Eth Bulls pulls $ 393m on exchanges as ETF Inflows Top $ 240m and breakout Bets Build

Ether (ether)

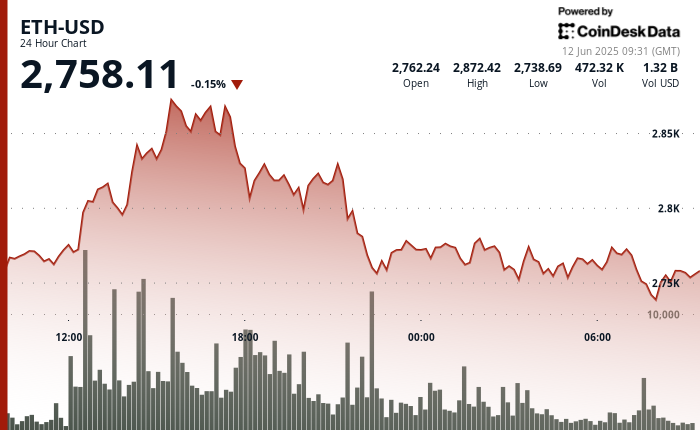

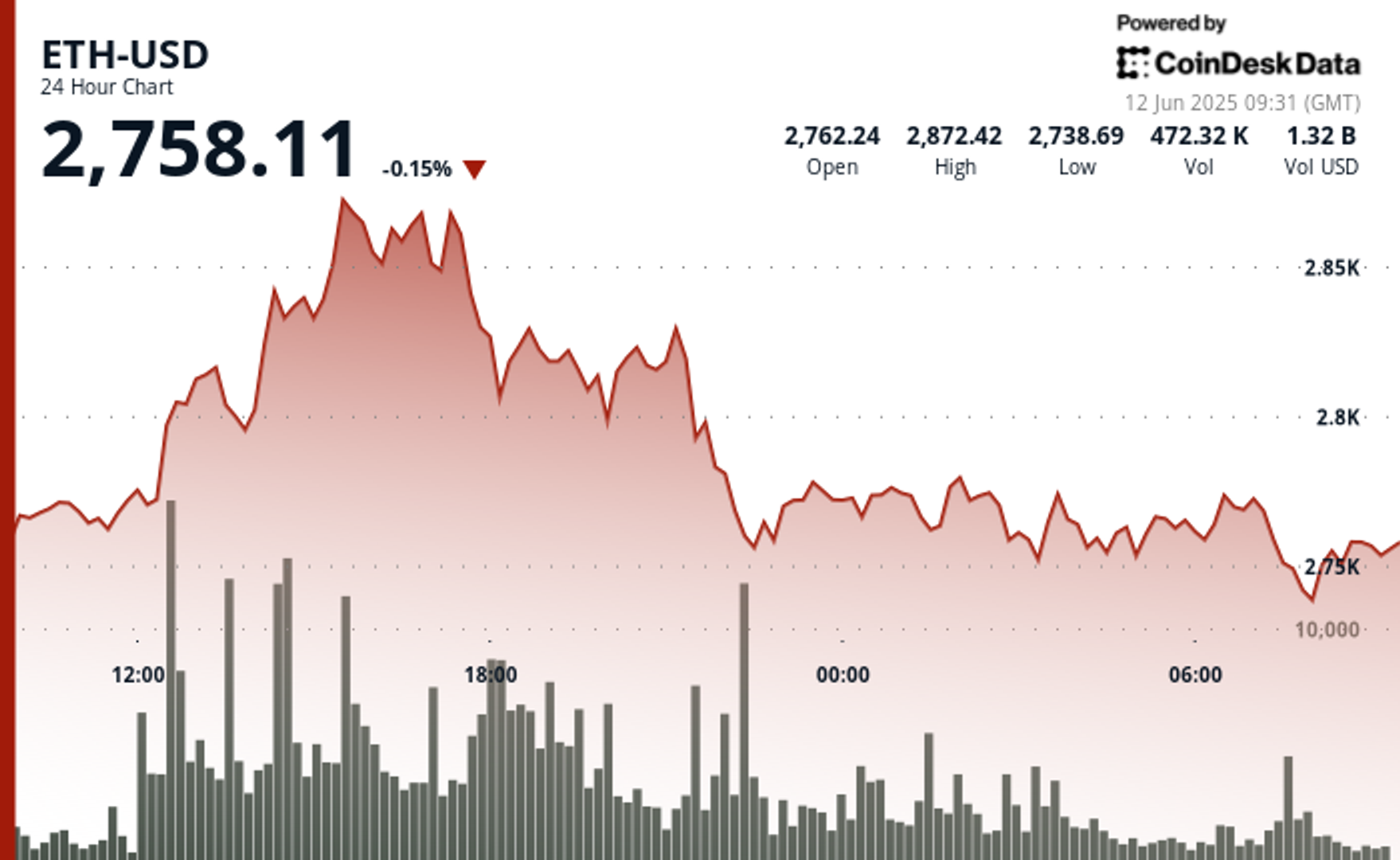

It struggles to maintain Tuesday’s momentum, falling 0.15% to $ 2,758 in the middle of the sale of pressure that appeared in Japanese trading on the afternoon on June 11.

The pullback followed a short rally at $ 2,872.42, which was proven uncertain as the price action was reversed by 15:00 and 17:00 UTC, according to the CoinDesk Research’s technical review model.

The late-session-off-session intensified in the early hours of Asia, puncturing a 1.29% sink from $ 2,772 to $ 2,736 in heavy quantities, before Ether had to bounce for $ 2,758 at the time of press.

Despite the collapse, major metrics suggest increasing convincing the bulls.

Glass node reported Those options flipped tightly negatively over the past 48 hours-a weekly skew decreasing from –2.4% to –7.0%-which indicates an increase in demand for short-term calls. Ratios of Put-Call Stay heavily tilted toward the reversible exposure, with open interest and volume of ratios holding close to many weeks of lows.

On-chain flows also strengthen bullish bias.

Analytics firm Sentora (formerly, intoteblock) That -flag More than 140,000 ETH, worth approximately $ 393 million, was removed from the exchanges on June 11-the largest flow of single day over a month.

At the same time, ETH-based ETH expanded their outflow with another $ 240.3 million added Wednesday, which exceeds the rest of the day’s bitcoin ETF. Analyst Anthony Sassano mentioned Ethereum has avoided a single day of net flow since mid-May, calling for the “speed” trend and it is upheld that the property remains structurally inconsistent.

While price action shows short-term weakness, market positioning and capital flows suggest entrepreneurs who can buy sinking in the hope of another attempt.

Technical assessments

- ETH exchanged for a $ 139 range between $ 2,733 and $ 2,872 before closing $ 2,758.

- Heavy sale appeared near $ 2,870- $ 2,880 during the late US session.

- Support near $ 2,745- $ 2,755 was damaged after many trials, which triggered a rapid spiked over 34,000 ETH during a rapid collapse from $ 2,772 to $ 2,736 on early June 12.

- A temporary bounce towards $ 2,752 failed, and a new support zone could make up near $ 2,735

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.