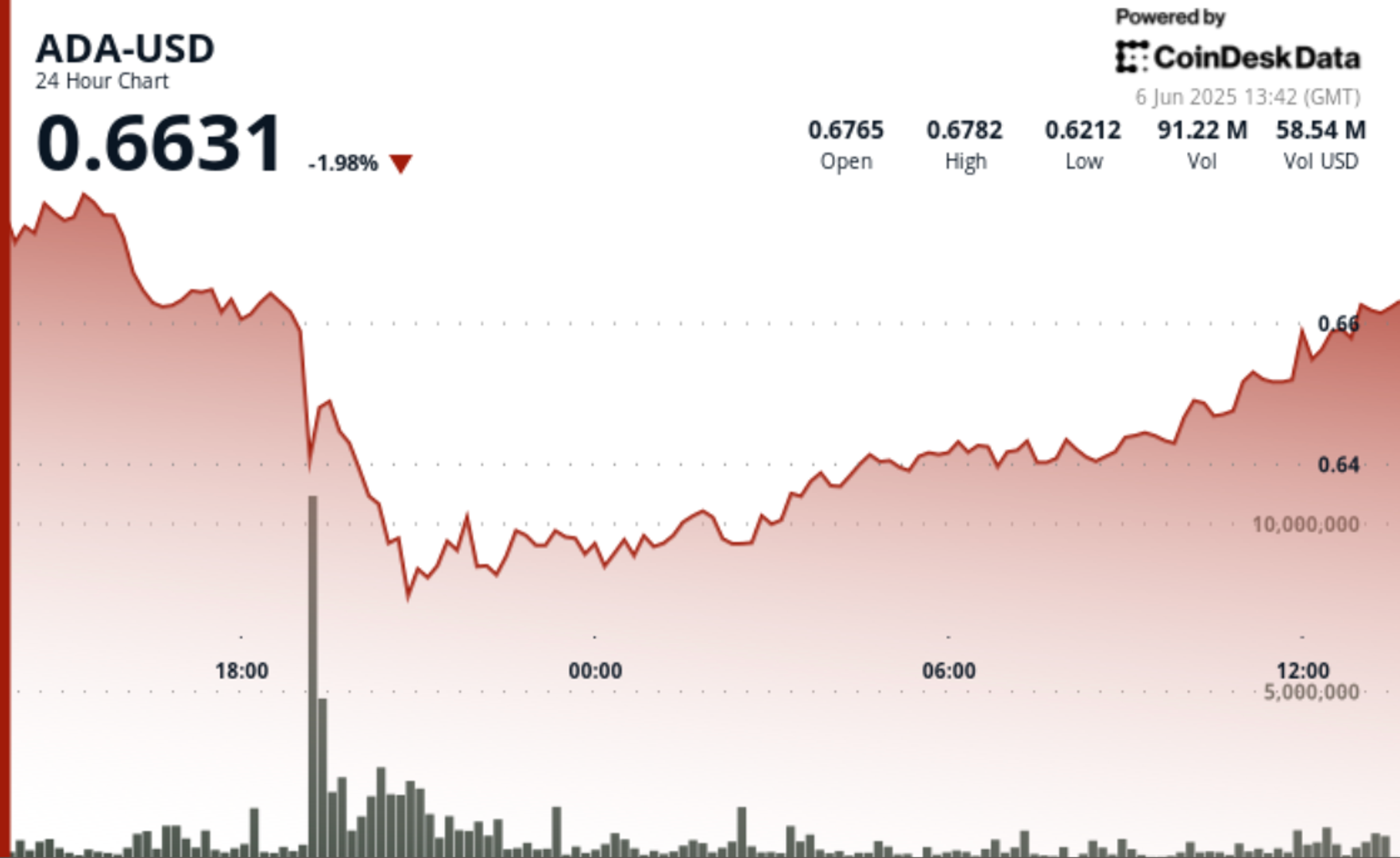

Cardano (ADA) falls 3% after dramatic 10% plunge, finds ‘strong support’

The cryptocurrency market is experiencing US economy state.

Cardano is there

Severe price swings were also seen amid market uncertainty.

After dropping from $ 0.688 to $ 0.621, ADA found strong support and rebound, forming an ascending channel with a resistance to $ 0.644, according to the technical review model of Coindesk Research. Technical indicators suggest a potential -updated bullish momentum while cryptocurrency reclaims a $ 0.640 level with a reduction of volatility.

At the time of the press, ADA traded at $ 0.66, down about 1.8% in the past 24 hours, while the broader market size CoinDesk 20 Index fell 1%.

Some recent news within the ADA ecosystem provided the market of potential catalyst for the token.

Interest in the institution with Cardano Blockchain continues to grow, with Franklin Templeton, a $ 1.6 trillion asset manager, now Running Cardano nodes. In addition, Norway’s NBX recently co-worked with Cardano to build a DEFI-based Bitcoin, which featured a safe blockchain design for institutional adoption.

The successful implementation of the first bitcoin-to-cardano transaction involving ordinances marks a significant milestone that can unlock $ 1.5 trillion in cross-chain trade opportunities.

Technical assessments

- A sharp decline from $ 0.688 to $ 0.621 (10.29% drop) occurred in extremely high quantities.

- Strong zone support established at $ 0.620- $ 0.623 where consumers are aggressive.

- Recovery is formed by an ascending channel with a resistance to $ 0.644.

- The overall incidence of $ 0.070 (10.29%) features severe market conditions.

- The potentially updated bullish momentum while ADA has reclaimed the $ 0.640 level with a reduction of volatility.

- The time -a -price action showed a possible recovery pattern from $ 0.641 to $ 0.643.

- The short-term resistance level established at $ 0.643- $ 0.644.

Divinity: The parts of this article were formed with the help from the AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk whole You have a polycy.