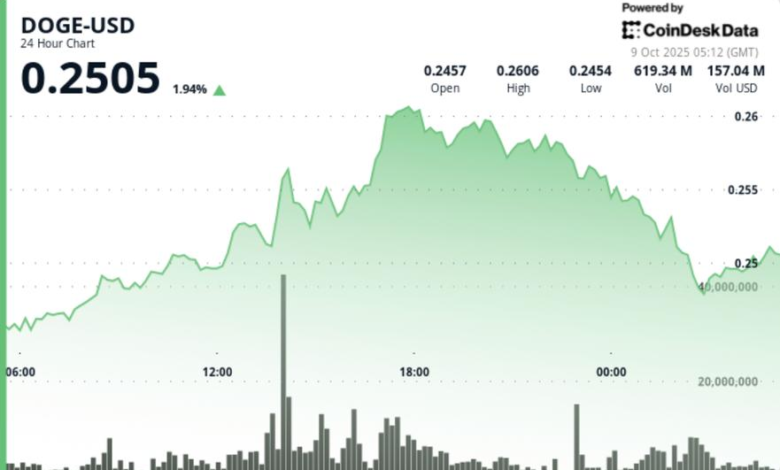

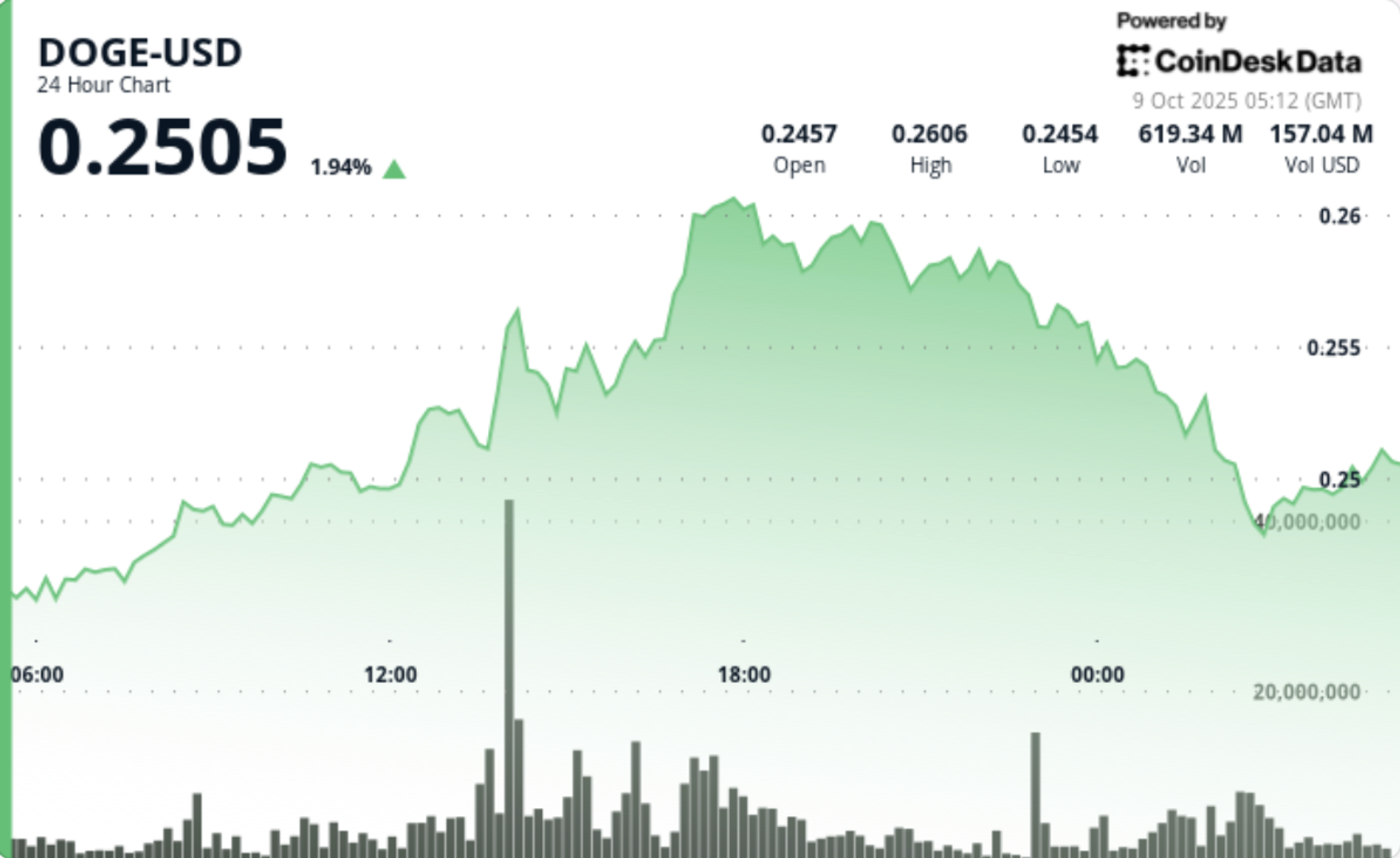

Declined at $ 0.26, slide 2% as hit-taking hits

Dogecoin failed to maintain more than $ 0.26, triggering heavy institutional income that calmed the price back to $ 0.25.

Despite the short-term contraction, on-chain flows show large holders that add 30m tokens (approximately $ 8m), suggesting accumulation remains intact even with the lid on the reversed momentum.

News background

DOGE exchanged a 6% incidence between $ 0.24 and $ 0.26 to 24 hours until October 9. The token rallied at $ 0.26 in Japanese session but achieved strong institutional sale pressure. Whale addresses added more than 30m doge, strengthens longer positioning despite close weakness. Analysts highlighted similarities to previous history cycles where major resistance breaks locked exponential upside down, with a $ 0.41 flagged as a critical longer trigger.

Summary of price action

- Doge spiked from $ 0.25 to $ 0.26 around 17:00 to 750m turnover -double the sun -average.

- Strong income earns to $ 0.26 reversed earners, pulling the price back to $ 0.25 by session nearby.

- Late trading saw a breakdown below $ 0.25 as the fluid flow hit, with 14.6m progress at 02:01 am proving the distribution.

- Doge closed at $ 0.25, down ~ 2% from the intraday’s highs.

Technical analysis

The resistance was strengthened at $ 0.26 after repeated decline in high volume. Support $ 0.25 eventually failed in the session under the flow of extermination, which increases the close risk. However, the accumulation patterns – with 30m doge added by large wallets – point the institution’s trust in the wider structure. A prolonged recovery of $ 0.26 will open the path to $ 0.27- $ 0.30, while $ 0.24 is now the near-floor watch.

What entrepreneurs are watching?

- If the Doge can quickly recover $ 0.25 support after the extermination of the extermination.

- If the whale accumulation continues to be offset the resistance distribution.

- A clean break by $ 0.26 to re -establish the reversed momentum.

- Longer watch: $ 0.41 resistance, tied to historical breakout cycles.