First US Solana Staking ETF launches with $ 12m flowing

The United States’s first Solana Staking Exchange-Traded Fund (ETF) ended the Debut Trading Day with $ 12 million in outflows-a positive sign for Crypto-enabled ETFs.

The rex-osprey solana staking etf Debuted In the CBOE BZX Exchange on Wednesday, $ 33 million was recorded in trading volume and $ 12 million in flow, According to to Bloomberg ETF analyst Eric Balchunas.

The fundsTrade under SSK, provides direct exposure to investors in Solana (Sol) Along with staking yields, it makes it the first crypto staking ETF to be approved in America.

This is a “healthy start to trade,” says Bloomberg ETF analyst James Seyffart, who noticed That saw $ 8 million in trading volume in the first 20 minutes.

Balchunas din Commented In the amazing volumes of the first day, stating that “fired” Solana Futures ETF and XRP futures ETFs but less than the Bitcoin area (Btc) and ether (Eth) funds when they launch.

The US listed area listed a joint $ 4.6 billion worth of sharing exchanged on their first day in January 2024.

“Launching Crypto Staking ETFs is a reference to the moment for digital possessions and a significant step forward in full access to the crypto ecosystem,” Says Anchorage digital co-founder Nathan McCauley, whose firm is the staking and custodian partner for the Rex-OSPREY ETF.

Regulations barriers

The Rex-Ostprey fund faces regulatory barriers along with the Securities and Exchange Commission, which objected to this late May after cleaning an initial registration.

The issue is whether the product is qualified as a “investment company” under security laws, but the company has managed to surround it by investing at least 40% of its ownership with other ETPs, most of which are domicile outside the US.

More eyes on spot solana etf, altcoin etf summer

Unlike the Solana ETF spots that still require approval from the SEC, the Rex-OSPREY’s Solana ETF is outlined under the Investment Company Act 1940, which covers the standard 19B-4 filing process.

In May, Novadius Wealth Management President Nate Geraci described it as the “end-around regulation.” However, some have Debate If the fund should be considered a traditional area Solana ETF.

Meanwhile, the recent ETF performance can be lighthearted in the institution’s demand for a Solana ETF area, which can be launched this year.

Seyffart and Balchunas Recently has been lying a 95% chance That place Solana ETF will be approved by the end of the year.

“We look forward to a wave of new ETFs in the second half of 2025,” Seyffart said earlier this week, predicting that place XRP, Solana, and Litecoin (LTC) Products will be the SEC’s greenlit before the end of the year.

Related: Analysts increase the chance of SOL, XRP and LTC ETF approved by 95%

On Tuesday, the regulator Approved A grayscale application to convert the digital large cap fund to an ETF. The fund consists of a basket of top five digital assets through market capitalization.

Minor reaction for soluble prices

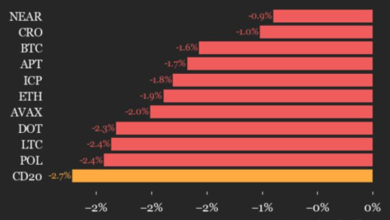

There is no basic Reaction In Solana prices, which gained 3.6% in the past 24 hours, less than most other high-cap altcoins.

The owner traded around $ 153 at the time of writing and climbed around 5% last week, but still dropped 48% from January’s climax.

However, Solana CME Futures saw “Record Demand, Signaling Rising Institutional Interest” because open interest hit $ 167 million following the launch of the ETF, reported Solanafloor.

Magazine: The eyes of Bitcoin ‘Bull Pennant’ $ 165k, POMP SCOOPS UP $ 386M BTC: Hodler’s Digest