Sol fell 4.5% while Canada launches the first ETF areas

Global economic tensions and trade uncertainty continue to create volatility in the crypto market, with SOL navigating these challenges better than many successors.

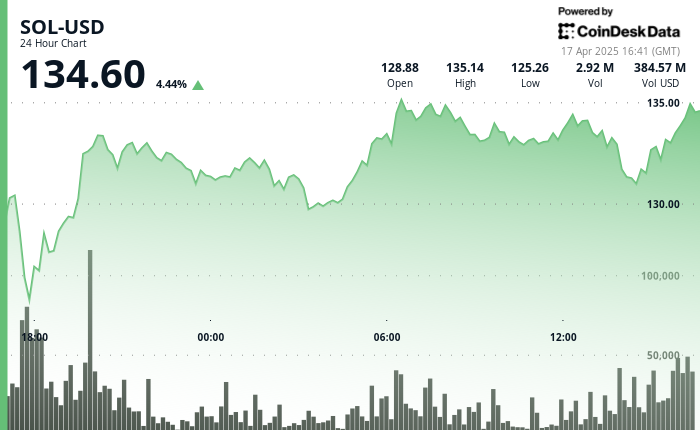

Solana token’s price rose more than 4% on Thursday, while the broader market gauge, CoinDesk 20, rose almost 3%.

The $ 125- $ 127 range for Sol appeared as a critical support zone that successfully rejected many attempts on the downside, while the area of $ 133.50- $ 133.60 represents significant objection, according to the CoinDesk Review technical review model.

Blockchain data shows more than 32 million soles (more than 5% of the total supply) accumulated at the level of $ 129.79, establishing it as an important pivot point for future price action.

Technical assessments

- SOL has established a well-defined support zone between $ 125-127, which has successfully rejected many attempts on the downside.

- The price shows strong stability, recovering 4.5% from April 16 low to $ 123.64 to $ 135.57, establishing a clear climbing.

- Canada launched the first place Solana ETF In North America on April 16, issued by asset managers including 3IQ, Purpose, Change, and CI, which strengthens institutional interests.

- Solana took the top area to the dex activity, which exceeded Ethereum after 16% gain for seven days, with a total amount locked (TVL) rising by 12% to $ 7.08 billion.

- The volume analysis shows particularly strong accumulation on April 16 afternoon, with more than 3 million units exchanged as the price destroys the resistance level of $ 130.

- The Fibonacci Retracement from April 14th high ($ 136.01) to low April 16 suggests a recent rally reclaimed the critical level of 61.8%.

- During the final 100 minutes of trading, Sol experienced a significant downward correction, which fell from $ 134.11 to $ 130.81, representing a 2.5% decline.

- The seller-off intensified around 14: 03-14: 07, when the volume sprouted to more than 92,000 units in a single minute candle.

- A strong resistance zone at $ 133.50- $ 133.60 denied many recovery attempts.

- A well -known breakdown took place at the $ 132.00 support level, which triggered cascading liquidations.

- Prices retreated beyond 78.6% Fibonacci levels, suggesting potential continuity towards $ 125-127 zone support if the Bearish momentum continues.

Denial: This article was formed using AI tools and our editorial team reviewed to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s entire AI policy. This article may include information from external resources, listed below as appropriate.

External Reference:

- “Solana’s cost basis changes dramatically: $ 129 appeared as a major pivot zone“Published April 16, 2025.

- Newsbtc, ”Solana Retests Bearish Breakout Zone – $ 65 Target still playing?“Published April 17, 2025.

- Cointelegraph, ”Why the Solana price this week?“Published April 12, 2025.

- Cryptopotato, ”Solana (Sol) jumps by 7% day -day, the eyes of Bitcoin (BTC) $ 85k again (market watch)“Published April 17, 2025.

- Cointelegraph, ”Solana prices are up to 36% from crypto market crash lows – is $ 180 sol to the next stop?“Published April 16, 2025.