Edge the tariff waving on Donald Trump fails to cram the Bitcoin (BTC)

Written by omkar GodBole (at all times ET unless it is indicated otherwise)

Despite the increasing rhetoric surrounding President Donald Trump’s definitions, Bitcoin (BTC) is kept alongside positive signals from foreign drainage risk measurements such as Aud/JPY. Later on today, Trump is scheduled to impose a 25 % tariff on steel and aluminum imports at the top of additional metal duties.

This situation in the market contradicts the imminent tariff with the risk of risk that was observed a week ago, when Trump launched the first tariff shot. Participants in the market may believe that it uses aggressive tactics to negotiate commercial deals instead of adhering to the ongoing tariffs. This idea gained strength in the wake of the Monday’s decision to suspend the customs tariffs on Mexico and Canada for 30 days, which alludes to a more strategic approach to commercial negotiations.

According to QCP capital, the current market stability may encourage Trump to take a more strict position. “The feedback ring appears – President Trump, is very sensitive to market reactions, facing a market that increases its increasing deception. This can encourage him more, adding another layer of fluctuations,” QCP said in the broadcasting of the Telegram.

It will be interesting to see how this is developing.

There is Social media yet Carry out the tours that show short open records in the future of the ether listed in CME. These short pants are not necessarily explicitly extracurricular bets and are likely to be components of pregnancy deals, as investors occupy long sites in the investment funds circulating with the shortcomings of CME futures. Note that ETH ETF flows increased last week. It is possible that some short pants are the investors? Amid concerns On the number of coins and large open openings.

During the weekend, a base member kabir.base.eth refute claims Before Coinbase Sequencer was selling ETH as drawings, adding a layer of transparency for its processes.

In another remarkable development, Archang Touadéra, President of the Central African Republic, issued a new mechanical, which witnessed the transfer of $ 5,000 to 12 million dollars in less than three hours, which achieved a noticeable return of 2450x, According to Lookonchain data.

Meanwhile, Litecoin (LTC) still shines as a higher -performance cryptocurrency during the past 24 hours, an increase of 9 %.

On the total economic front, An increase in the expectations of consumer enlargement in the United States It raises concerns about the possibility of a long temporary stoppage in the FBI discounts. In addition, the US Consumer Prices Index (CPI) is scheduled to be launched on Wednesday. Stay on alert!

What do you see?

- Checks:

- Macro

- Feb 11, 2:30 pm: The sub -committee for financial services in the United States (“digital assets, financial technology and artificial intelligence”) hearing Entitled “The Golden Age of digital origins: drawing a path forward.” Among the witnesses are Jonathan Jashim, the Deputy General Adviser to Karkan. Livestream link.

- February 12, 8:30 AM: The American Labor Statistics Office (BLS) launches a consumer price index report in January (CPI).

- The basic inflation rate is Ami Pets. 0.3 % against the previous. 0.2 %

- The previous Yi’s basic inflation rate. 3.2 %

- The rate of inflation is 0.3 % against the previous. 0.4 %

- Yoy EST inflation rate. 2.9 % against the previous. 2.9 %

- February 12, 10:00 am: Federal Reserve Chairman Jerome Powell submits his bi -annual report to the Financial Services Committee in the US House of Representatives. Livestream link.

- February 13, 8:30 am: The American Labor Statistics Office (BLS) launches the product price index report (PPI).

- The basic ppi mom 0.3 % against the previous. 0 %

- Basic ppi yoy prev. 3.5 %

- PPI mom EST. 0.2 % against the previous. 0.2 %

- PPI yoy prev. 3.3 %

- February 13, 8:30 am: The US Department of Labor launches the weekly request for unemployment insurance for the week ending February 8.

- Initial unemployment allegations. 215K against the previous. 219k

- Profits

- February 10: Canaan (He can), Before the market, -0.08

- February 11: Digital Cell Techniques (cell), Post -market, -0.15 dollars

- February 11: Exit Movement (exit), After the market, $ 0.14 (2 ESTS.)

- February 12: Cotton 8 (hut), Before the market, $ 0.05

- February 12: Irene (Irene), Post -market, -0.01 dollars

- February 12 (TBA): Metaplanet (Tyo: 3350)

- February 12: Redit (RDDT), After the market, $ 0.25

- February 12: Robinhood Markets (Hood), after the market, $ 0.41

- February 13: Coinbase Global (currencyAfter the market, $ 1.89

Symbolic events

- Voices of governance and calls

- AAVE DAO discusses Acknowledgment of spasm AAVE friendly shoes published on the Evm Hyperleliquid series, as well as AAVE V3 post on the ink, Kraken Layer-2 Rollup.

