Coinbase (coin), Shopify (Shop) partner to enable USDC payments to base for traders around the world

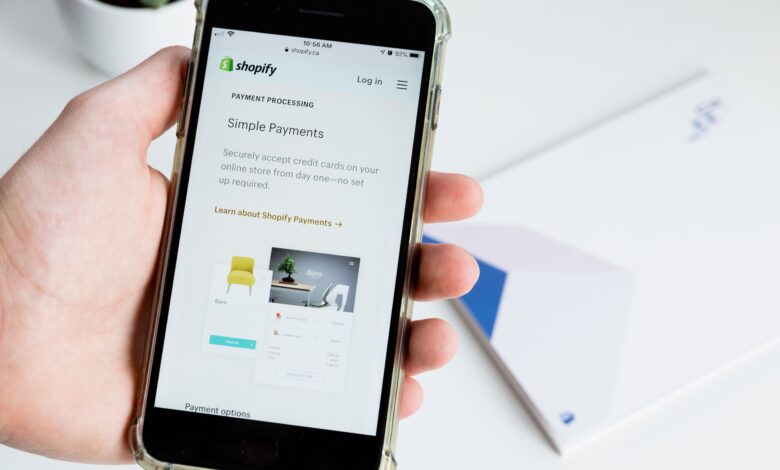

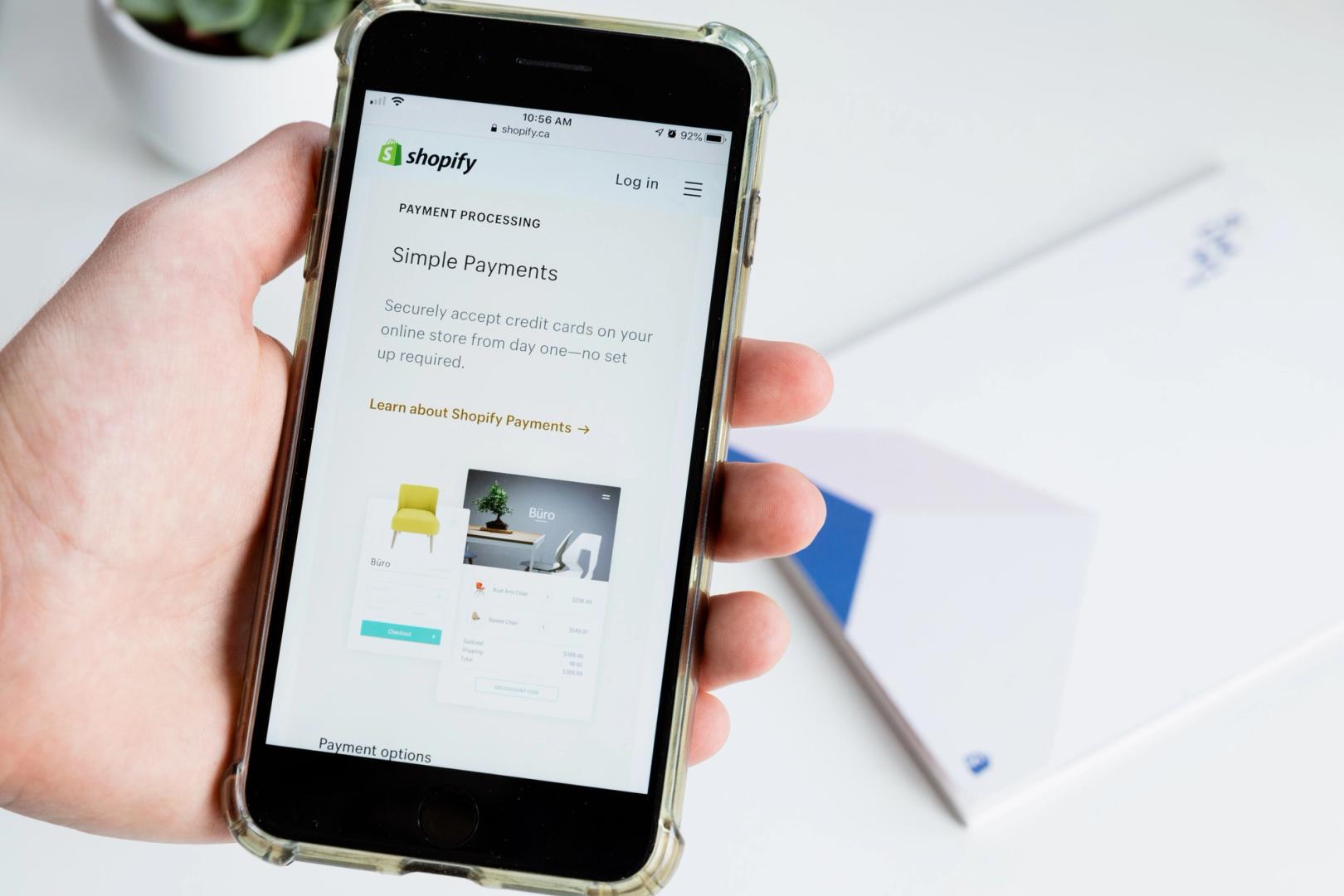

E-Commerce Giant Shopify (Shop) brings stablecoin payments to its merchants BaseCrypto Exchange Coinbase (Coins) ‘S Ethereum Layer-2 Network, companies said on Thursday.

The integration is set to launch on June 12 in a limited group of early accessial entrepreneurs, with a broader existence that will be expected later this year for all traders using Shopify payments, companies said.

Once the control is complete, traders will receive Circle (CRCL) token payments while receiving local currency repairs without the availability of foreign transaction fees. Shopify said it plans to return 1% cash back to customers who pay with the USDC. This feature will be launched later in the year.

Stablecoins. Use explodes, with a 54% growth in supply year-on-year, and increased use of companies such as PayPal (PYPL) and Grab (Grab) for payments and international remittances.

The new initiative is designed to streamline the global commercial with a crypto-native infrastructure, decreased costs and boosting efficiency, and supports a new open-source protocol jointly developed by Coinbase and Shopify.

The Smart Contract and Commerce Payment Protocol supports common features such as delayed acquisition, tax calculation and refund processing, and integrated directly into the existing fulfillment systems of entrepreneurs, companies said.

Shopify said it selected the base for cheap costs, high-speed, and secure transaction environments, aimed at helping to bring crypto payments to the main retail experience.

Read more: Shopify customers can now pay to USDC by Solana Pay