Eigenlayer adds the main feature ‘Slashing’, completing the original vision

Almost a year to the day after the Ethereum protocol Eigenlayer launched a “restoration” network on the uninterrupted adventure in the industry, the network finally adds a key feature that, to this day, stunning without: “Slashing.”

The Eigen Labs expect to collapse-the eigenlayer system for keeping it honest with “restakers” by removing the collateral if they are acting maliciously-finally realizing the original pitch of the protocol.

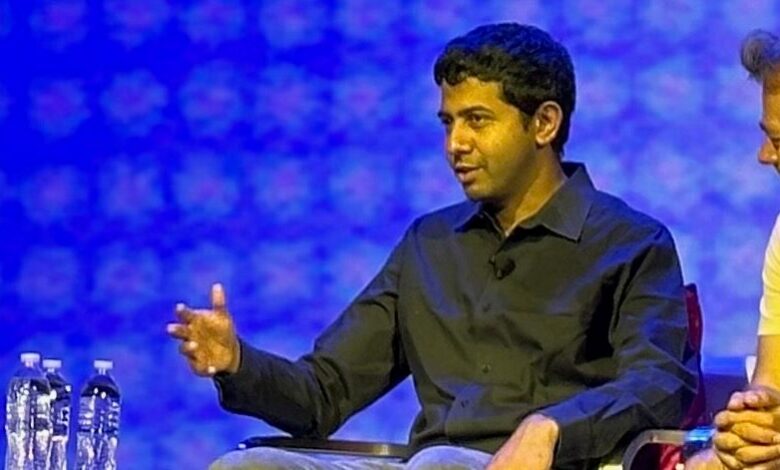

“We are happy to say now that the whole promise has been delivered,” said eigenlayer Sreeram Kannan.

Eigenlayer became one of the worst protocols in Ethereum history when it introduced investors to the restoration concept, an evolution of “proof-of-stake” in Ethereum.

Ethereum’s “proof-of-stake” system enables users of “stake” ether (ETH) collateral with a chain to help operate and secure it in exchange for interest. Eigenlayer allows users to stake et Ethereum and then ReI -stake again with other protocols for more interest.

Despite the launch of its main network last year, the collapse, a major element of eigenlayer’s shared security technology, disappears until Thursday. This led to the criticism that Eigenlayer’s ambitious pitch does not match its technical reality.

Today, Eigenlayer boasts more than $ 7 billion in restaked assets, making it one of the largest decentralized financial apps (DEFI). It also supports an ecosystem of 39 actively proven services (AVSS) that uses the security model.

The new collapse system will be released on Thursday, but the AVS teams will have to opt-in, which means it can take some time before the slashing survives any applications. Eigen Labs announced on April 17 as the date of launch for the collapse Earlier this month.

Redesigning for safety

Eigenlayer users rest ether (ETH) and other tokens through third-party “operators”-infrastructure that delegates their pool eigenlayer deposits to different AVS.

Operators who dedicate stakes to an AVS help to run it in exchange for rewards: the more they bet, the higher the rewards.

In theory, the collapse ensures these operators are running the AVSS correctly. If the operators were “proven malignant according to an on-chain Ethereum contract, their stake or part of their stake could be lost,” Kannan explained.

When the collapse is live on Thursday, the AVSS will have the option to set the slashing conditions and start the penalty on the evil actors.

“Except for Ethereum and Cosmos, most proof systems, including Solana, run live without slashing,” Kannan said. “Although this is the main mechanism of liability, unlike every proof of the stake system already – that’s not true. That’s what we’re building.”

Like why Eigenlayer received so many blowbacks compared to other incomplete proof-of-stake systems: “We talked a lot about the fall, so we’re held at that bar,” Kannan said.

Removal of Leverage

The eigenlayer’s collapse system was redesigned last year to address the fears that the protocol introduced an unsafe form of action in the Ethereum ecosystem.

“I think we have completely healed this problem with this redesign,” Kannan said.

The whole idea behind the eigenlayer is to allow the new protocols to instantly embrace a large security pool – the total pool of restaked assets.

In proof-of-stake systems, the volume of properties staked with a protocol almost corresponds to how it is safe. Generally, attacking a protocol like Ethereum requires control of half or more of staked -owned, which can run in billions -billion dollars.

The eigenlayer pooling model leads to fear that a poorly constructed slashing system can expose the entire protocol to new risks, where a single bad actor in an AVS can damage each operator.

The Eigenlayer version of Live Thursday, tested on Ethereum developer networks since December, is designed so that operators can limit their exposure to a given AV, which means bad actors to one do not necessarily affect another.

“You have a unique stake feature on a particular AV,” Kannan explained. “As an AVS, I know I have, like, 10 million of ‘slashable’ stakes that don’t double count – so no action.”

In addition, the system has been configured to “even though my AVS has a small amount of slashable stake, it is still protected in some sense, by large amounts of capital,” Kannan said, as there are still systems in the area to ensure that the cost of attacking a system increases the total pool value of the restored property.