BTC YTD Performance th -2 in gold but 308,709x higher total return since 2011

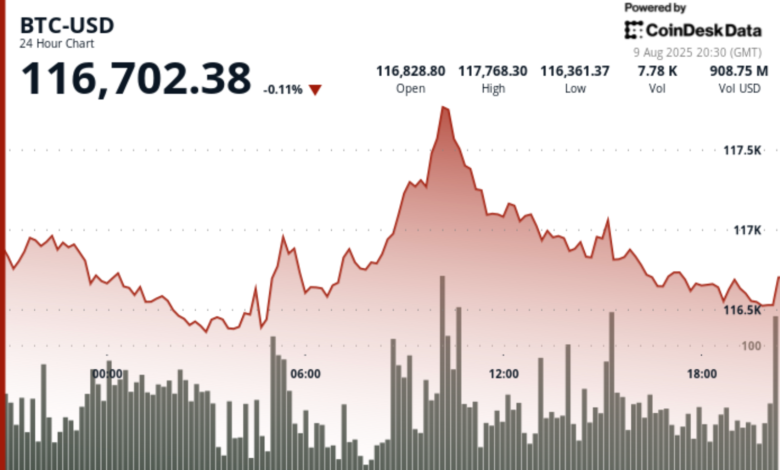

Bitcoin slipped 0.11% in the past 24 hours up to $ 116,702, according to CoinDesk data, but remains 25% years to date, second only to 29% of gold revenue in the main types of ownership, according to data shared By financial strategic Charlie Bilello in X.

2025 performance so far

As of August 8, the 25% year-to-date return of Bitcoin behind just 29.3% of gold advancement. Other major classes posted to post more moderate gains, with emerging market stocks (Vwo) Up to 15.6%, the NASDAQ 100 (QQQ) up to 12.7% and us the large caps (Spy) rising 9.4%. Meanwhile, the US Mid Caps (Mdy) and small lid (Iwm) 0.2% only gained 0.8%, respectively. It was marked for the first time Gold and Bitcoin conquered the top two positions in the annual Bilello class ranking since the notes began.

2011–2025 Combined -Sersive Returns

In the longer term, Bitcoin has delivered a rare 38,897,420% total return since 2011 – a figure that dwarfs all other types of dataset ownership. The 126% combined -with the gold return at the same time putting it in the middle of the pack, the equity equity benchmarks like Nasdaq 100 (1101%) and us the big caps (559%)as well as mid caps (316%)Small cover (244%) and emerging market stocks (57%). Based on Bilello’s numbers, Bitcoin’s total return has exceeded gold more than 308,000 times over the past 14 years.

2011–2025 annual return

When measured on an annual basis, bitcoin dominance is equally clear. The flagship of cryptocurrency has delivered a 141.7% average annual gain since 2011, compared to 5.7% for gold, 18.6% for NASDAQ 100, 13.8% for large US caps and 4.4% to 16.4% for other major equity and real estate indexes. Long-term gold stability has become an important fence in some market cycles, but the speed of appreciation is slower than the climb of Bitcoin.

Gold compared to Bitcoin, according to Peter Brandt

Well -known businessman Peter Brandt weigh On August 8, comparing gold merits as a value store with the potential of Bitcoin to surpass all FIAT alternatives. “Some think that gold is a great store of value-and it is. But the ultimate value store will prove that Bitcoin,” he said to X, who shares a long-term chart of the US dollar purchase power. His comments boast of the growing narrative that the lack and decentralization of Bitcoin makes it uniquely positioned to overcome traditional fences over time.

Technical assessments

- According to CoinDesk Research’s technical review data model, between August 8 to 21:00 UTC and August 9 at 20:00 UTC, Bitcoin exchanged for a $ 1,534.42 range (1.31%) from $ 116,352.52 to $ 117,886.44.

- The price opened near $ 116,900 and moved to the sideways before sinking in Asian time, rising from $ 116,440 to $ 117,886 between 05:00 UTC and 10:00 UTC on August 9, with a 24 -hour trade volume exceeding 9,000 BTC in these intervals.

- The strong purchase appeared near $ 116,420 at 6pm, while the sale of pressure intensified around $ 117,886 height.

- Bitcoin closed the session to $ 116,517, down 0.32% from tomorrow, with a specified support to $ 116,400- $ 116,500 and resistance to $ 117,400- $ 117,900

- During the last time of the review period (August 9, 19: 06–20: 05 UTC)Bitcoin remained under the downward pressure within a $ 195.11 band, slipping from $ 116,629.40 to $ 116,519.29 (-0.09%).

- The largest last time spike volume took place in 19:27 UTC, when 296.43 BTC changed hands as the price of $ 116,547 support tested.

- Recovery attempts are repeatedly trapped near $ 116,600- $ 116,713, in accordance with earlier intraday resistance.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.