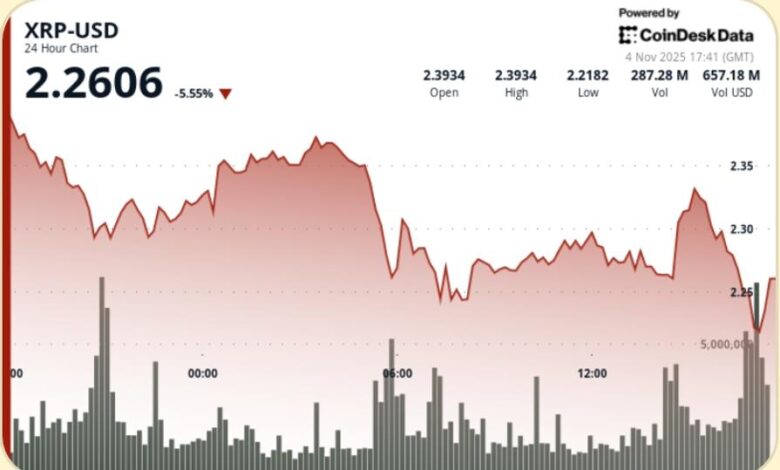

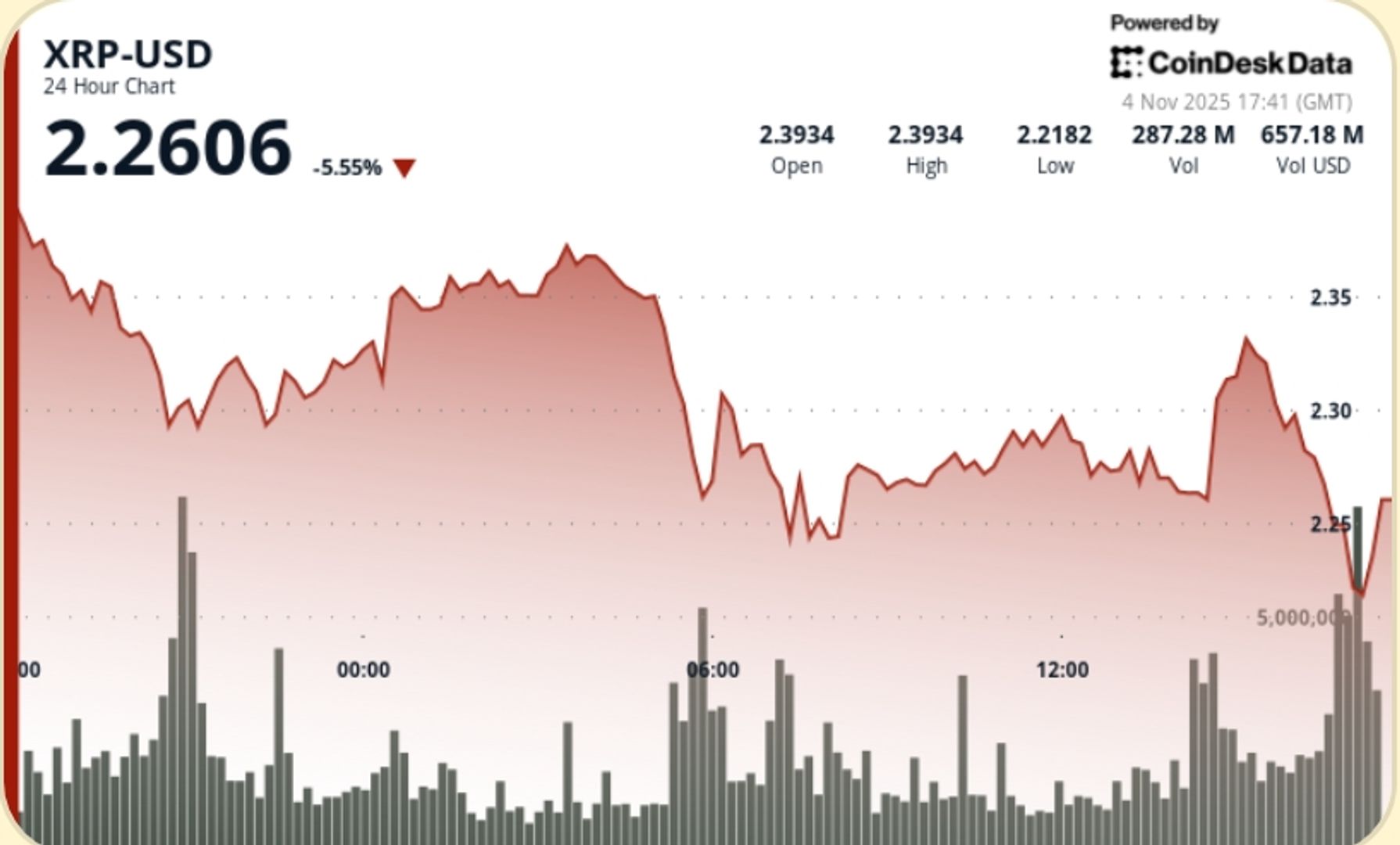

Doomsday Risk Builds as Ripple Token Plunges 6%

XRP extended its decline Tuesday, dropping 6% to $2.25 as a whale selloff and a clean trendline break accelerated momentum. The move—which included a 15% open-interest drop—puts pressure on the bulls ahead of a floating death setup and a key $2.20 support retest.

What to Know

• XRP fell from $2.39 to $2.25 (-6%), confirming a break below the multi-month uptrend

• Loaded whalet wallets ~ 900,000 XRP in five days

• Open interest down ~ 15% as Leveraged Longs Unwound

• Volume spiked to ~ 193.7m during the breakdown

• Today’s lower high structure is established at $2.39 → $2.37 → $2.33

News background

The selloff has tracked the ongoing whale distribution since late October, with large holders shedding positions following repeated failures above the 200-day moving average. Macro risk revived across risk assets as open interest compressed into royalties, suggesting a deleveraging – not panicked retail flow – move Tuesday. Analysts are pointing to a floating death setup as momentum indicators are changing clearly, while some positioning tables have flagged bids near $2.20 as the next pocket of liquidity for potential stabilization.

Summary of Price Action

• It is futile to recapture the $2.37–$2.39 supply zone

• Progressively lower high signal distribution

• Trendline violation triggers accelerated algo selling

• Volume surged ~ 87% compared to the 24-hour average during the breakdown

• Session Low printed at $2.24 before moderate bid recovery at $2.25

Technical Analysis

• Trend: Breakdown from rising structure, momentum bearish

• MAS: 50-Day MA curling up to 200-day → Death-Cross Risk

• Support: $2.25 short-term base; $2.20–$2.00 psychological layer; Deeper pockets towards $1.85

• Resistance: $2.37–$2.39 zone remains the dominant wall of supply

• Quantity: Expansion confirms distribution; Late-session pullbacks indicate an imminent pause

What traders are watching

• If the $2.20 absorber sells pressure or cracks at $2.00

• Confirmation (or fading) of death setup

• Open-interest stabilization after 15% flush

• The wallet wallet behavior after ~ 900k tokens thrown

• Recovery of $2.37–$2.39 range as bull invalidation threshold