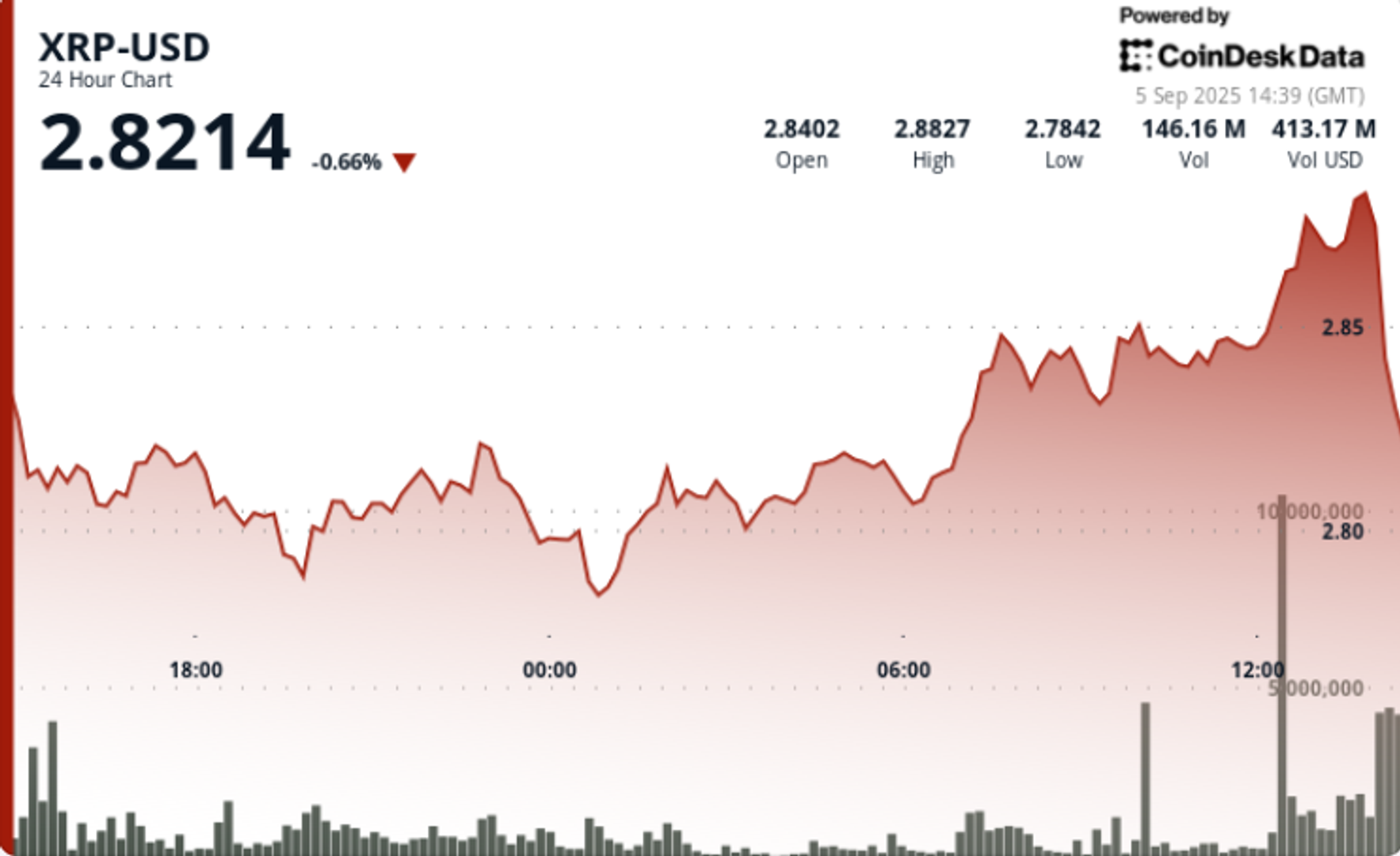

Drops 4% after $ 2.88 refusal while the etiquette’s speculation develops

The XRP returned greatly after failing to maintain the momentum above the $ 2.88- $ 2.89 resistance of the zone, even though the ETF -Haka -Haka -haka continues to build ahead of October Sec.

The sale features a pivotal inflection point while the institutional flow of battle against long-term integration patterns believes many analysts that can lead a larger move.

News background

• XRP fell 4% from $ 2.88 to $ 2.84 on September 5 after hitting an intraday high of $ 2.89, while institutional sale pressure emerged.

• Trade volume exploded at 227.75 million in 12:00 hours, about 4x 24 hours average of 58.40 million.

• Six ownership managers, including Grayscale and Bitwise, have filed for XRP ETF areas, with SEC decisions expected in October.

• Ripple’s legal regulatory regulation improved regulatory clarity, industry strengthening was estimated to an 87% possibility of ETF approved.

• Strategic technical strategies compare the current 47-day integration to the 2017 XRP structure, which precedes a parabolic rally.

Summary of price action

• exchanged by XRP to a range of $ 0.10 (3.47%) Between $ 2.78 and $ 2.89 during the 24 -hour session from Sept. 4 15:00 to Sept. 5 14:00.

• The owner advanced from $ 2.84 to $ 2.89 in massive quantities at 12:00 and 13:00 before the resistance was refusing.

• A concentrated 60-minute move from 13:26 to 14:25 saw a 4% slide from $ 2.88 to $ 2.84 to 10.6m volume, the intraday violation supports $ 2.86 and $ 2.85.

• XRP closed the session for $ 2.84, just above the basic support levels near $ 2.77.

Technical analysis

• Resistance: $ 2.88– $ 2.89 zone proven after many failed breakouts.

• Support: Immediate level to $ 2.84- $ 2.85, with a stronger backbone at $ 2.77.

• Pattern: 47-day integration suggests potential breakout setup; $ 4.63– $ 13 Target that -Flag if the structure is solved higher.

• Momentum: RSI in the mid -50s, showing neutral bias; The MacD histogram that converts to the bullish crossover.

• Volume: 227.75m in the peak compared to the 58.40m average confirming the distribution of the institution.

What do entrepreneurs watch

• If $ 2.77 holds as decisive support in September.

• October of Sec’s Spot XRP ETF decisions – seen as a potential bullish trigger.

• continuation of whale accumulation (340m token recently added) despite short -term distribution pressure.

• Breakout signs above $ 3.30, which analysts focus on which can open paths to $ 4+.