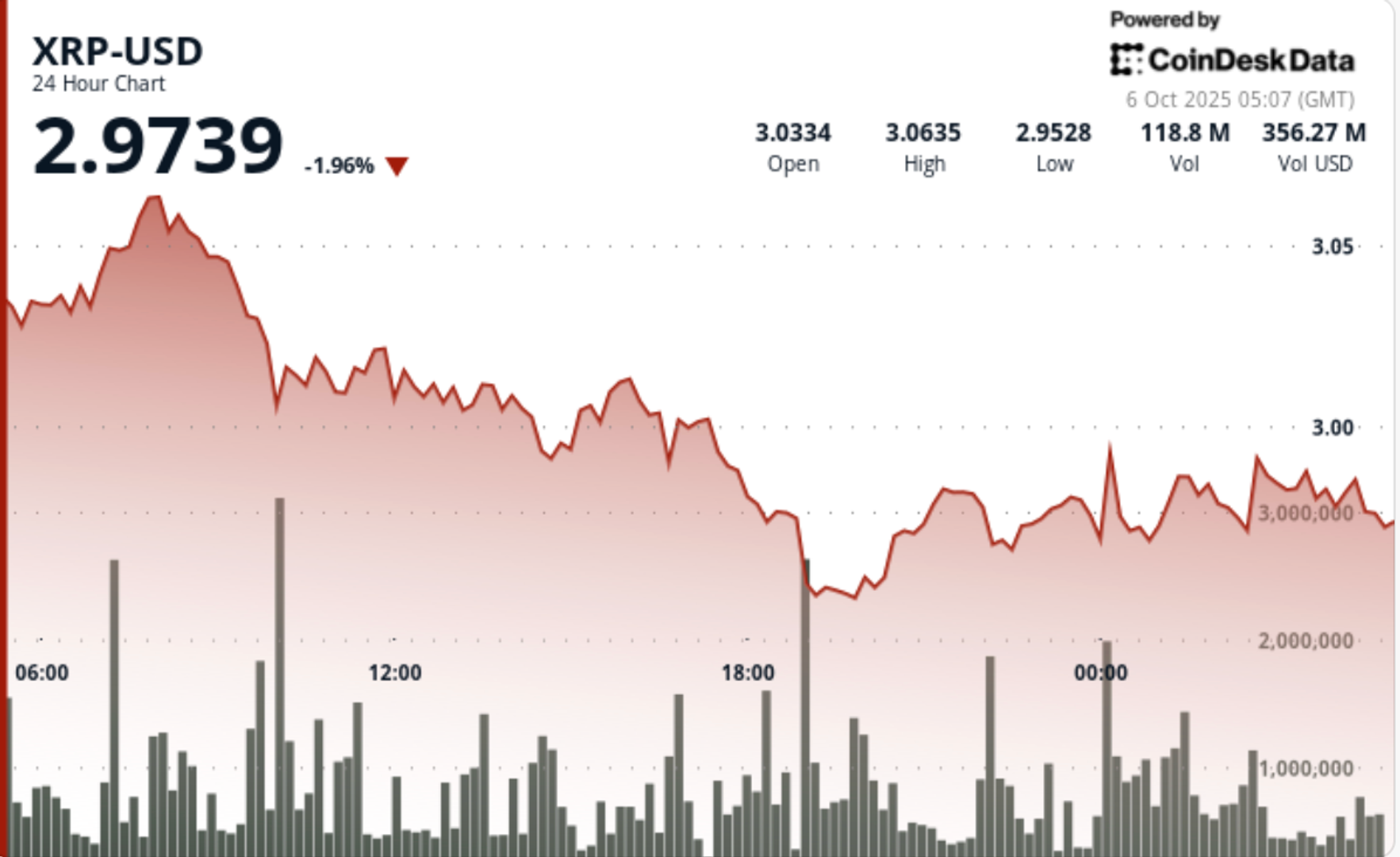

Declined above $ 3, will close less while sellers are dominant

The early XRP rally at $ 3.07 recognized heavy distribution in high volume, leaving a high volume of ceiling intact and pulling the price back to $ 2.98. Institutional copies confirmed $ 3.07 as a resistance, while repeating defenses near $ 2.98 kept losses.

News background

XRP slides 1% from October 5, 03:00 to October 6, 02:00, retreats from $ 3.01 to $ 2.98 despite the opening of the strength.

The token has sprung up to $ 3.07 in the early hours, only to deal with concentrated pressure selling.

Analysts said institutional tables were active in the resistance, with a turnover of 17% above -day -day averages. Despite bearish control by most of the session, the XRP ended with a rebound off $ 2.98, signing the continued interest of accumulation.

Summary of price action

- XRP exchanged a $ 0.09 corridor, or 3% intraday range, between $ 2.98 and $ 3.07.

- The price sank to $ 3.07 before the decline in the 64.3m token was sharp, compared to 54.7M average.

- Pressure sale drags XRP to $ 2.98, where the support is repeatedly defended.

- A late-session dip triggered a 1.95m-volume flush at $ 2.979, consumers immediately absorbed.

- Rebound flows stabilized prices near $ 2.98, with a Volume of 750K per bar.

Technical analysis

- The resistance was firmly established at $ 3.07, proven by the upper-average sale pressure and repeated failures higher. The support holds for $ 2.98, where consumers continue to enter, including a high flush volume absorbed by the latter in the session.

- Price action reflects a pullback driven by decline within a $ 3.07- $ 2.98 band. As sellers dominate the two-thirds of the session, the defense of $ 2.98 shows institutions that continue to accumulate in the dip, keeping the structure intact for another attempt to be higher.

What entrepreneurs are watching?

- If $ 2.98 holds in support of the upcoming sessions.

- If $ 3.07 remains a difficult ceiling or weakened under the modified pressure.

- Signs of prolonged institutional flow as an approach to ETF catalysts.

- Potential test of $ 3.10 if consumers can control control above $ 3.03.