Doge Flashes Classic ‘1-2 pattern’ as Bulls Eye $ 0.28- $ 0.30

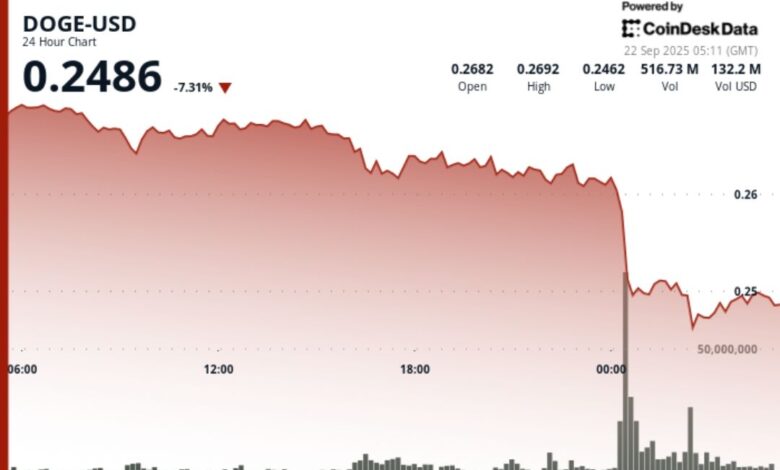

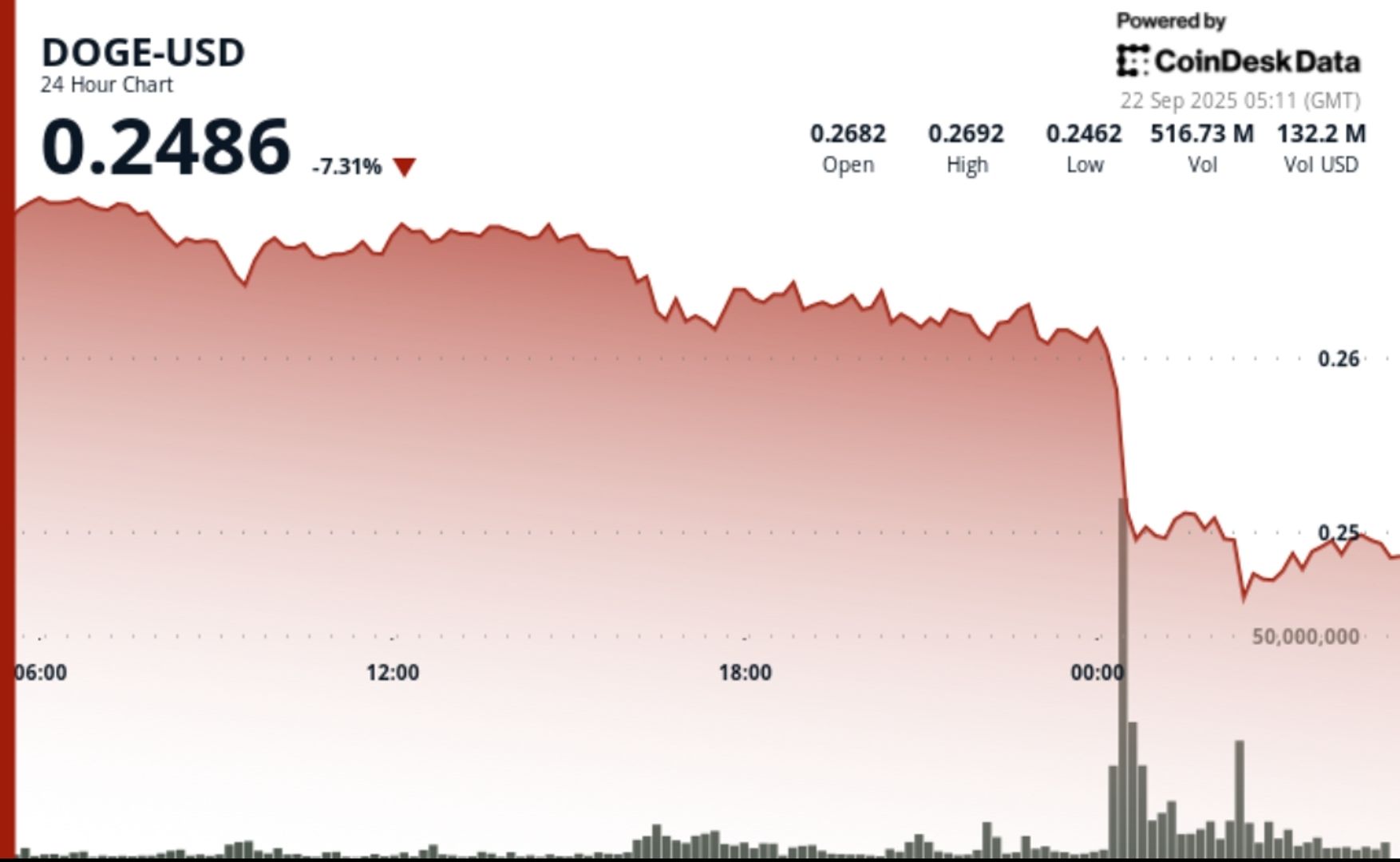

DOGECOIN has endured a sharp overnight sale, sliding from $ 0.27 to $ 0.25 during the September 21–22 session, while institutional traders are offloading positions to record volumes of more than 2.15 billion tokens.

The midnight route carved through support levels and established fresh resistance zones, leaving the Doge’s integration around $ 0.25 while trading entrepreneurs for recovery or continuing to lower.

News background

• The Doge fell 7% within 24 hours ending September 22 at 02:00, which retreated from $ 0.27 to $ 0.25.

• Midnight Trading saw a fall from $ 0.26 to $ 0.25 on a record of 2.15 billion volume, dwarfing the 24 -hour average of 344.8 million.

• Analysts flagged a “1-2 pattern” formation with history preceded by dog breakouts over $ 0.28- $ 0.30.

Summary of price action

• The scope of the Doge (≈8%) between a $ 0.27 high and $ 0.25 low.

• Resistance firmly close to $ 0.27 following repeated denial.

• Institutional support has emerged around $ 0.25, with recovery attempts keeping the dog anchored at this level.

• At the last time (01: 14–02: 13)The Doge has been bouncing within a narrow $ 0.25- $ 0.25 channel, showing accumulation patterns with spikes at 1:25 and 02:03.

Technical analysis

• Record 2.15B tokens exchanged at midnight dump proves heavy institutional activity.

• Support confirmed at $ 0.25; Failure here is risks that expand denial towards $ 0.23.

• The main resistance is to sit at $ 0.27, with the next tests within $ 0.28- $ 0.30 should buy a resume.

• Volume of spikes during recovery attempts i highlight the potential interest underneath.

• Pattern recognition: Technicians recognize a repeated “1-2 setup” consistent with previous rally structures.

What do entrepreneurs watch

• If the $ 0.25 can hold as strong support after the spinning flow.

• Institution positioning around $ 0.28- $ 0.30 band resistance if recovery gets traction.

• Follow the volumes in upcoming sessions to confirm whether the accumulation or further distribution is dominant.

• More extensive impact of emotion from ETF delays and ongoing regulation uncertainty.