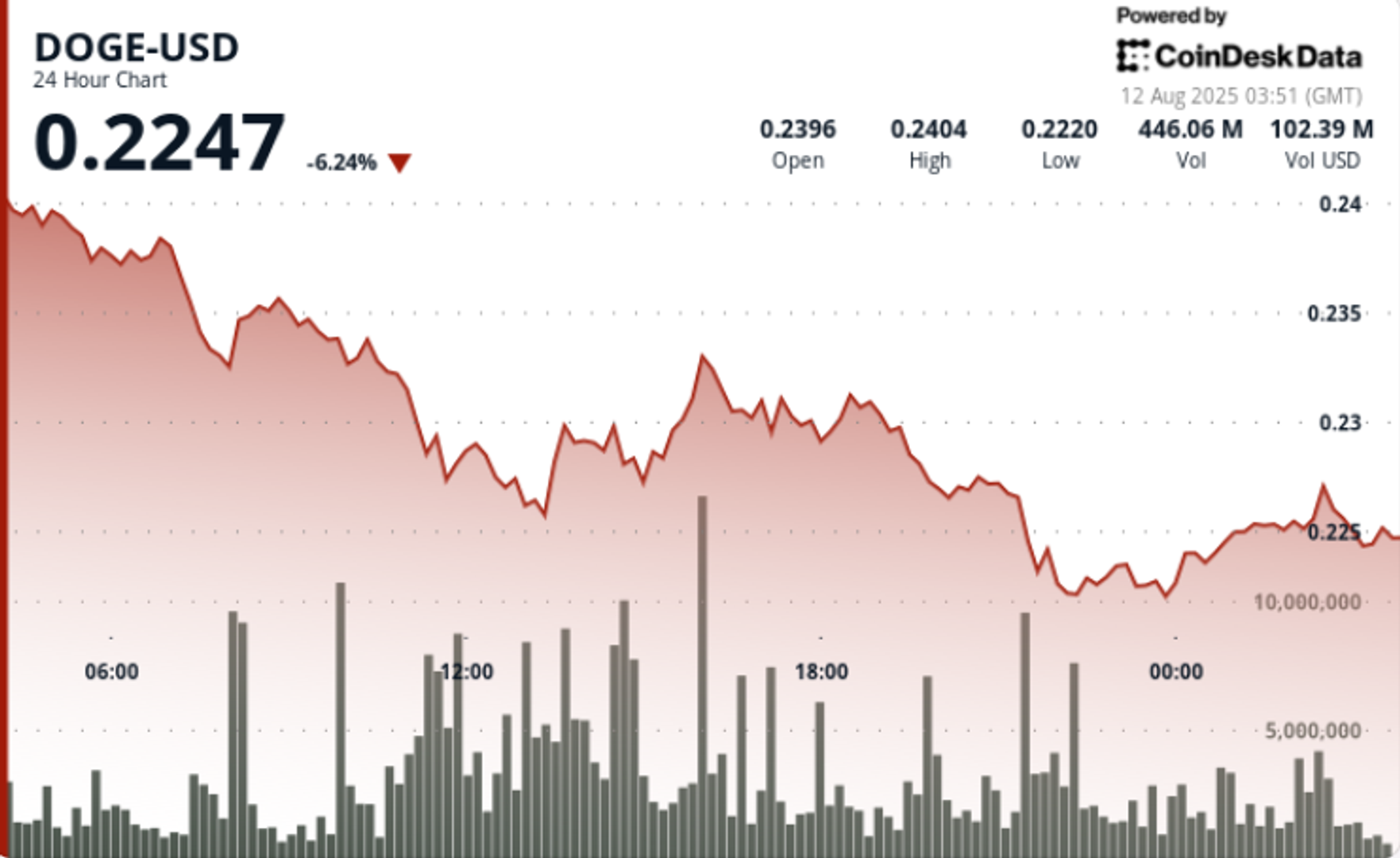

Sharp 7% drop sends Doge to 22-cent high-volume support support

Overall -analysis of technical analysis

DOGE FALLS 6.88% in the 24-hour period ending August 12, which drops from $ 0.24 to $ 0.22 while sellers are excessively bid-side liquidity. The worst pressure hit at 07:00 on August 11, with a price slide from $ 0.238 to $ 0.233 to 485.69m volume -31% above the sun -average of 371.45m. It establishes $ 0.238 as a major resistance level.

Consumers stepped at $ 0.226 during the 11:00 session, making up 793.38m in volume. Secondary resistance forms to $ 0.231 as many rally attempts failed. The final trading time sees the scope of the DOGE bound between $ 0.2247- $ 0.2253 with the amount of compression, suggesting potential fatigue to the seller.

News background

The sale comes amid greater weakness in digital possessions, with uncertainty in regulation and global trade stress weighing the sentimental sentiment. The major economies are rising tariff disputes, pressing the multinational supply chains, while central banks have signed a sign of potential policy changes-a mixture that prompted the institutional de-risking in crypto handling.

Summary of price action

• DOGE 6.88% refused from $ 0.24 to $ 0.22 on August 11 01: 00 – August 12 00:00 Window

• $ 0.238 Resistance is locked after 07:00 pm selling peak at 485.69m Volume

• Support $ 0.226 sees 793.38m in buy-side flows; $ 0.231 Secondary Resistance Caps Rebounds

• Final trading time in tight $ 0.2247- $ 0.2253 range with falling volume

Market assessment and economic factors

The whale and institutional profit-taking at $ 0.238 resistance set the tone for the session, triggering a breakdown below $ 0.23 and forcing retests of $ 0.226. The purchase of support is apparent in two major quantities of spikes (11:00 and 21:00), but repeated denials near $ 0.231 is kept onpin.

With the volume of thinning in session lows, the structure indicates the possible base formation-even if macro headwinds can see $ 0.22 tested again.

Technical assessment

• Resistance: $ 0.238 (high decline volume), $ 0.231 (second cover)

• Support: $ 0.226 Initial Defense, $ 0.2247- $ 0.2249 Intraday Floor

• 24 hours range: $ 0.019 (7.89% volatility)

• Compression quantity near Lows signals possible seller fatigue

• Multiple Failed Breakouts above $ 0.231 Confirm Supply Zone Overhead

What do entrepreneurs watch

• Retest of $ 0.22 and if the buyer flows again with the main support

• Breakout attempts above $ 0.231 as a first step toward recovery

• Impact of macro titles on greater emotions of meme coin

• Signs of that -updated whale accumulation after selling peak