The eyes of BTC 70% rally odds toward new highs

Key Takeaways:

-

Analysts see a 70% chance that Bitcoin has hit the fresh ones for two weeks.

-

Spots ETF Inflows and Bullish Futures Premium reinforces the upside outlook.

-

Internal liquidity near $ 114,000- $ 113,000 can spark a short pullback before a breakout.

Bitcoin (Btc) sets the stage for a potential rally, with analysts pointing to a 70% possibility that cryptocurrency can be pushed towards fresh all hours within the next two weeks. According to Bitcoin researcher Axel Adler Jr., market conditions are currently balanced and primed for a move higher.

Adler Jr. Highlights That short-term holders (STH) MVRV Z-Scores for both 155-day and 365-day cohorts walk near zero, indicating that the market is not too hot or oversold. With the BTC trading just above the realized STH price, the setup suggests a one-to-two-week consolidation phase can ahead a breakout. “Uptober comes in,” said Adler JR, pointing to the tails.

Further added data by derivatives Reinforce The constructive perspective. Bitcoin futures trade on a constant premium to see, with a seven-day basis running above 30-day, a structure that is usually linked to bullish trends. However, Adler JR warned that minor overheating signals appeared early in the recent FOMC event, where the basis of the cost increased in lightweight volume, suggesting some stages of positioning.

However, the base case remains tilted to the strength. “There is a 70% opportunity in the next two weeks to see a step or a -lease -joining step,” explained Adler Jr.

Meanwhile, institutional demand remains a stable anchor as the US Bitcoin ETF areas have It’s appealing $ 2.8 billion in net inflows since September 9, pushing the activity specific to positive territory. With the flow that supports BTC prices and technical indicators, merchants summarize for what could be a determination of stretching the next bullish leg of Bitcoin.

Related: Bitcoin to try all the time high ‘fast’ if the bulls recover $ 118K: Traders

Is Bitcoin pausing for a sink, or go straight to $ 124,000?

Bitcoin rallied 8.5% this month, up to $ 117,800 from $ 107,000 leading the Federal Reserve’s interest rate decision. The stable increase is left in the pockets of internal liquidity, suggesting the possibility of a short -term pullback before continuity. The September -time, historic leaning bearish, increases weight in this situation.

That said, Bitcoin’s broader behavior in 2025 further consulted expectations for the renovations. For most of the year, the possession skipped the internal levels of liquidity, rather than switching between the outer liquidity zones, that is, swing highs and lows into higher time charts over weeks. A comparable transition occurred in July, when the BTC exceeded the liquidity near $ 105,000 and quickly advanced to new highs after confirming a sun -day -to -day structure (BOS).

A similar setup appears to be developing today. If Bitcoin ensures a day -to -day -up to $ 117,500, it will confirm another BOS and clearly reduce the odds of a dip below $ 114,000. Such development will also align with the projection of analyst Axel Adler Jr. of new all-time highs within the next two weeks.

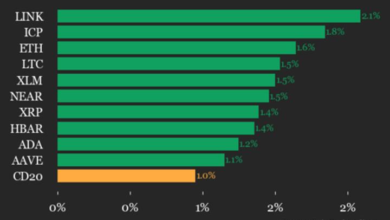

While a narrow window remains for a retest of order blocks near $ 114,000- $ 113,000, improving macroeconomic conditions and accelerating ETF flows suggest consumers can walk earlier, limiting downside opportunities. The balance between the structures of the liquid and bullish momentum can decide whether to pause bitcoin or destroy directly towards $ 124,000.

Related: Knocking Bitcoin’s lack of yield shows your ‘Western Financial Privilege’

This article does not contain investment advice or recommendations. Every transfer of investment and trading involves risk, and readers should conduct their own research when deciding.