Gold-backed tokens hold the $ 19B crypto route, but the rally may be close to fatigue

While Bitcoin Ether and other major cryptocurrencies fall into a $ 19 billion Destruction Event on Friday, major digital digital assets emerged in the middle of the rally of precious metal.

The tokens tied to physical gold, including the Paxos’ Paxg and Tether’s Xauut, are among the few who hold their land, and even higher, as the wider market sinks.

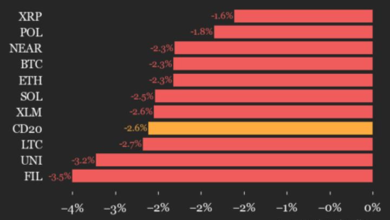

Bitcoin lost 8.5% of its value in the last 24 hour period, while the broader crypto market fell by 12.75% measured by CoinDesk 20 (CD20 ) index. Meanwhile, PAXG dropped only 0.23% to $ 3,998, while XAut reached 0.2% to $ 4,010. A troy ounce of gold, whose tokens are supported by, Closed close to $ 4,018.

These coins are supported by precious metal reserves, which offer crypto investors a shelter from volatility that reflects the historic role of gold to traditional finance. Year-to-date, these tokens are over 50% amidst the historic gold rally.

But while the gold-backed crypto weather weather crashed, there are signs that their underlying properties may approach fatigue. Gold will rise to eight consecutive weeks, which according to the World Gold Council’s Monitor markets Price pushed to “overbought” territory. That is throughout the daily, weekly and monthly charts, which has increased the likelihood of a close shrinkage.

“With the” typical “historical excessive thought-25% above the 40-week average-it is seen not far from the top here at US $ 4,023/oz. Then we will be careful at the rally for this stage of the golden bull. “Long positioning remains elevated but have never been overlooked.”

In the broader crypto market, the recovery path may Now is a slow grind. Barriers to liquidity, ETF closure over the weekend and a careful return of market manufacturers suggest a process lowering.

Through US -China trade tensions, the floor can remain elusive.