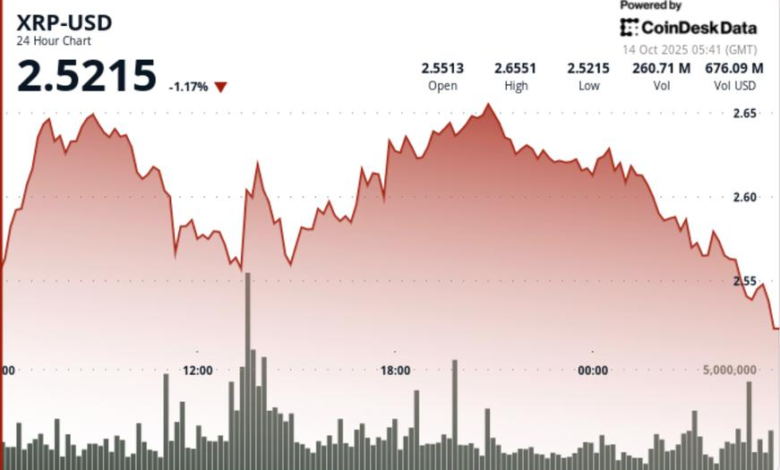

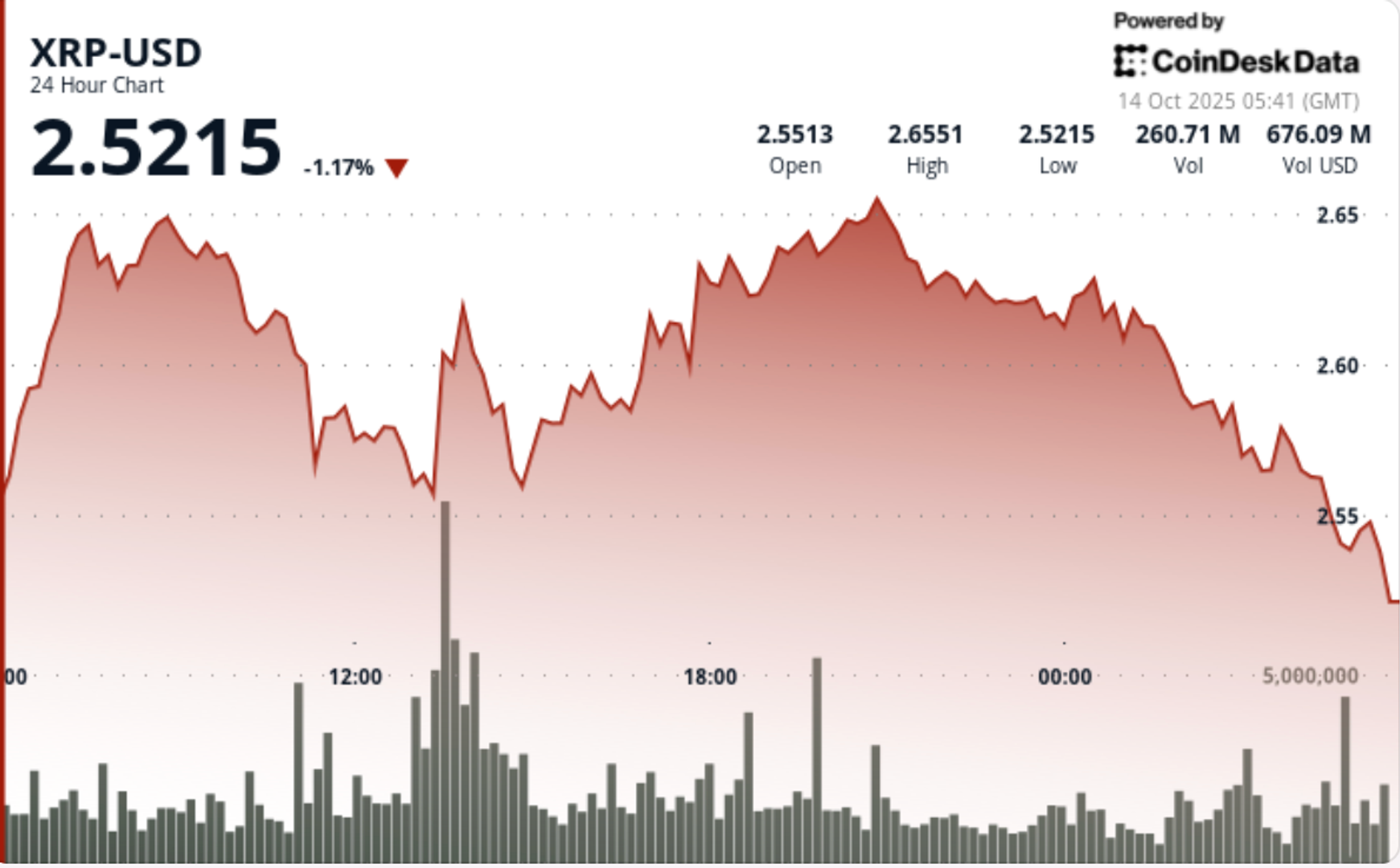

Fades below $ 2.60 as $ 63m Whale Sales Hit Binance

The aggressive sale near the $ 2.66 resistance and a major Binance Inflow Signal short-term distribution as volume data shows institutional purchase of $ 2.55.

News background

Rebounding the XRP from the sub- $ 1.58 career lost the vapor overnight while fresh whale activities struck the exchanges. A single 23.9 m xrp transfer (≈ $ 63 m) to binance in conjunction with the sale of pressure that removed the early gains. The move came as the open interest jumped 2.4 % to $ 1.36 B, suggesting leveraged positioning remains elevated even after recovery of the $ 32 B market-cap following the route driven by the Tariff driven by Trump.

The broader risk markets stabilized as the trade-war rhetoric soften, but derivatives flagged renewed short build-ups near $ 2.65- $ 2.66.

Summary of price action

- XRP exchanged a $ 0.11 band (4 %) from $ 2.54 to $ 2.66 between October 13 05:00 and October 14 o’clock.

- The volume exploded at 244.6 m at 13: 00-part 3 × the average 91.8 M-proving the aggressive purchase of sinking near $ 2.55.

- The price leaks at $ 2.66 for 20:00 hours before the long sale pushed a $ 2.55 nearby.

- The bears have expanded control over the final time, which destroys $ 2.57 support at 4 m volume at 04:10, then combines $ 2.55- $ 2.56.

Technical analysis

The $ 2.55- $ 2.56 zone continues to anchor close to term support after repeated high volume defenses. The resistance is stable at $ 2.65- $ 2.66 where revenue and whales have triggered many declines.

The momentum bias is leaning against the bearish while the XRP is trading below the 200-day MA ($ 2.63), although a long re-recession above $ 2.60 can reset the structure for another $ 2.70 test. The volume remains key: spikes in dips show institutions that buy weakness, but lower supply supplies are more than demand.

What do entrepreneurs watch

- $ 2.55 Support – can it hold in sessions on the Asian weekend?

- Reaction to the $ 2.65- $ 2.66 Resistance Zone to the next upcoming.

- Binance Whale flows as a sign of continuous distribution or rotation.

- The potential seizure if the open interest ($ 1.36 b) remains elevated.