Ark Invests takes a 11.5% stake in the NASDAQ listed by Solana Treasury Firm Solmate (SLMT)

The Solmate Infrastructure (NASDAQ: SLMT) is revealed to a Press release Earlier today it bought $ 50 million SOL directly from the Solana Foundation to a 15% market discount.

The company said the tokens would be used to power nude-metal validator in Abu Dhabi, UAE as part of the foundation’s “Solana By Design” program, and that the foundation has agreed to the right to nominate up to two directors on the Solmate Board. Solmate described the timing as a purchase “in the lows of the market” during a major extermination and framed the transition as a alignment of its treasury ark into its infrastructure build-out.

The press release also noted that the Ark Invest held about 11.5% of the solmate, on September 30, 2025, citing a 13G filing schedule.

Solmate said Ark bought 6.5 million shares at an oversubscribe pipe and disclosed subsequent purchases worth nearly 780,000 shares, which the company described as continuing to convince its approach.

Solmate is the Rebranded, alternatively focused on Solana in Nasdaq listed in Brera Holdings, moving from a multi-club football approach to a digital asset and business-centered asset-centered asset in Solana.

Chief Executive Marco Santori said the firm “Buy a Dip” and called the Solmate “Brand New Solana Infrastructure” for the UAE. He argued digital assets wealth were “capital accumulation machines” and said the UAE was the “capital of capital,” which positions Abu Dhabi as a basis for validator’s performance.

Solmate said it would work with Rockawayx with staking infrastructure and plans to stand naked metal validators in Abu Dhabi, with many initiatives to follow.

Tednical Analysis of Coindesk Research

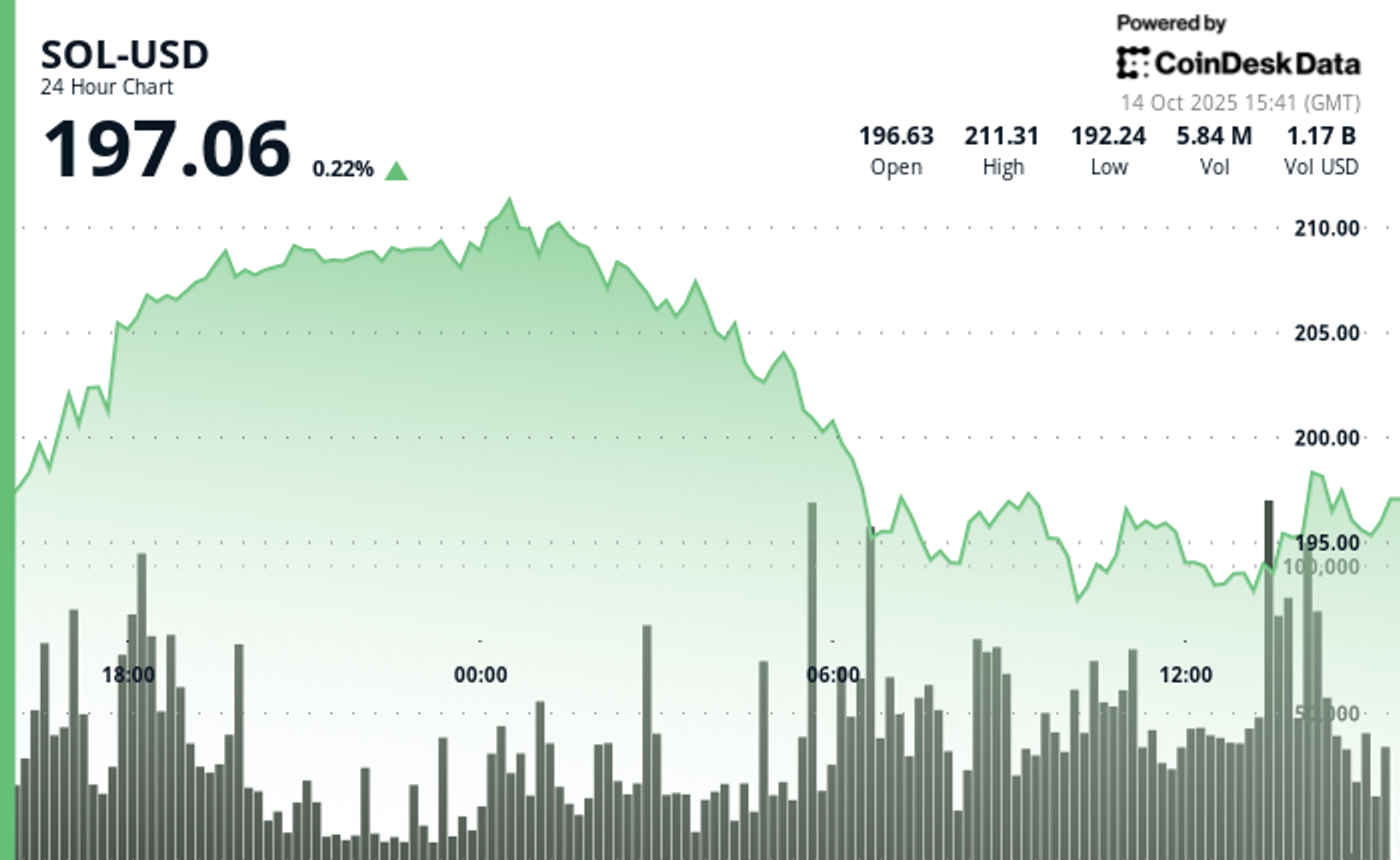

The review window runs from October 13, 2025, 11:00 UTC to October 14, 2025, 10:00 UTC. Below are highlights:

- According to CoinDesk’s technical analysis data model, over that span, Sol exchanged between $ 191.42 and $ 209.45, approximately a 9% swing.

- The price was advanced from about $ 192.79 and sliced by $ 200.62 and $ 205.64 places in heavier-than-common trade, then the momentum faded after 00:00 UTC on October 14, with a slide from about $ 206.34 to $ 193-$ 194 place where consumers reappeared.

- In the final time, 09: 41–10: 40 UTC on October 14, Sol was able to bounce from $ 196.20 but could not maintain a move, dipping to $ 191.46 at 10:35 UTC before repairing $ 192.43 by 10:40 UTC.

- Taken, the tape shows support that makes up close to $ 193- $ 194 with a deeper pillow around $ 191, and the supply shows close to $ 205- $ 206 and again closer to $ 209- $ 211.

- Handling above the mid $ 190 retains the open door for a retest of $ 200 and then $ 205- $ 206; The loss of $ 193 will return $ 191 to play.

Latest 24 -hour chart read (all UTC)

Until October 14, 2025, 15:31 UTC, Sol was $ 197.06, up to 0.22% in 24 hours.

The session is now printed a high of $ 211.31 and a less than $ 192.24. The early decline near $ 211.00 was followed by a drift lower and stabilizing around $ 196- $ 198.

In practical terms, $ 195.00 is the close term pivot for consumers; Holding the upper level leaves the room to investigate $ 200.00 and, if that -reclaimed at UTC closes, $ 205.00- $ 206.00 where sellers are active in the research window.

A decisive push by $ 206.00 in UTC closing will return $ 209.00- $ 211.00. On the downside, a break below $ 195.00 is likely to invite a check of $ 193.00- $ 194.00; If that area gives way, the late-window cushion around $ 191.00 becomes the next reference.

Denial: Parts of this article were formed with assistance from AI tools and our editorial team reviewed to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s entire AI policy.