- Sky Dao is discussing, among other things, Onboarding is one To the spark liquidity layer, increasing the limits of the PSM2 rate on the base, manufacturing $ 100 million of SusDs at a base to accommodate growth on the network.

- Feb 10, 10:30 AM: OKX for A contract AMA lists With the chief marketing employee Haider Raq and Product Marketing Chairman Matthew Osofisan.

- February 12, 2 pm: Display (offer) to Broadcasting of Amnesty International Discord Ama session.

- to open

- February 10: APTOS (APT) to open 1.97 % of $ 71.14 million.

- February 10: Berrachain (BERA) to open 12.08 % of the trading offer of $ 66.07 million.

- February 12: Aethir (ATH) to open 10.21 % of the $ 23.80 million trading offer.

- February 14: The sand box (sand) to open 8.4 % of the trading offer of $ 80.2 million.

- Launching the distinctive symbol

- February 10: Anlog to be included on Bitget, Gate.IO, Mexc and Kucoin.

- February 12: Avalon (Avl) and Game 7 (G7) to be included on the Bybit.

- February 13: ETHEREUMPOW (ETHW) and MATAC are no longer supported in Deribit.

Conferences:

Coindsk consensus in occurrence Hong Kong on February 18-20 In Toronto from 14 to 16 May. Use today’s code and save 15 % on passes.

Distinguished symbol speech

Written by Shuria Malwa

- Different tranquin mechanics Around the world from Asia to AmericaReturn the signs of frenzy that tend to control the encryption market every few months.

- The BNB series, which was originally created in an educational program, rose to a 300 million dollar market ceiling after being mentioned by the Binance Changpeng Zhao. The symbol gained popularity in Chinese societies, View posts.

- David Porto of Barstol Sports in the United States promoted the prison, as the market observers accused him of using his social influence to pump the LowCAP code, which reached more than 200 million dollars before settling with a market roof of $ 78 million.

- The Central African Republic has released its car, aiming to support national development and increase the country’s global vision.

Locate the location of the derivatives

- The basis in BTC and ETH CME futures decreased less than 10 %, which may translate into a slower flow into circulating investment boxes.

- Permanent financing rates on external stock exchanges of most major metal currencies are still marginally optimistic between 5 % to 10 %. XLM highlights that it has a more negative financing rate -more than -20 % -which reflects a bias of short strains.

- In the front end, ETH places a bean premium trade from two to five points in relation to calls, and shows negative concerns. BTC front options also show a bias, according to Amberdata data.

Market movements:

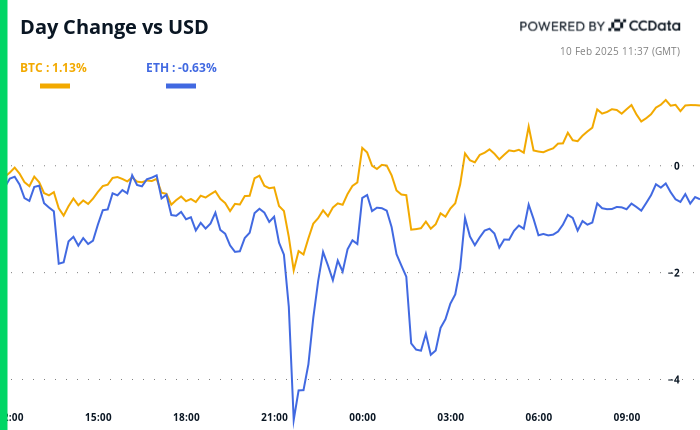

- BTC increased by 1.80 % from 4 pm East to 97,805.98 dollars (24 hours: -1.01 %)

- ETH decreased by 0.79 % at 2,647.53 dollars (24 hours: -0.63 %)

- Coindesk 20 increases by 2.92 % to 3,209.42 (24 hours: +0.19 %)

- The CESR 3 -bit vehicle survey rate decreased to 2.97 %

- BTC financing is 0.0087 % (9.48 % annually) on Binance

- DXY is 0.12 % in 108.16

- Gold rises by 1.44 % at 2,902.17 dollars/ounces

- Silver increased by 1.29 % to $ 32.22/ounces

- Nikkei 225 closed unchanged at 38,801.17

- Hang Seng closed by 1.84 % in 21,521.98

- FTSE increased 0.53 % in 8,746.63

- Euro Stoxx 50 is 0.34 % in 5,343.63

- DJIA -0.99 % closed to 44,303.40

- S & P 500 closed -0.95 % in 6,025.99

- Nasdak closed -1.36 % in 19523.40

- S & P/TSX Complex -0.36 % at 25442.91

- S & P 40 America America closed -1.10 % in 2,410.24

- The Ministry of Treasury in the United States increased for 10 years 4 bits per second to 4.48 %

