XRP struggles to recover $ 3 as demanding areas

The XRP is chopped with a narrow $ 2.78- $ 2.85 band, masking heavy institutional sale and increasing stolen risks. The reserves to go up to nine -month highs in 440m tokens distributed for 30 days, as futures turned interest close to $ 9B.

The bulls continue to defend the $ 2.78 floor, but the distribution patterns cover the momentum.

News background

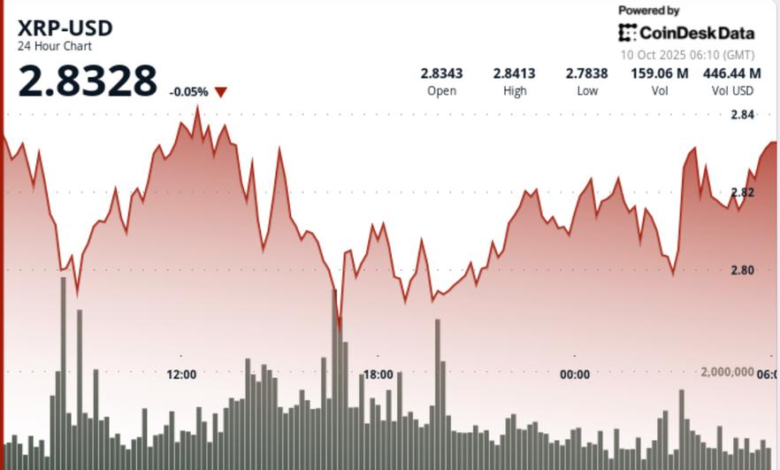

XRP exchanged flat to less than 24 hours until October 10, opening near $ 2.83 and closing at $ 2.82. The token briefly rally at $ 2.85 before the decline, with spiking volumes above 123m at 8am -double -sun average -confirming institutional activity at basic levels. The session arrived as entrepreneurs were positioned in advance of Macro catalysts, with Fed policy and regulatory clarity that continued to shape emotion.

Summary of price action

- The XRP was that -oscillated between $ 2.79 and $ 2.85, a 2% corridor.

- The resistance will be held firm for $ 2.85, with a decline in 12:00 hours.

- The support continued at $ 2.78, repeatedly defended in high volume.

- The latter session saw a profit from $ 2.83 to $ 2.82, with 1.6M copies confirming the ongoing distribution.

- The last bars showed a waning volume, indicating the sale of fatigue near $ 2.82.

Technical analysis

The $ 2.85 zone hardened to the supply after multiple declines, while $ 2.78 remains the main pivot support. Inflammation of exchange and distribution from large holders strengthen near-term risks, especially as the seizure builds up with futures approaching $ 9B.

However, the repeated defenses of the $ 2.78 signal institutional accumulation at the base. A break above $ 2.85 could reopen $ 2.90- $ 3.00, while a slip through $ 2.78 risks accelerating to $ 2.72.

What entrepreneurs are watching?

- If $ 2.78 continues to hold as a floor structure.

- If positioning positions rest, adding volatility to the $ 3.00 retest attempt.

- Continued distribution of whales compared to signs of Dip accumulation.

- ETF and Fed catalysts as drivers of the next breakout from the range of $ 2.78- $ 2.85.