Galaxy Digital says the BTC’s emerging leverage deals show signs of stress.

Good morning, Asia. Here is what makes news in the markets:

Welcome to Asia Morning, a daily summary of the highest stories during the United States hours and a general view of market movements and analysis. For a detailed overview of the American markets, see Coindsk’s Crypto Daybook America.

The influence in the encryption markets is due to the levels of the Taurus market, Even with a decline last Thursday Males mentioned how excessive excessive stakes can relax.

Galaxy Research’s Q2 The state of the leverage for encryption The coded loans appear by 27 % in the last quarter to 53.1 billion dollars, the highest since early 2022, supported by the standard demand for Defi lending and a renewed appetite for risks.

That background put the theater for Shakeout last week.

Bitcoin’s decline from $ 124,000 has led to a decrease of $ 118,000 to more than a billion dollars in references via encryption derivatives, the largest long scanning operations since early August. Analysts framing it as a health profit achievement Instead of the beginning of the reflection, it confirms how fragile market is when this leverage builds this quickly.

Galaxy analysts argue that stress points are already visible.

In July, A wave of withdrawals on AAVE pushed ETHBreaking the economies of the famous “episodes” trade where ETH Staped is used as a guarantee to borrow more ETH. The relaxation process sparked a rush to get out of the extension positions, which led to the sending of the etherem lighthouse series to a 13 -day record.

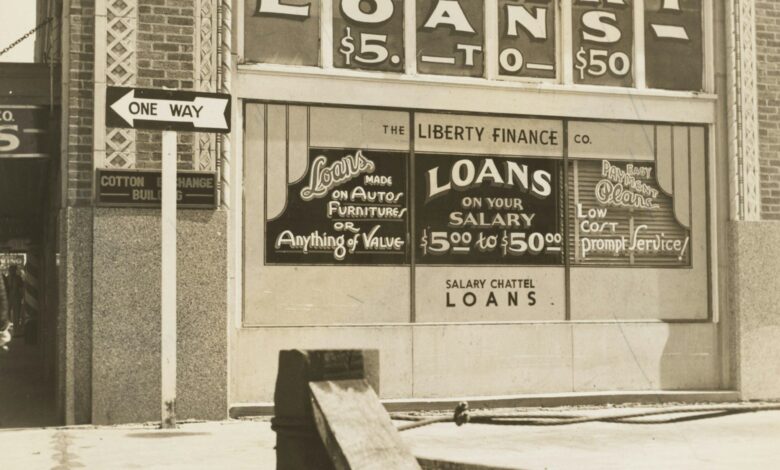

Galaxy also reported that USDC borrowing costs on the market without a prescription have been climbing since July, even with lending rates in the chain flat.

The spread between the two has expanded to its highest levels since late 2024. This separation indicates that the demand for the dollar outside the chain exceeds liquidity on the Unhachin, which creates an inconsistency that can inflate volatility if the circumstances are tightened.

With institutional demand and ETF flows still support the upscale background, strategists remain based on encryption.

But among the enlarged loan sizes, the focus of the lending power, the Defi liquidity profits, and a medium gap between the dollar markets on the chain, the system shows more tension points, as Galaxy writes.

On Thursday, at a value of $ 1 billion, a warning was a warning that the return of the leverage cut both directions.

Market engine

BTC: The fluctuation has decreased across the market before the Jerome Powell’s Jackson Hole speech, where traders are betting on September price discounts, but some satisfaction with the warning can be risked by BTC risks at 118,061.51 dollars, an increase of 0.44 %.

Eth: A standard $ 3.8 billion in the ether is on the parking lot with 15 days waiting, adding possible pressure to make profit even with the high requirements of ETF and the Treasury Treasury, with ETH trading of $ 4524.10, an increase of 2.13 %.

gold: Gold is trading at $ 3332.95, a decrease of 0.11 %, as inflation data in the United States reduced the stakes cut in the feeding rate and the coordination of Xau/USD, which is more than 3,310 dollars in support before the Powell Hole Jackson speech.

Elsewhere in the encryption

- VANECK VC says: (Deciphering)

- Why circle and tape (And many others) They launch their Blockchains (Coindsk)

- Gemini rented Goldmans, Citi, Morgan Stanley and Cantor as a major leader in public subscription (Coindsk)

publish_date