Crypto funds View $ 223M outflows, FOMC meeting ends 15-week streak

Cryptocurrency Investment Products ended last week in green, interrupting 15 weeks of consecutive flow after the investor’s sentiment struck from hawkish comments at last week’s Federal Open Market Committee (FOMC) meeting.

Global Crypto Products exchanged by exchange (ETP) Saw $ 223 million worth of flow last week, According to In the latest report from the Crypto Asset Management Firm Coinshares, published Monday.

Despite a strong start to the week with $ 883 million amounts of flow, the “run upside down” in the second half of the week, “probably triggered by the Hawkish FOMC meeting and a series of better than expected economic data from the US,” the report stated, increasing:

“Since we saw US $ 12.2bn net inflows in the last 30 days, representing 50% of the flows for the year until now, it is probably understood to see what we believe is a minor making of income.”

US Federal Reserve statements Jerome Powell also licks investor expectations of a cut of interest rate for September to 40% From 63% before the FOMC meeting, Cointelegraph reported on Thursday.

Falling emotions come as bitcoin (Btc) enters August, history of one of the worst months of performing. Data from coinglass Shut up Bitcoin’s median return in August stood at -7.49%.

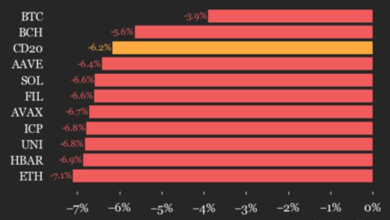

Bitcoin products were having most of the losses last week, with $ 404 million in flows. Despite the pullback, some analysts believe The next catalyst may come after tag -day Recess. In a research note Na -Published Last Friday, Matrixport said Bitcoin could get traction when the US Congress was re -reconvenven after Labor Day.

“The uncertainty in the fiscal has historically a strong tail for hard assets, and Bitcoin remains in front and center in the narrative,” the report said.

Related: Bitcoin becomes the 5th global premise in “Crypto Week,” Flips Amazon: The financial re -define

Ether destroys the broader backdrop of funding

Despite the flows in global cryptocurrency funds, Ether (Eth) ETPs closed their 15th week of net positive flow, attracting $ 133 million investment despite a pullback in the second half of the week.

The report relates to the ongoing ether’s funding to “stable positive emotion for possession.”

Crypto fund dedicated to XRP (XRP), Solana (Sol) and sui (Sui) Sunday was also closed to green, seeing $ 31.2 million, $ 8.8 million and $ 5.8 million in streams, respectively.

Related: Ethereum to 10: The Top Corporate Eth Holders as Wall Street Eyes Crypto

On Thursday, US president Donald Trump signed An executive command that imposes rewarding tariffs of 15% to 41% on goods from 68 countries, effective Thursday, August 7.

Despite the Tariff of President Trump’s Tariff of President Trump’s Augi sending a “chill through global markets,” cryptocurrency markets have seen a “re -return” instead of a breakdown, Stella Zlatareva, a dispatch editor on the Digital Asset Investment Platform Nexo.

“The Digital Asset Market remains stable above the $ 3.7 trillion, which has anchored flow structures, institutional beliefs and the promise of clear US regulation,” he told cointelegraph, adding that “altcoin stability could gradually return.”

https://www.youtube.com/watch?v=DBYVWY_BR7Q

Magazine: Crypto entrepreneurs are cheating themselves’ with price predictions – Peter Brandt