Declining 2% as ETF news fails to break resistance

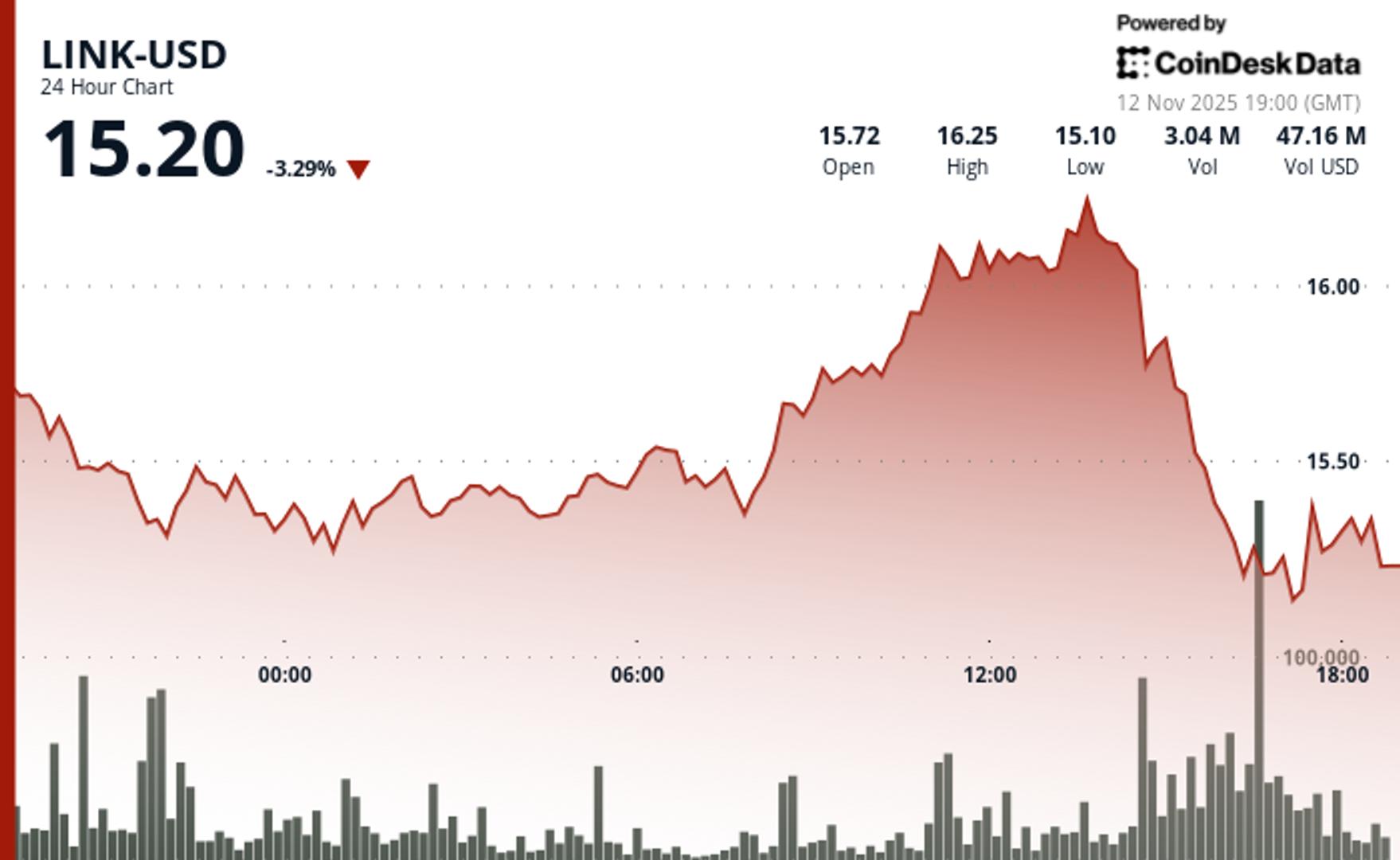

Chainlink’s Link Token fell 4% on Wednesday after running into strong technical resistance amid broader weakness in the crypto market.

The pullback came as the proposed chainlink ETF was seen in the DTCC Registryy Under the ticker CLNK, signaling operational readiness for a potential launch.

The advance initially sent the link higher, testing resistance near $16.25, Coindesk Research’s technical analysis model said. But the move triggered aggressive selling, with 3.36 million tokens traded during 16:00 UTC time, 138% above the 24-hour average, sending the link to a session low of $15.10, according to Coindesk data.

While the DTCC listing represents a step forward for the ETF process, it does not guarantee SEC approval. Market participants treated the listing more as a procedural milestone rather than a bullish catalyst, keeping their focus on chart levels. The $16.15-$16.25 zone proved too strong to break, reinforcing it as a key region of overhead supply.

Key Technical Levels Range Range-Bound Action

- Support/Resistance: Key support locked in at $15.10 from Institutional Selling Wave, with immediate resistance at $15.40-$15.50 based on recovery channel recovery

- Quantitative Assessment: 24-hour activity is running 9.39% above the weekly average, with 3.36m shares

- Chart patterns: The ascending channel formation from the overnight lows has met ceiling resistance, with current action suggesting a continued range between the $15.10-$16.25 boundaries.

- Targets and Risk/Reward: The upside targets sit at the $15.50 and $16.00 levels, with a risk of below $15.00 psychological support if the momentum recovers.

Disclaimer: Parts of this article were generated with help from AI tools and reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see Coindesk’s full AI policy.