Link Rallies of Chainlink 12% on New 2025 High in AMID token Buyback, wider crypto rally

The Oracle Network Chainlink’s (Link) native token strictly rebounds to the broader crypto market following the federal chairman of the Jerome Powell reserve in the Jackson Hole, Wyoming.

The link rallied 12% in the past 24 hours, hitting $ 27.8, the strongest price since December. Bitcoin (BTC) appreciates 3.5% at the same time, while the Broad-Market Coindesk 20 index jumped 6.5%.

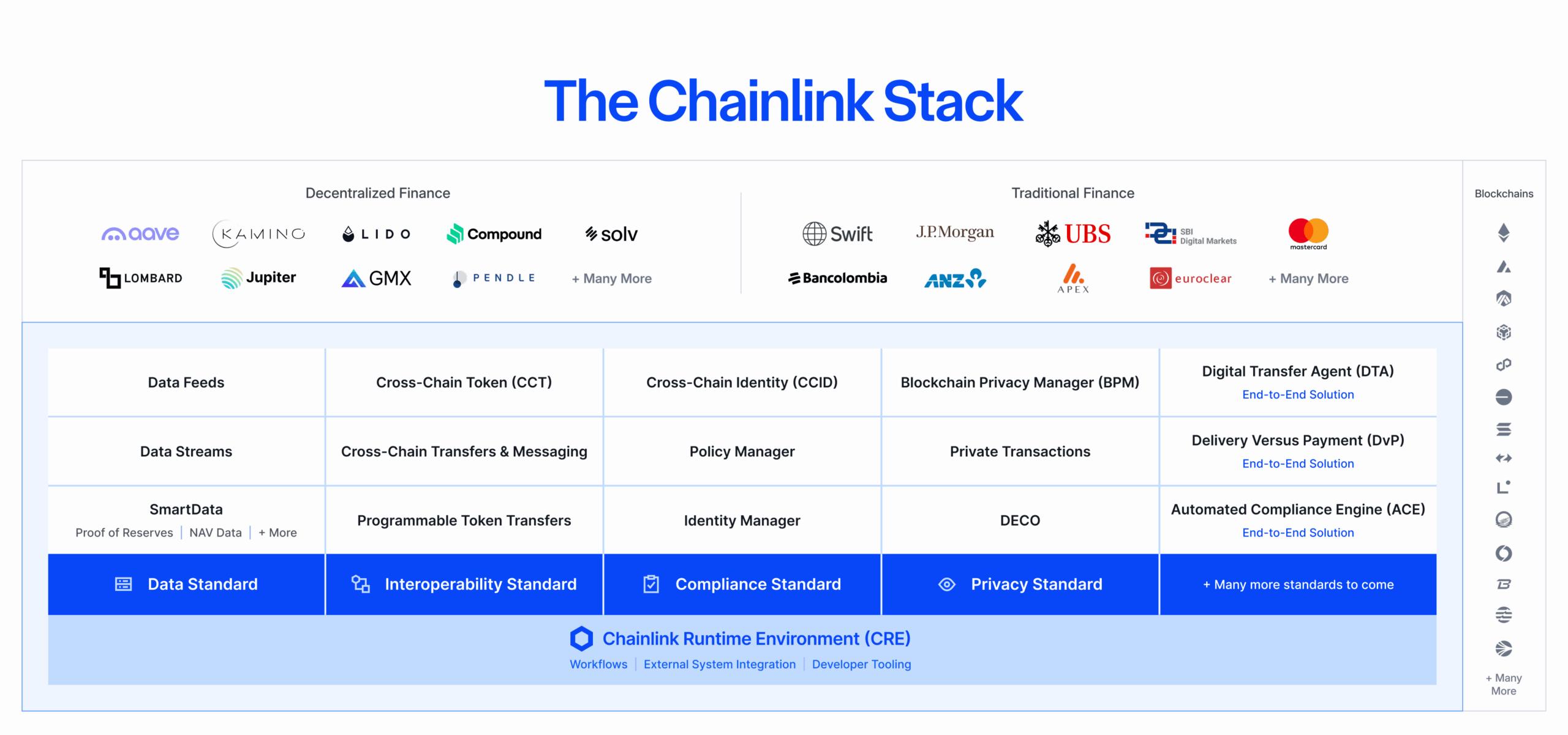

In the news of the specific protocol, the chainlink obtained two major security certifications this week: ISO 27001 and a SOC 2 type 1 authentication, marked first for a blockchain Oracle platform. The audits, conducted by Deloitte, cover chainlink price feeds, proof-of-reserve services and the cross-chain Interoperability Protocol (CCIP).

The Oracle Provider said the transition strengthens its data services and may strengthen the banks of banks, those who provide assets and decentralized financial protocols.

Further supporting the rally, the Chainlink ReservePanna -time to buy link tokens in the open market with protocol revenues, buy 41,000 tokens on Thursday, which costs nearly $ 1 million at that time. That brought a total handling of 150,778 tokens, around $ 4.1 million at current prices.

Technical analysis

- Support Levels: The large defense established at $ 24.15 with high -volume confirmation, according to CoinDesk’s technical research technical research data.

- End of penetration: Systematic advances by $ 25.00, $ 25.50, and $ 26.00 level with validation of volume from institutional participants.

- Trade volume analysis: Exceptional 12.84 million volume of climbing during the breakout phase, representing the 24-hour average of 2.44 million units.

- Combining patterns: Extended tight integration range around $ 24.70- $ 25.10 before the explosion driven by institutional breakout.

- Momentum indicators: prolonged trajectory with measured advanced properties and institutional accumulation signals from corporate treasury operations.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.