- E-MINI S & P 500 rises against 0.46 % in 6,077

- E-MINI nasdaq-100 futures increased by 0.70 % at 21,742

- E-MINI Dow Jones Industter Indust Vilese Endust Huster is 0.35 % at 44,576

Bitcoin Statistics:

- BTC dominance: 61.70 % (0.05 %)

- ETHEREUM ratio to Bitcoin: 0.02717 (-0.22 %)

- Hashrate (Seven Day Average): 808 EH/S

- Hashprice (Stain): $ 54.1

- Total fees: 5.04 BTC / 337,318 dollars

- CME FUTERES Open benefit: 164,510

- BTC at gold price: 33.5 ounces

- BTC market roof against Gold: 9.52 %

Technical analysis

- Strategy shares (MSTR) were immersed from a small emerging channel, at the end of the reversion from December 31.

- Prices have found acceptance less than 38.2 % of Fibonacci’s spread from the Rally four times seen from September to November.

- The golden rule of technical analysis is that for the market to maintain its current direction, it must exceed the level of 38.2 %. If he fails to do this, it is said that the direction of the bull is over.

Encryption

- Microstrategy (MSTR): closed on Friday at 327.56 dollars (+0.56 %), an increase of 2.27 % at $ 334.98 in the market before the market.

- Coinbase Global (COIN): Closed at $ 274.49 (+1.52 %), an increase of 1.83 % at $ 279.52 in the market before the market.

- Galaxy Digital Holdings (GLXY): Closed at $ 26.89 (-0.66 %)

- Mara Holdings (MARA): Closed at $ 16.77 (-0.18 %), an increase of 1.97 % at $ 17.10 in the market before the market.

- Riot platforms (RIOT): closed at $ 11.64 (+0.26 %), an increase of 1.89 % at 11.86 dollars on the market before the market.

- Core Scientific (Corz): Closed at $ 12.56 (+0.24 %), an increase of 0.88 % at $ 12.67 in the market before the market.

- Cleanspark (CLSK): Closed at $ 11.33 (+9.15 %), an increase of 1.5 % in 11.50 in pre -market.

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): Closed at 23.15 dollars (+1.71 %), an increase of 0.52 % at $ 23.27 on the market before the market.

- Semler Scientific (SMLR): Closed at $ 49.20 (-1.44 %), an increase of 2.20 % at $ 50.28 in pre-market.

- Exit (exit): closed at $ 48.37 (+0.75 %), +0.52 % at 48.62 in the market before the market.

Etf flows

BTC Etfs Stain:

- Daily net flow: 171.3 million dollars

- Cutting net flow: 40.70 billion dollars

- Total BTC Holdings ~ 1.176 million.

ETH ETFS spot

- Daily flow: flows have not been reported.

- Cutting net flow: 3.18 billion dollars

- Total Eth Holdings ~ 3.793 million.

source: Farside investors

It flows overnight

Today’s scheme

- The revenue on the securities that make the index of inflation for 10 years, which is called the real return, decreased by 34 basis points in slightly more than three weeks.

- The constant decrease can lead to higher returns, which packs demand for risk assets, including BTC.

While you sleep

- Bitcoin Hodler Metaplanet achieves $ 35 million in unrealized gains in 2024 thanks to BTC Treasury (Coinsk): The Japanese company, which already owns 1761 Bitcoin, said it plans to get 10,000 BTC at the end of the year.

- The Bitcoin Index, which indicates the outbreak of $ 70,000, turns into a decline with the growth of Trump’s commercial war speech (Coindsk): A famous technical index of Bitcoin weakened in the growing American trade discourse. Less than 90 thousand dollars will confirm the continuous declining momentum.

- Us Hoolments Join Crypto Rush by building Bitcoin portfolios (Financial Times): American institutions and university stands intensify cryptocurrency investments, driven by FOMO and TROMP position, despite fears of price volatility and regulatory clarity.

- Trump reveals plans for 25 % graphics on steel, aluminum imports (Bloomberg): The United States is scheduled to announce a 25 % tariff on steel and aluminum imports, and the mutual tariff will follow the countries that impose a tax on American goods this week.

- Inflation rises amid the lunar year of spending, with European stocks benefiting (Eurono): Inflation in China in January increased by 0.5 % on an annual basis, backed by a lunar -up and motivation spending. PPI’s continuous contraction and commercial tensions between the United States and China are still a concern.

- China’s strategy in the trade war: the threat of American technology companies (The Wall Street Journal): It is said that China is planning to target more American technology giants such as Apple and Broadcom with anti -monopoly investigations, aiming to enhance its position on negotiations in commercial negotiations with the United States

In the ether

publish_date